Dear Reader, If competition is healthy, as most generally agree, then the UAE is at a peak of fitness! Currently, the Emirates are being seen as a “battleground” where international and domestic banks are displaying their respective wares in a bid to win new trading customers, all to the benefit of local corporates. As we explain in this issue, much …

Read More »Issue 28 July / August 2014

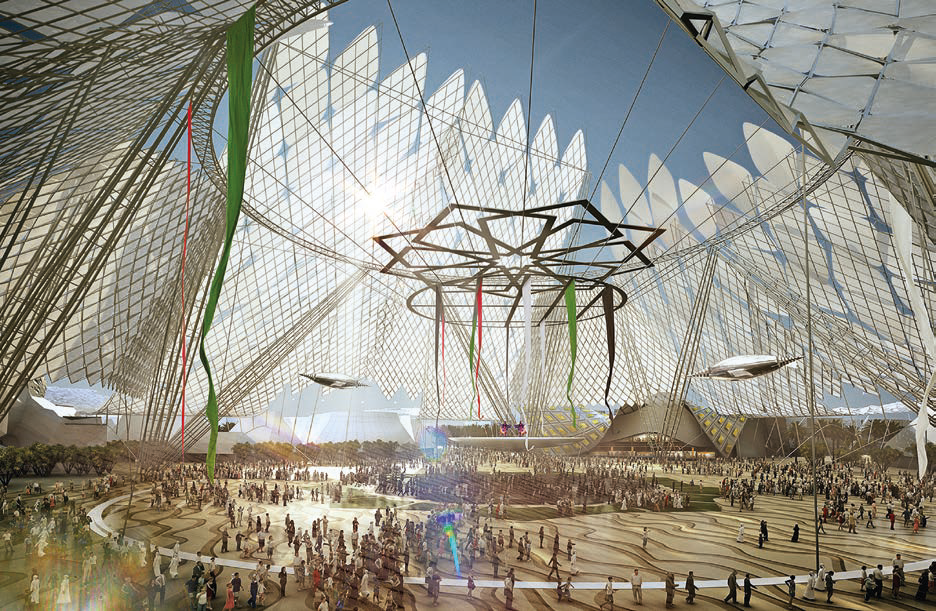

Abu Dhabi’s top spot in ‘corridor of the future’

Abu Dhabi’s strategic advantages as a conduit and enabler of trade and commerce across a rising “super region” stretching from West Africa to East Asia were presented by the National Bank of Abu Dhabi’s (NBAD) group chief executive officer Alex Thursby at the recent fifth Abu Dhabi Investment Forum (ADIF) held in London. The event is organised by Institutional Investor …

Read More »Book Review: Revolutionary ideas about mobile banking

A new book has posed what is considered a very significant question: is mobile banking a new channel, a new business model or a revolutionary platform for social change? Mobile banking will be big, but how big? Is it a new channel for existing banks, or a new business model for entrepreneurs and non-banks? Former Citibank executive Sankar Krishnan paints …

Read More »Islamic banking’s ‘Eldorado’

Asia is likely to be the main driver of Islamic banking growth in the near future given the untapped potential in Indonesia, Bangladesh and India, as well as the increasing uptake in Malaysia and Pakistan. This is the view of KFH-Research, a subsidiary of the Kuwait Finance House Group, which has issued a report saying that Asia presents huge developmental …

Read More »Step up for UAE bank

Al Hilal Bank, said to be one of the fastest-growing banks in the UAE, has announced that it has successfully implemented the award-winning Finacle Corporate e-Banking solution from its technology partner Infosys. This enables Al Hilal to provide a full range of internet banking services to its corporate customers in “an intelligent and seamless manner, without compromising security”. It also …

Read More »New treasury services chief

Anthony Brady has been appointed managing director and global head of the Business Strategy & Market Solutions (BS&MS) Group for BNY Mellon’s treasury services business. He has served in leadership positions in a number of important areas during his 31-year career with the company, including new business development and treasury services operations. “Tony’s appointment reflects his strong performance as interim …

Read More »Banking bout breaks out in the Gulf

The UAE is becoming a ‘battleground’ where international and domestic banks are touting their respective services in a bid to win new trading customers. MELANIE LOVATT looks at how this competition is benefitting corporates Much bank activity has centred on providing services to the Gulf region’s government- controlled oil companies. Securing this business remains important, but private sector growth and diversification …

Read More »Funding solutions: call for banks to buck up

Expansion, forward thinking and treasury upgrades have contributed to the success of one of Dubai’s leading commercial groups. But it would like to see an improvement in the quality of services being offered by banks. PAUL MELLY reports From traditional family trading house to modern company in just a few decades. This is a path that many of the …

Read More »Technology: Omani banks get set for the future

Omani banks are gearing up on the IT front following a Royal Decree encouraging the market to adopt more technology. This was one of the facts that emerged from a BNY Mellon Roundtable in Muscat. The questions were put by Cash&Trade Cash&Trade: What challenges do Omani institutions (banks and their corporate clients) face with regard to the new regulatory environment …

Read More »KSA confirms its position as a ‘growth economy’

The GCC Tajara Monitor series for the financial year 2013 is shortly being released beginning with the KSA analysis. The focus is to provide transparency on developments, trends and the financial and capital dimensions of the trade-finance market-place. CAROLINE MAGINN reviews the findings The complex trade finance business proposition delivered by banks continues to evolve in an attempt to support …

Read More »Cyber crime: MENA is now a prime target

More than 38 per cent of those in the Middle East who responded to an economic crime survey said they expected their organisations to be victims within the next two years. PAUL WRIGHT, of AccessData Professional Services and Investigations, looks at how companies can cope in the ‘digital world’ The Middle East is fast becoming a prime target of cyber …

Read More »New funding on the way for SMEs in Africa

The Islamic Corporation for the Development of the Private Sector is at the forefront of a massive drive to support SMEs. MUSHTAK PARKER reveals who will benefit Due to celebrate its 15th anniversary in 2015, the Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IDB) Group, is a …

Read More »Zeroing in on the Euro Zone

Several financial institutions and corporates in Asia, the Middle East and North Africa – although not tied to the 2014 Single Euro Payments Area (SEPA) deadlines – have joined SEPA schemes, and are already ‘grabbing the operational benefits of optimised euro payments’, according to OLIVIER DENIS, product manager for SEPA compliance at EastNets T he single euro payments area (SEPA) …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East