Dear Reader, The importance of managing cash effectively and having visibility and control over it cannot be overstated. For example, in the current climate careful timing over payments and receipts can be hugely beneficial, while the ability to minimise counterparty risk by rapidly moving cash to more stable banking partners is invaluable, especially in the event that the eurozone crisis …

Read More »Issue 15 May / June 2012

How banking can buck up

“For many banks, the question has not been ‘how do I succeed’ but ‘how do I survive’? according to David Hamilton, president of SunGard’s banking business. Fundamentally, he explained, the global banking model had shifted and a transformation was occurring in how money was being managed as banks strove to re-build trust and create value for their shareholders. “A focus …

Read More »ICIEC backing goes above $3bn

More than $3bn in export credit insurance has been provided over the past year to member countries by the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC). This was revealed at its recent annual meeting in Khartoum. The annual report showed that this was an increase of 59 per cent compared to 2010, and financial results were …

Read More »SWIFT launches Sanctions Screening

SWIFT has announced the launch of Sanctions Screening, a centralised service for small- and medium-sized financial institutions in need of a cost-effective, easy route to compliance with sanctions regulations. It was developed to help those SMEs keep up with increasing regulatory obligations. Complying with evolving sanctions regulations and frequently updated lists has become more complex, costly and time-consuming for financial …

Read More »‘Alternative future for corporate funding’

Leading names from the world of international finance were at the third annual Falcon Group trade and corporate finance forum held at the Madinat Jumeirah Hotel, Dubai. Moderated by BBC World’s Nima Abu Wardeh, the forum brought global CEOs and CFOs together to hear speakers discuss crucial issues for corporate funding. Offering political, economic, banking and corporate perspectives, the list …

Read More »Banks in ‘Asia deal’

Standard Chartered has signed two agreements with Warba Bank to facilitate their transactions in Asia. The announcement comes in light of increased trade activity between MENA financial institutions and companies with Asia in general and China in particular. Warba Bank joined Standard Chartered’s “Asia Express Guaranteed Payments Programme”, which ensures delivery of funds to beneficiaries in Asia on the same …

Read More »Groundbreaking finance deal for oil

The International Islamic Trade Finance Corporation (ITFC), a member of the Islamic Development Bank Group, signed a $855m Import Finance Murabaha Agreement with The People’s Republic of Bangladesh (represented by the Energy & Mineral Resources Division) and Bangladesh Petroleum Corporation (BPC) for the import of crude oil and refined petroleum products. The agreement brings together a total of 28 financial …

Read More »The ‘21st century Silk Road’

Trade corridors between China and the MENA region carry huge economic growth potential for businesses, offering the greatest prospects in the commodity and energy sectors, HSBC said at its Middle East and North Africa (MENA) and China Forum held in the UAE recently. Emphasising the growth of China as a trading powerhouse, HSBC added that China is poised to become …

Read More »New glow for commercial banking

Transaction banking has never been viewed as an especially glamorous facet of the industry, with most young bankers eschewing careers in this area for high-rolling investment banking positions. Now, however, while investment banking headcount is being pared back, transaction banking is quietly booming.

Read More »Ministries move into e-banking

Governments across the Middle East are embracing change. The social justice agenda, which has been rolled out across most of the region, has seen them place a stronger focus on spending on employment, healthcare and education reform – as well as investing in infrastructure and the private sector to encourage growth. LIZ SALECKA reports Many governments are now seeking to …

Read More »Strengthening cross-border trade

The rising levels of transaction banking sophistication throughout the MENA region coincide with an increasing corporate focus on how to better manage risk and working capital throughout the supply chain. SRIRAM IYER, regional head of global transaction banking at Deutsche Bank, discusses the role financial supply solutions can play in facilitating trade against the backdrop of these developments While the …

Read More »New era for banks in the sultanate

PAUL MELLY, looks at growing competition in what has traditionally been one of the Gulf’s quieter financial markets News that HSBC is taking a majority stake in Oman International Bank confirms the growing intensity of competition in what has traditionally been one of the Gulf’s less frenetic financial markets. The government’s decision to allow the development of Islamic finance will …

Read More »Sukuk to the rescue

MUSHTAK PARKER looks at a unique new fund raising and liquidity option that has been taking MENA by storm One of the ongoing consequences of the global financial crisis has been a sustained credit crunch in economies all over the world as liquidity remains scarce and financing is targeted at “safe” customers by an over-cautious global financial sector. This, despite …

Read More »Play by the rules

There have been many approaches to corporate governance over the last 20 years, with new approaches constantly suggested. In the UK there has been the Cadbury Report (1992), the Greenbury Report (1995), the Turnbull Report (1999) and the Higgs Report (2003), among others. New mechanisms are usually introduced in response to corporate scandals, such as Guinness in the 1980s, Maxwell, …

Read More »How to steer through crisis

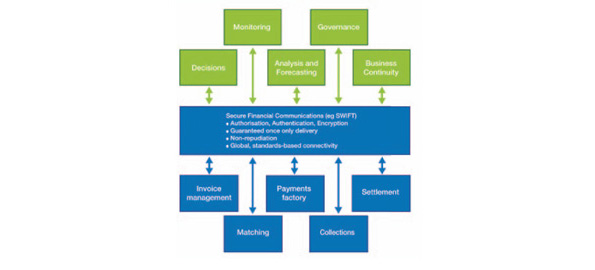

The scars left behind by the 2008 credit crunch and resulting financial crisis have barely faded and yet 2012 already looks as though it will be another highly challenging year for corporate treasurers. MARCUS HUGHES, business development director, Bottomline Technologies, looks at how they can cope The world economy is once again on the verge of a new crisis as …

Read More »Boost for small business funding

Governments across the Middle East are now looking for ways to help SMEs. MUSHTAK PARKER, looks at what’s in store Small-and-medium-sized enterprises (SMEs) form the backbone of many Middle East and North Africa (MENA) economies. In the aftermath of the global financial crisis, governments are seeking to generate employment, especially youth employment, and economic growth to try to mitigate the …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East