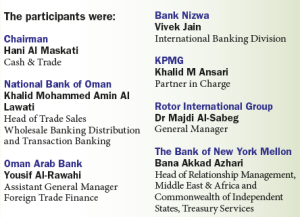

Omani banks are gearing up on the IT front following a Royal Decree encouraging the market to adopt more technology. This was one of the facts that emerged from a BNY Mellon Roundtable in Muscat. The questions were put by Cash&Trade

Cash&Trade: What challenges do Omani institutions (banks and their corporate clients) face with regard to the new regulatory environment and tougher reporting requirements – not just in terms of achieving compliance, but concerning the wider impact on business?

Dr Majdi Al-Sabeg: I feel there is a great deal of improvement needed in the Omani financial sector to compete at the regional level.

Khalid Ansari: Central Bank of Oman (CBO) regulates the banking sector very well and probably has the most regulations amongst the GCC countries, with clear regulations and policies on banks and non-banks (such as money exchanges). Banking laws have been around for a very long time in Oman, where CBO plays a very active role and was one of the first to adopt global changes in regulations. For example, when Basel was introduced, Oman was one of the first countries to implement the Basel regulatory framework. The overriding reason for regulations is obviously the protection of banks’ depositors and this is one of the reasons why during the global financial crisis the Omani banks were not affected.

CBO has not allowed banks in Oman many product offerings, such as derivatives products. Such products have been available outside Oman, from international banks in Bahrain and Dubai.

CBO has not allowed banks in Oman many product offerings, such as derivatives products. Such products have been available outside Oman, from international banks in Bahrain and Dubai.

CBO allows more or less the vanilla product

offerings. Omani banks are regulated on two fronts:

- CBO regulations apply to all banks, both foreign and local

- Local banks listed on the local stock market are also subject to regulation from the Capital Market Authority. After the Omani stock market crashed in 1989, the Capital Market Authority came out with much more robust and stringent corporate governance and disclosures. It is also mandatory by a Royal Decree for all companies to follow international account standards, hence there is quite a burden on the institutions to disclose information. In terms of profitability, banks are profitable, with the bulk of the profitability arising from the retail/consumer lending business, and here we see an active role from the regulator to cap personal loans in Oman.

Recently, it has become mandatory for all banks to lend five per cent of their portfolio to SMEs to promote entrepreneurs. Lending to SMEs will present its own challenges to the banks as their infrastructure has always been geared for consumer banking and corporates. SME lending was not focused appropriately in Oman by the banks. SMEs, however, have different characteristics that work very well in developed economies, and lending is based on a structured formula. But here the same approach will not work as the economy is at a very different stage of development.

Although the stock market and central bank regulate the large businesses, small traders are not regulated much. There are no sales taxes and they do not pay income taxes; no authority is regulating to ensure that record keeping in this market segment is accurate – i.e., the mixing of personal cash with business cash will continue to be the biggest challenge for this segment.

Now that banks are being asked to commit five per cent of their books to this segment, we could see the authorities moving closer towards having a regulation for the SMEs.

Also, a fund under the name of Al Rafad was created on 1 January 2014 to support Omani SMEs with an initial capital of 70 million Omani riyals. This will be increased by seven million riyals annually and it will be used to lend to SMEs and micro-finances. For example, there is a programme empowering rural women. The mandatory five per cent for all banks in Oman to lend to SMEs constitutes a large and staggering number. The challenge will be its effective utilisation.

Corporates are growing at a much faster rate and this is where a lot of interest is focused; looking for good, exciting and innovative products. But unfortunately, these corporates have to look outside the country to meet their demands, mainly towards Bahrain or Dubai. Given the size of imports and exports, innovative trade products and solutions are always in demand.

Vivek Jain: From a local bank’s point of view, with regard to the impact of some of the compliance regulations on our business and customers, relationships with international banks continues to be a challenge. For example, sometimes we receive a simple draft issued by a commercial bank belonging to one of the internationally-sanctioned countries. However, due to the FATCA declaration required by most of the US correspondents, we can’t entertain any financial instruments with internationally-sanctioned institutions, which places us in a very awkward position with our customer.

Bana Akkad Azhari: US banks are, quite understandably, very careful not to tread on regulators’ toes, to avoid penalties and any potential reputational damage. They are therefore stringent in ensuring that no transaction that violates any US rule or sanction passes through them. Indeed, for any international bank, there are myriad international, regional and local regulations and practices to navigate and contend with. But, on the flipside, such challenges can in fact spark innovation; not just in terms of new products or technological infrastructures, but organisation-wide changes to realise greater efficiencies.

Yousif Al-Rawahi:Central Bank of Oman is doing a great job in watching, controlling and supporting commercial banks. In this case, we do not face difficulties or impacts, as banks in Oman are following and complying with regulation. Oman is a country supported by its own culture, which includes regulation and systems practised internationally.

We often hear business owners from sanctioned countries calling for our support to do business with Omani companies, complain that they have nothing to do with their governments’ policies, yet the sanctions make them lose many opportunities simply because they are of the same nationality as the sanctioned country. In such cases, we are unable to help them.

Dr Al-Sabeg: One cannot operate without regulation. However, I think some market decision-makers themselves add additional elements above those imposed. For example, look at the past year’s corruption scandals in Oman’s oil and gas and construction sectors, which resulted in senior officers ending up in jail. Consequently, some senior bankers added an extra requirement to avoid being questioned in the future for any mistakes that may occur. This extra caution has impacted some of our pending contracts that have yet to be awarded. I can see the snowball effect continuing this year and next. We must have a balance between process control and process efficiency. Although control minimises business risks, the more control built into the process, the less efficient the process becomes.

The other interesting point concerns the treatment of instruments (such as cheques) issued by licensed Iranian banks in the country. Surprisingly, some banks will not cash these cheques, although they are issued by a licensed and supervised institution.

Vivek Jain: Due to the fact that almost 95 per cent of the cross-border settlements carried out in Oman and across the GCC are in USD, the USD accounts are the backbone of any commercial bank in the country. Hence we cannot risk clearing a cheque issued by internationally-sanctioned institutions, even if it is allowed by the Central Bank, as commercial banks here give a written FATCA declaration to the US correspondent banks that they will not deal with any of the internationally-sanctioned institutions. All international banks ask for the same compliance if any commercial bank needs to open and operate a USD account.

I would like to ask this question, though – what about the impact of other upcoming regulations? Basel III for example?

Yousif Al-Rawahi:Regarding sanctions, recently we’ve been requested by a few international banks to confirm LCs with sanction clauses to cover both European and US sanctions. As you know, these are irrevocable documentary credits. We at banks are dealing with documents that comply with credit terms and conditions without seeing the goods or the ship. Hence, adding the suggested clauses places a great risk on us, and is time-consuming internally between different business units, which in turn affects business and our customer relationships. It is banks’ responsibility to handle “clean” customers, and ensure port of loading/discharge, covering goods that are not under sanction. This can be detected in the safe watch system.

Without a doubt, increased regulations and requirements will affect business as more bank resources are allocated to ensuring we adhere to and comply with ongoing local and international rules and requirements.

Cash&Trade: Turning to Oman’s role in shifting trade corridors, how are intra-regional and international flows shaping corporate needs? What new trends can be seen, both in terms of the wider market (eg, diversification into non-oil exports, and the development of free trade zones) and on a practical level (for example, the use of open-account trade and a wider range of currencies)?

Khalid Al Lawati: The most recent change implemented by the National Bank of Oman has been the emphasis on its distribution via electronic channels.

Vivek Jain: During the six years I have been in Oman, I’ve observed that most international trade is within the GCC, channelled through the UAE. I don’t see substantial volumes arising between Oman and the rest of the world because most of the shipments go through the port of Jebel Ali. Ships offload at Jebel Ali and shipments are delivered on an open-account basis by road from the UAE. That is why we don’t have such a large number of LCs as compared to any other Arab country.

Khalid Al Lawati: Oman usually re-exports to the UAE, particularly cars and spare parts due to the fact that Omani car dealers enjoy a very large quota from the car manufacturers.

Bana Akkad Azhari: This raises an interesting point. If there is a growing trend in the Omani market for business conducted on open account – in comparison to more typical LC business – could Omani banks take advantage of this trend and capture part of these flows by offering the new Bank Payment Obligation being promoted by SWIFT? The BPO has been designed to combine the security of LCs with the efficiency and flexibility of open account – so should be well-suited to a region that traditionally prioritises risk-mitigation, but which needs to harness efficiencies wherever possible to make the most of shifting trade patterns.

Khalid Al Lawati:There is a lack of innovation when it comes to open-account product offerings in Oman. At the same time, generally speaking, Oman corporates prefer a simple loan rather than complicated open-account arrangements. Today the market demands online trade finance capabilities but not all Omani banks offer it.

Transaction banking is something new amongst Omani banks and there isn’t a dedicated division within corporate banking to build, sell and manage transaction banking products. It all comes about within the banks’ general operations.

Bana Akkad Azhari: I agree in that the term “transaction banking” is new – however, its underlying activities and products have been covered by banks in the region for a very long time. Certainly, transaction banking, in one form or another, is an age-old business, and its core pillar – supporting commerce by establishing trusted partnerships – never changes. Instead, it is about adapting to the ever-changing environment by finding new ways to accomplish these core tasks; and while some more innovative electronic platform-based solutions may be a more recent addition to the region’s activities, there’s no doubting the fact that local banks understand the value of close client relationships, local market knowledge and the ability to nurture collaborative partnerships.

Cash&Trade: In light of these changes, how can Omani banks help their clients overcome the corresponding challenges? For example, is innovative technology – aiding automation and standardisation – the key to facilitating growth, and helping corporates embrace new opportunities?

Khalid Al Lawati: We all know that cash management and trade finance business is often a sticky point with customers. The challenge among Omani banks in the Sultanate is building up expertise regarding promoting innovative added value and more complex products for non-oil related export products. For example, when it comes to exports, there is a lack of innovative products for insurance companies, and most of the time those companies require some sort of collateral from the banks. Today, banks in Oman compete heavily on pricing, in order to win business, and not so much on the innovation and structure side.

Yousif Al-Rawahi:A few years ago we introduced an internet trade finance offering with full security measures, and worked hard to persuade customers to use it. However, they were still apprehensive about the security risk of the digital world. It was, and still is, a culture challenge. The second management generation in Omani corporates who are more IT savvy will, however, push for these changes.

Through our large, well trained trade team of 40 staff, which provides a high level of customer service and correspondent banking relationships, our bank captures almost 80 per cent of the export LC business in the country.

Dr Al-Sabeg: I think the market is ready to embrace technology; however, there is a shortfall among Omani banks. What Oman needs is a lead bank that introduces, promotes and supports technology. One of the big problems with Omani banks is the lack of customer service empowered with the latest technologies.

Yousif Al-Rawahi: Top management sponsorship, supported by proper staff training both domestically and internationally, are two important factors that will contribute towards enhancing customer service.

Bana Akkad Azhari: How do you see international banks playing a role and contributing towards training? For example, by sharing insights gleaned from other regions, or product-related expertise, or the encouragement of greater market dialogue around such developments?

Yousif Al-Rawahi: International banks can help a great deal through workshops and product training sessions. Roundtables, such as ours today, are vital in helping share “the international experience” with Omani banks. In our trade operation we are always hiring fresh graduates. Then we invest the time to train them regarding trade and over the years we have managed to supply the market with local talent.

Cash&Trade: How are corporate cash management strategies evolving, and in order to meet changing needs and preferences do local banks need to be able to provide a broader set of cash-management solutions?

Yousif Al-Rawahi: Omani banks need to increase their technology offerings, whilst at the same time the government needs to continue automating its activities with the public as much as possible.

Dr Al-Sabeg: Take the biggest company in Oman: PDO (Petroleum Development of Oman). In the past 10 years, it was always done via a file-shared arrangement with the banks executing the wire transfer transactions. Then only recently it switched into more semi-automatic treasury transactions with the main banks they deal with. Most of the efforts required to achieve this initiative came from PDO itself and not the banks. The transition to a fully automatic financial transaction lies with the Omani banks and their capabilities including technology offerings. However, they are not there yet and we do not have a leading bank to raise the bar.

Khalid Al Lawati:Years ago we offered the market automated solutions. However, the most challenging area remains a cultural one. We still have first generation management holding key positions in large corporates, as well as in the government, and they tend to shy away from technology as they are not IT savvy. With His Majesty’s vision encouraging information technology and communication, the market started adopting technology between banks and their customers, and we have started to see an increase in the take-up of banking technology offerings.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East