Black gold is not the only oil of industry in the emerging Emirati economies. In a final look at last year, CMM’s CAROLINE MAGINN makes transparent some of the extracts from thecompany’s 2014 UAE Tajara Monitor

Black gold is not the only oil of industry in the emerging Emirati economies. In a final look at last year, CMM’s CAROLINE MAGINN makes transparent some of the extracts from thecompany’s 2014 UAE Tajara Monitor

The trade and investment storyboard was very positive across even the non-oil based Emirates economies and corporate banking continued to be central to banks operating premise accounting as it did for above 30-40 per cent of the full range of financial indicators whether total assets, liabilities, operating income or net income.

So whilst banks are understandably attracted by, and investing in, other business segments, the corporate segment is simply too important and dynamic in its needs to ignore, or rein in investment on.

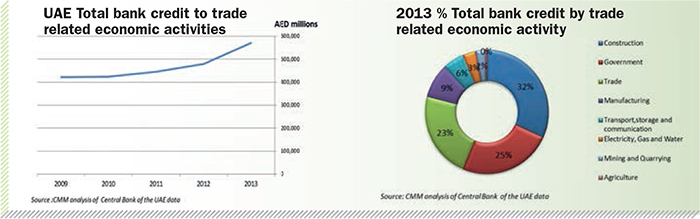

In absolute terms, thankfully for GCC corporates, clearheaded loyal UAE banks grew their lending in substantial double digit per cent terms of well above the AED 500bn mark to trade related economic activities in 2013.

This underscores the confidence in, and stability of, the fundamentals when it comes to corporate banking and trade finance. It reflects an expansion in trade and manufacturing operations both in terms of existing and new corporate activities, some on the back of GCC, some on the back of further afield inward investment. This supports an emerging increasingly poly-cultural and industrial engine of growth in the Emirates.

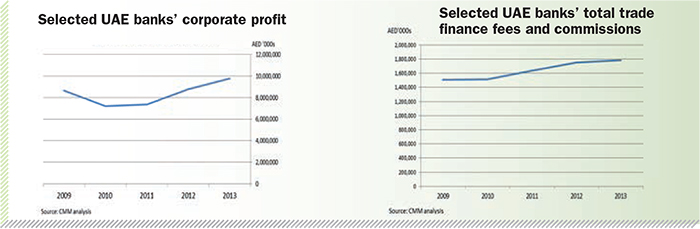

The region’s banks responded with mixed bags of degrees of progress and gains commensurate with strategic foresight and corporate banking focus. Trade finance continues to drive the corporate relationship dynamic across the spectrum of client size in the UAE economy.

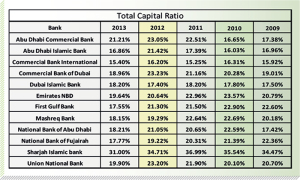

Very significantly, for future upward growth potential, banks’ capital adequacy remained prudent under the supervision of the Central Bank and significantly above “Basel” requirements with banks demonstrating positive liquidity and a turnaround in debt provisioning.

In 2013 and into 2014 unfolding corporate banking and trade finance opportunities have translated into a rising, if more complex, flow of mandates. This is an intra-day transaction flow reality at the selected banks covered by the UAE Tajara Monitor. These opportunities have not gone unnoticed by the new wave of foreign bank stakeholders from Korea, China and Japan, who are expanding their footprint in the Emirates and wider GCC.

Banks making the right investments and strategic decisions in corporate banking and trade finance in the UAE recorded a very encouraging year in 2013 positive both in absolute value and relative market share gains.

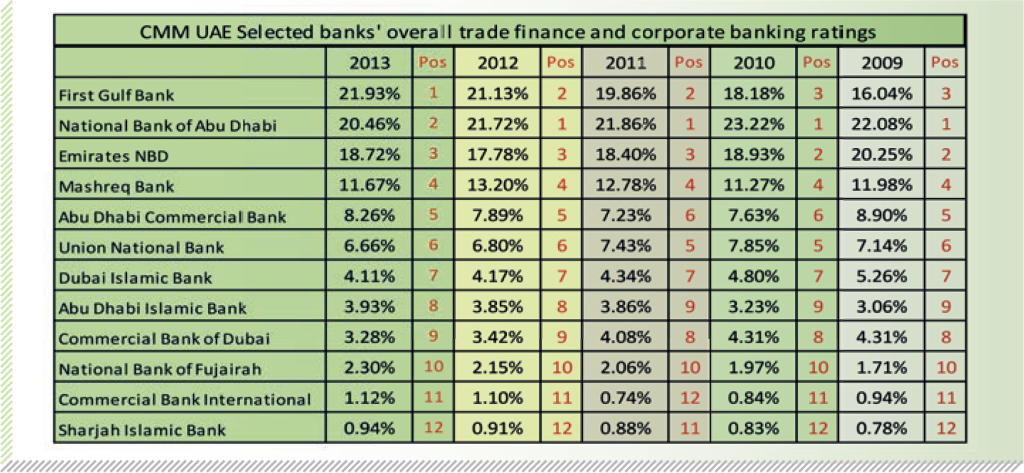

There were very significant shake-ups at the top of the CMM overall league- table. First Gulf Bank realised the promise reflected in their lead in CMM’s Trade Finance Benchmark Bank Ratings last year to leap-frog to the top of the table ahead of NBAD. There were further dramatic and differing fortunes at the top of the table with Emirates NBD and Mashreq having very different fortunes.

The contrasting fortunes of different banks was continued in the bottom half of the table with the National Bank of Fujairah proving itself once again as a marked consistent improver justifying its benchmarking rating last year. The banks will need to keep pace with their corporate clients needs and be mindful of their competitors to meet / stretch performance and financial targets for this full year in 2014 and more generally in their rolling forecasts and strategies.

In 2013 the increasingly important systemic role of the UAE financial sector in wider trade liquidity across the MENA region and Pan-Arab world was again clearly evidenced in many ways:

- ambassadors, trend setters and thought leaders for the MENA region to the external bank and supranational segments

- hosts of the widely commented on “best SIBOS yet”

- informed attendees at the return of the NBAD sponsored Global Financial Markets Forum (GFMF) in Abu Dhabi

- trend-setting new borrowers in important overseas markets such as Hong Kong, Japan and China in club and public financings in addition to longstanding European and US markets through medium-term note programmes bond issues sukkuk and other trade related financings thereby diversifying investor and borrower relationships with the new emerging stakeholders in the Emirati economies

- supporters of progress in the development of the UAE as a new and alternative finance hub to the more traditional hubs in the Americas and Europe with the direct supporting trade flows with Asia and Africa to underpin the correlated financial flows of capital and liquidity

- bankers to commodity trading and value added ancillary manufacturing industries through efforts of the DMCC and the multiplication of focused and in general terms complementary free trade zones in the different emirates

- direct and indirect sponsors of industry-wide progress in shipping, bunkering, warehousing and inspection facilities in petrochemical industries but also very significantly and successfully in non-petro-chemical flows such as precious metals, value-added industries and import export and re-export flows but also meaningful footprints in enhancing the trading and, liquidity of commodities such as tea and related items and other food and beverage products and the packaging thereof

- continued builders of trade assets and contingent liabilities and related risk participation activities meaningfully to deploy prudent legal lending limits on capital whilst providing reliable and needed support to corporates with growing working capital needs on the back of successful domestic and export activities.

- more pro-active interaction with their corporate client partners to empower corporate export flows and improve corporate import flows

- more pro-active investors in their local talent inventory of trade practitioners experience at an operational and origination level for the relationship and product managers active in trade.

- employers of local resources to support daily contact and advisory to corporates trying to optimise the management of their daily trade transactions and operations

- establishers of two way on-the-ground trade operations in partnership with UAE and Asian banks in each other’s geographies to cement partnerships and deepen corporate trade offerings.

Moreover, the Emirates are collectively moving towards new economic models. The same level of vision that engendered the world-class tourism and leisure facilities is now spurring new unfolding industries in a, to some, surprisingly broad spectrum.

Amongst this second wave of modernisation is a wave of tangible goods based import, export flows and re-export flows and value added manufacturing activities. Around these flows are secondary supporting hi-tech and media strands of development evidenced in the free trade zones, trade flows and increased value of banks intermediation through trade finance.

The sustainability of the same is underwritten in no small way by the prudent capital provision of the UAE banking sector, which compares very favourably to that in other parts of the world and gives the wider economic agenda the added muscle to ensure delivery of its promise.

It is in the interests of banks individually and collectively to further the legacy as a national group in order to safeguard, protect and uphold the reputation and practice of integrity of compliance and good practice in trade finance and cash management.

Individual bank voices and a strong collective voice of a harmonised Emirates banking sector will be the lasting foundation for the next generation trade flows of the Emirates, thereby ensuring that black gold is not the only oil of trade and industry in the Emirates!

Against a backdrop of some international banks paring their cash and trade correspondent relationships whether with good grounds or not, it is timely for the Emirates banks to be able to articulate demonstrate and describe their trade finance credentials and good practice to overseas correspondents to ensure ongoing robust bank liquidity for trade for the sustainable future.

The development of dynamic trade finance and cash management offerings and services to clients both FI and Corporate is one of the most natural and worthwhile spheres to build on good KYC and KYCC intelligence and value added.

In short, Brand UAE is paving the way for the quality label Made in the UAE across a diverse range of services, manufactured goods and fifth generation technologies. This makes for smart industrialisation and means that best in class trade financiers have a critical role to play in how it unfolds. This is against a backdrop of the significant physical and more intangible benchmarks widely in evidence.

The former includes rich diversity infrastructure enhancements, including port handling and air traffic capacity enhancements – eg, ADT’s millionth container through Khalifa’s port in December 2013, multiple new air transport/service agreements with countries far and wide, including Iran, Australia, Kosovo, Columbia, Sudan, Malaysia to name just a few.

In a parallel and complementary move, the UAE continued to open new consular and ambassadorial activities (eg, the UAE opened new embassies in Bogota and Somalia) and consulates overseas continued to add to their presence and virtual and actual activities on the ground.

In general terms the health and sustainability of the new interchanges and developments is also evidenced in the physical goods non-oil as well as oil related flows – eg, gold, tea, and cotton, cement and food products. These are a small sample of segments of emerging excellence each with their own in-depth structure and storyboard of private sector entrepreneurism and growing physical and intellectual leadership.

The role for the region’s banks to evolve their corporate trade finance offerings for all corporate segments to support this new growth wave is arguably the UAE’s “Big Bang” and a more beneficial one than that which preceded it in the financial sector in other parts of the world.

More important than the consolidation of investment and commercial banking, which drove the big banks elsewhere, commercial banking now belongs centre of stage in the UAE. This is the evolution of a new world-class generation of trade financiers and institutions to deliver sustainable low-volatility risk mitigating capital protection trade finance solutions.

The paring of financial with commercial capital will hopefully drive the reciprocity and discussions between corporates and banks and make for a value-added focus of many bank corporate partnerships. This will reflect well the true spirit of murabaha and musharaka in the near term and shape the delivery of solutions with speed efficacy and the supporting human, risk and IT infrastructures for the future across the tenor spectrum.

It is a very exciting time to be a trade financier in the Emirates and wider GCC.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East