Expansion, forward thinking and treasury upgrades have contributed to the success of one of Dubai’s leading commercial groups. But it would like to see an improvement in the quality of services being offered by banks. PAUL MELLY reports

From traditional family trading house to modern company in just a few decades. This is a path that many of the Gulf’s leading commercial names have followed.

As the regional economy has grown and diversified, one-time merchant houses have evolved into competitive business groups, active across a range of sectors and exploiting the latest management and financial techniques.

Dubai-based Easa Saleh Al Gurg Group (ESAG) exemplifies this forward thinking trend.

Group general manager Abdulla Al Gurg in an exclusive interview with Cash&Trade outlined his agenda for enhancing financial management capacity at a time when ESAG is on course for expansion in both retail and project activities.

“Growing our brand portfolio and focusing on our retail segment is a key. Our retail sector comprises fashion, appliances, office and home furniture. In the past year, all these varied sectors have shown healthy growth, both within the UAE and in the other regional markets where the group has a presence,” he says.

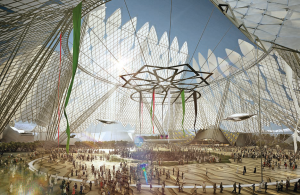

“We also intend to leverage on opportunities provided by Expo 2020, by bidding for infrastructure projects through our project-based entities.

“The increasing number of projects that are set to take off in the run up to Expo 2020 will benefit our various entities such as Scientechnic, which is involved in traffic management solutions, industrial automation, power transmission and distribution, telecommunication solutions and safety related projects by providing fire alarm and fire-fighting equipment.

“The large influx of tourists forecast for Expo 2020 will also ensure good returns for our retail entities.”

With business operations on course to expand, ESAG managers need to ensure that the group’s supporting financial functions are efficient and competitive.

“We would like to bring the accounting system to a level that will set a standard in the region,” says Al Gurg.

He says that ESAG aims to further upgrade its treasury management system, which has been operational since 2011.

“This is a centralised function that manages liquidity for the entire group, which includes 23 distinct business entities. It comprises an in-house bank, centralised trade finance and the payment factory. All bank accounts are netted across the group,” Al-Gurg explains.

“There is day-to-day automated cash pooling performed by the bank. This process helps the group to manage liquidity effectively.”

The group has a dedicated treasury team. Moreover, says Al Gurg, ESAG would like to further develop trade finance solutions to support its growing activity.

The Association of Corporate Treasurers Middle East (ACTME) selected ESAG for its 2013 award for Corporate Treasury of the Year for SMEs – a sign of the credibility that the group’s financial management team enjoys among its peers.

Because of the diverse nature of its activities, including those in Gulf countries other than its UAE home base, ESAG deals with a range of currencies. And, of course, these include the currencies of major international trading partners.

“We mainly deal with the following currencies: the UAE dirham, the US dollar, the euro and Omani and Qatari riyals. We also deal with the British pound, Danish krone, Australian dollar, Saudi riyal and the Japanese yen,” Al Gurg says.

Recent years have seen the emergence of treasury service providers offering services based on “the Cloud”. Some companies see these as a cost-effective chance to benefit from the latest – and regularly updated – technology.

However, others feel that reliance on Cloud service providers for a function as critical and confidential as treasury would pose unacceptable security risks. And ESAG is certainly in this sceptical camp.

“We have a robust in-house system for treasury management. As a policy, the group does not export any data related to accounting or treasury from its internal server to an outside source,” he says firmly.

Moreover, ESAG is prepared to spend the money required to ensure that its own in-house systems are up to date, and able to support the competitiveness of its business systems.

“From 2011 onwards, we have been continuously investing in new technology; this includes tailored SunGard Quantum software for our treasury management system. This has brought our data management systems and reporting mechanisms on to a par with international benchmarks,” says Al Gurg.

“In 2013, the group embarked on a project for the automation of enterprise-wide business planning, financial consolidation and management reporting processes. The project aims to ease work procedures within the group and also assist various departments in making forecasts, consolidating financials as well as producing an automated MIS report.”

This project uses SAP Business Planning & Consolidation (BPC) and SAP Business Objects (BO) applications, Al Gurg points out.

“It was delivered in a phased approach, with three distinct work streams – business planning, consolidation and MIS Reporting. It will also automate consolidation (financial and management) as well as selected management reports.”

But ESAG’s determination to stay up to date is balanced with a pragmatic recognition of the need to what is practicable in day-to-day business life.

“While keeping abreast with technological advancements is essential, cautious upgrade is the key, as it requires being in contact with both market and operational needs,” says Al Gurg.

“The system efficiently supports the business – and not vice versa.”

When it comes to banking, ESAG has the good fortune to be based in one of the region’s most well catered markets. But Abdulla Al Gurg has high expectations and is not entirely satisfied with what is on offer at present; ESAG has to take on some of the financing burden itself.

“There are already a large number of banks operating in the country, but a change in the quality of services being offered is required,” Al Gurg says.

“Banks need to offer better financing solutions for businesses. In other words, there is a distinct gap in offering funding tools for both suppliers and clients. As a group we are, therefore, compelled to take on this funding role, which is also one of the key reasons why we have optimised our in-house liquidity.”

Al Gurg also feels that the Gulf needs to see the emergence of more effective credit reporting systems.

“Most companies have to critically assess the credit worthiness of clients and define credit limits based on their own experience in the market due to the fact that there is inadequate credit information available in the financial market,” he says.

“This also reduces the risk-taking appetite of major businesses. The need of the moment is to enable greater cooperation between financial bodies and businesses, to facilitate knowledge transfer that will positively impact on the economy.”

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East