Dear Reader, Mythology has it that Midas was a king who turned everything he touched into gold – a “talent” that the UAE seems to possess at the moment. As we say in this issue, in an extract from the CMM’s 2014 UAE Tajara Monitor, “Black gold is not the only oil of industry in the emerging Emirati economies…In 2013, …

Read More »2014

Global payment changes to re-shape expectations

The next generation of tech-savvy entrepreneurs and business leaders is transforming the global payments market, according to a new report, Global Payments 2020: Transformation and Convergence, from BNY Mellon, a global leader in investment management and investment services. The report says the payments landscape is being shaped by the needs and expectations of retail customers as much as by commercial and …

Read More »Step up financial monitoring, corporates are advised

The UAE hosted the Global trade Development Week EMEA, which will see an unprecedented gathering of influential business and government leaders, entrepreneurs and academics from more than 70 countries. The event, which is the world’s largest trade facilitation, development, investment and customs programme, was held in Emirates Towers, Dubai, from 27 until 29 October. Businesses are being encouraged by leading …

Read More »New MENA-Japan link

The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a member of the Islamic Development Bank Group, and Sumitomo Mitsui Banking Corporation Europe Limited (SMBCE), a subsidiary of the Sumitomo Mitsui Banking Corporation (SMBC) of Japan, have signed a Memorandum of Understanding (MOU) regarding co-operation. The MOU is intended to strengthen the existing partnership between the SMBC …

Read More »NBAD among ‘50 safest banks’

NBAD has been ranked among the World’s 50 Safest Banks for the sixth consecutive year by Global Finance magazine, which rated it 25th, up 10 positions compared with the previous year. In addition, it found NBAD remained the safest bank in the Middle East and Emerging Markets. Alex Thursby, group chief executive officer of NBAD, said, “This recognition reflects the …

Read More »$45m murabaha backs exporters

The International Islamic Trade Finance Cooperation (ITFC), a member of the Islamic Development Bank Group, signed a $45m Murabaha Agreement with the Turkish “Aktif Bank” as a line of financing aimed at supporting Turkish exporters. This highlights ITFC’s mandate to promote intra-trade among Organisation of Islamic Conference member countries and its continuous efforts to support vital economic sectors in those countries.

Read More »Gulf ripe for project financing

There is huge potential for project financing in the Gulf, according to the French banking giant Société Générale, which said it sees the region as an important market as it meets the bank’s expectations on safety, security and return on capital. “There is much liquidity available to be deployed, but we have to be mindful of the safety, quality of …

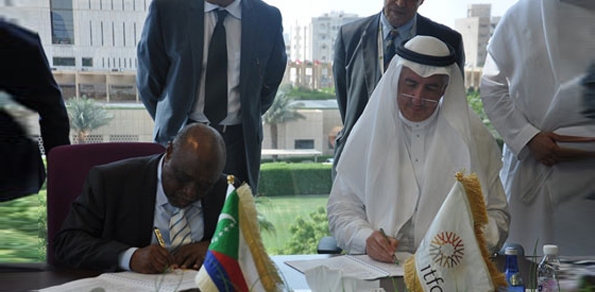

Read More »‘Trade advance’ for The Comoros

The International Islamic Trade Finance Corporation (ITFC), a member of the Islamic Development Bank Group, has signed a financing agreement with the government of The Comoros regarding a revolving $20m facility to secure strategic supplies of petroleum products in the country. HE Mohamed Ali Soilihi, IDB governor and The Comoros vice-president, and Eng. Hani Salem Sonbol, deputy CEO ITFC, signed …

Read More »New Gulf chief for Euler Hermes

Euler Hermes has appointed Mahan Bolourchi as GCC CEO, with responsibility for Euler Hermes operations in Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE. “The Euler Hermes GCC team is strongly focused on providing high-quality service to our customers, and to delivering tailor-made solutions to protect companies of all sizes and sectors against payment defaults,” he said. “The market …

Read More »Early price cut from SWIFT

SWIFT announced at Sibos last month that it had delivered early on its commitment to reduce its messaging prices by between 30 and 50 per cent between 2010 and 2015, a goal the company set as part of its SWIFT2015 strategy. “We have now achieved the high-end of our commitment, delivering a 50 per cent reduction in messaging prices to …

Read More »Emirates develops the Midas touch

Black gold is not the only oil of industry in the emerging Emirati economies. In a final look at last year, CMM’s CAROLINE MAGINN makes transparent some of the extracts from thecompany’s 2014 UAE Tajara Monitor The trade and investment storyboard was very positive across even the non-oil based Emirates economies and corporate banking continued to be central to banks …

Read More »Airline forecasts its financial future

Etihad Airways has transformed its profit and loss forecasting and cost modelling procedures to introduce dynamic planning. Helped by a new Adaptive Insights software tool that shifts accountability for inputs to the business and encourages everyone’s participation, the overhaul has eliminated disparate Excel and Access-based models to enable more analysis. Vydya Venkateswaran, of Etihad Airways, presents a case study Etihad …

Read More »It’s still ‘safety first’ as world trade picks up

The cost of trade finance and the pricing of risk has stabilised or even fallen, but new research shows that the need for some form of security is still widely felt. PAUL MELLY examines why that is the case In a climate of cautious economic recovery, concerns about risk have abated. But, nevertheless, there has been little change in the …

Read More »MENA moves towards tipping point for rapid trade growth

Vincent O’Brien, chairman of the ICC Banking Commission Market Intelligence, talks exclusively to Cash&Trade about the results of this year’s survey. What do this year’s survey results tell us about attitudes to risk in the present climate? The survey registered an increase in demand for confirmation of letters of credit, which analysts attribute to the fact that international traders are …

Read More »The future is on the doorstep

The world of global payments is undergoing fundamental change, reshaped by technology and redefined by regulation, the emergence of new economic powers, and changes in the global currency landscape. Most importantly, payments will be refocused from a commoditised proposition to a strategic, value-adding solution. Therefore, it’s time for banks in the MENA region to gear up if they wish to …

Read More »Sukuk heads for stardom

According to several bankers in the Islamic capital market space, Sukuk activity by international issuers indicates that Islamic finance, especially the Sukuk, is becoming a more mainstream source of funding. MUSHTAK PARKER provides a unique, in-depth, up-to-date analysis of the situation. If the growth trajectory of global Sukuk issuance continues as it has done over the past three years, …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East