Facilitating trade finance for new businesses is paramount to nurturing continued growth in the Middle East. Small and Medium Sized enterprises (SMEs) are proliferating in the region and creating an increased demand for bespoke and flexible financing, which is not being met by the region’s banks. Chris Ash, Managing Director of ExWorks Capital UK, describes the challenges and opportunities in …

Read More »Trade

Looking on the Bright Side: Financing Solar in the GCC

With an extremely favourable climate and ample available land, the GCC countries are well placed to benefit from a global rise in solar power. Rachel Goult, director at S&P Global Ratings, considers the GCC’s efforts to become a large producer of solar energy – and how new capital market involvement and green Islamic finance initiatives could help support the growing industry …

Read More »Banking on digital expertise banking – corporate transaction the changing trend

THE CHANGING TREND Corporates today are focused more than ever on technologies and insights that drive consolidation and integration. Treasurers and financial managers not only need quick access to reliable financial data at a consolidated level but toward that end, they demand real-time, or at least near-real-time, details about transactions, cash positions, and liquidity – enterprise-wide. They want systems that …

Read More »DOKA-NG Awarded SWIFT Certification for 2017

Hamburg, Germany, October 10, 2017 – Surecomp®, the leading global provider of trade finance solutions for banks and corporations, announced today that DOKA-NG®, a back-office trade finance solution has been awarded ‘SWIFT Certified Application – Trade Finance’ for the 17th consecutive year. The SWIFT Certified program provides accreditation to companies that provide various SWIFT-related services and solutions to end customers. …

Read More »Etihad Airways and Natixis close the first Aircraft Leasing Transactions in Abu Dhabi Global Market (ADGM)

17 January 2017 Etihad Airways and Natixis have completed a Sale and Leaseback for two 2016 vintage Airbus A380 aircraft. Both aircraft are owned by special purpose companies based in Abu Dhabi Global Market (ADGM), the world’s newest international financial centre (IFC), and are leased to Etihad for a period of 12 years. This marks the first aviation finance transaction …

Read More »UAE imports of mattress supports, articles of bedding and similar furnishing reached USD 244 million in 2015 with a global value of imports exceeding USD 14 billion says Dubai Exports latest report:

300 exhibitor and 10000 experts gather in one platform to display the latest trends in the furniture industry DIFAC, a gold opportunity for the regional brands to promote internationally their businesses Dubai, UAE, 9 January 2017: Dubai International Furniture Accessories & Components & Semi-Finished Products Show (DIFAC) is announced to host more than 10,000 quality trade professionals from the …

Read More »Turkey and Mexico: Strengthening ties, leveraging opportunities

By Cihat Takunyaci, Managing Director, Country Manager for Turkey, BNY Mellon and Margaret Guevara, BNY Mellon Treasury Services’ Head of Sales and Relationship Management for Mexico and Central America Efforts to increase trade between Turkey and Mexico are gathering momentum – a trend fuelled by the global financial crisis. Indeed, the particularly detrimental effect of the crisis on their more …

Read More »BNY Mellon – the impact of fintech

Banks: the engine room driving digital change The rise of financial technology or “fintech” companies has sparked unprecedented levels of digital innovation, resulting in huge change, especially in the retail transaction space. While developments have been less prominent in the corporate sector – and particularly elusive in the trade finance sphere – that is set to change. BNY Mellon’s Anthony …

Read More »exploring funding options in emerging markets

The emerging markets are hotbeds for growing businesses. Will Nagle, CEO, and Nam Sahasra, Regional Head, UAE, at specialist financier Falcon Group, discuss the opportunities and challenges presented by emerging markets – particularly the Middle East – and the role specialist financiers can play in aiding expansion Gone are the days when the US, EU, and Japan accounted for 70% …

Read More »Clarifying Supply Chain Finance

Supply chain finance has been a growth area in recent years, yet there has been a growing feeling within the industry that its practitioners have – at times – been speaking in tongues. The new Standard Definitions for Techniques of Supply Chain Finance will hopefully go some way to address this confusion in supply chain finance terminology. Supply chain finance …

Read More »Lower oil prices may affect profits

A ‘gradual weakening in economic conditions’ may adversely affect Gulf banks, according to rating agency Standard & Poor. After posting positive results in the past year, Islamic banks in the UAE and the rest of the Gulf Cooperation Council (GCC) region are likely to see profits slowing down for what remains of this year as the decline in oil revenues …

Read More »The great fight to control the safe future of finance

One of the greatest duelling pairs in the history of crime fiction were the cerebral detective Sherlock Holmes and his nemesis Professor Moriarty. And, in spirit as it were, they might be living on in the digital age as Good and Bad clash for supremacy in the field of cybercrime in the financial services sector. What guards and tripwires can …

Read More »Lebanon: a pillar of strength

Lebanon remains a beacon of light in a sadly troubled region, partly due to the strength and reliability of its banking sector. As trade flows shift, regulatory requirements increase and regional uncertainties continue, Cash & Trade sat down with a number of Lebanese banks at a BNY Mellon-hosted roundtable in Beirut Cash & Trade: The Phoenicia Hotel here in Beirut …

Read More »World must rise to trade financing challenge

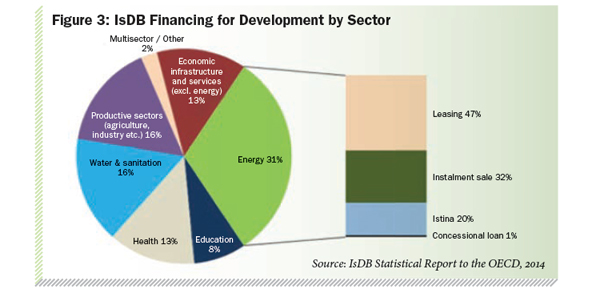

The hope that global growth will be driven by emerging economies suggests that the lack of adequate (and affordable) levels of trade financing is something that requires urgent commercial and political attention. ALEXANDER MALAKET, president of OPUS Advisory Services International Inc. and author of Financing Trade and International Supply Chains, looks at the issues. While the biggest mandate for treasury …

Read More »Records all round…

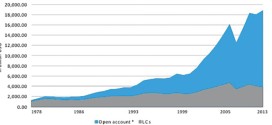

CAROLINE MAGINN looks at a triumphant year for UAE banks Trade finance and corporate banking enjoyed a robust year in the UAE in 2014 with our 12 selected banks reporting overall record figures in trade-related contingent liabilities, corporate assets, liabilities, operating income and profit. This was reflected also in trade finance fees and commissions where the seven banks who report …

Read More »Market may be seeking critical mass

Mushtak Parker looks at a slight slackening of Sukuk activity and raises some question as to what might be behind it given the flurry of issuances that occurred in the first five months of this year A wash with a surfeit of liquidity in the two key regional markets of the Gulf Cooperation Council (GCC) countries and South East Asia, especially …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East