The stable performance of trade receivables securitisation (“TRS”) through the volatility of recent years has made it an increasingly important alternative funding source for corporates as well as a favoured corporate financing technique for banks, according to the latest research from working capital specialist Demica. Conducted amongst Europe’s biggest 30 banks*, along with a small selection of US-based global banks …

Read More »Issue 27 May / June 2014

Letter from the editorial director

Dear Reader, What this issue makes clear is that trade and its financing are to grow in the BRIC countries: Brazil, Russia, India and China. As a whole, emerging markets are increasingly coming to the fore but it is the BRIC economies that are getting up the biggest head of steam. Indeed, it is expected that by 2018 they will …

Read More »New dawn for supply chain finance

Banks are increasingly committing to supply chain finance (SCF) as a line of business, reveals a new study by Demica, a leading provider of specialised working capital solutions, providing consulting, advisory and technology services to a diverse range of multi-national clients. The study, which examined job title responsibilities at the top 50 largest banks in Europe, identified that close to …

Read More »MENA treasurers are buoyant

Nearly eight in every 10 senior treasury and finance professionals at a Dubai conference (78 per cent) are feeling more positive about the prospects for their business over the coming 12 months. This was the key finding of the “Treasury Verdict” session taken by a live audience poll of senior treasury and finance professionals at EuroFinance’s 12th annual event on …

Read More »SWIFT expands compliance portfolio

SWIFT has acquired Omnicision, the UK-based provider of financial crime prevention services and solutions, which, it says, will underscore its “commitment to invest in its compliance offering and will enable the company to grow its sanctions testing service and further expand its compliance services, leveraging Omnicision’s technology, expertise and product pipeline”. Ian Horobin, CEO of Omnicision, said, “We are excited …

Read More »Deal of the year

The National Bank of Abu Dhabi (NBAD) lead- sukuk that was issued by the Dubai Department of Finance has been named the UAE Deal of the Year at the recent Islamic Finance News Awards. The US$750m 10-year Sukuk issuance was priced at a profit rate of 3.875 per cent. The oversubscription level of 14.6 times was the largest ever for …

Read More »New trading portal starts up

A new online social trading community for serious investors has been announced by Saxo Bank in Copenhagen. The new portal enables traders around the world to share their trades with peers and “transforms trading into a social experience”. Saxo Bank’s co-founders and co-CEOs Kim Fournais and Lars Seier Christensen said in a joint statement, “We want to set free the …

Read More »Fresh era in global payments

BNY Mellon, a global leader in investment management and services, has announced the beginning of a new era in its treasury business with the launch of a new global payments infrastructure. It is designed “to deliver significantly enhanced levels of processing efficiency, reliability, transparency and cash management oversight”. Focused initially on euro clearing capabilities for BNY Mellon’s global clients, it’s …

Read More »Honour for Arab Bank

Arab Bank was recently honoured with the Best Trade Finance Provider in the Middle East award from Global Finance magazine at the Bankers’ Association for Finance and Trade (BAFT) and the International Financial Services Association (IFSA) global annual meeting in London. Nemeh Sabbagh, Arab Bank’s CEO, commented, “Arab Bank plays an integral role in facilitating trade across the Middle East …

Read More »Emerging markets: the benefits of smart liquidity management

Against the backdrop of a slowly improving economy, corporates are once again focusing on growth. And the benefits of emerging markets are hard to ignore. Citi’s AMIT AGARWAL, treasury and trade solutions, liquidity management services head, EMEA; SYBIL CRASTO, treasury and trade solutions, MENA and Pakistan; and DIMITRIOS RAPTIS, treasury and trade solutions, liquidity management services market management head, EMEA, …

Read More »MENA banks face major challenge

Transaction banking – what’s next? MENA banks face major challenge Banks across MENA face a major technical and management challenge if they are to remain a force in the fast-evolving environment of today’s transaction banking – particularly if they want to hang on to their biggest clients. PAUL MELLY investigates what’s changing Research by the financial software group Misys reveals …

Read More »How computer giant re-programmed itself

Microsoft has now redesigned and implemented a new cash forecasting process for 200 subsidiaries in 118 countries, creating a unified reporting and holding mechanism. This has allowed it’s treasury to reduce worldwide cash balances by more than $250m dollars and cut cash forecasting variances by between 50 and 70 per cent (to under 15 per cent globally) since the new …

Read More »International trade: ‘the time’s come for simplicity’

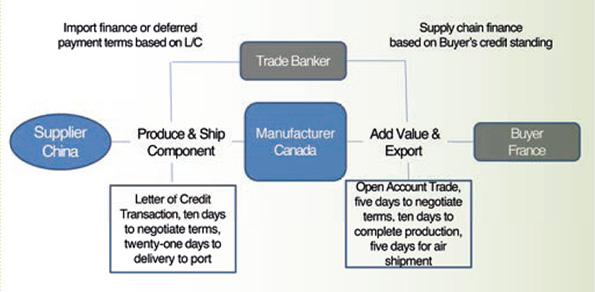

Trade finance: eliminating the mystery International trade: ‘the time’s come for simplicity’ International trade and investment requires a way forward that is grounded in a nuanced and finessed understanding of international affairs, including business, trade and investment. ALEXANDER R. MALAKET, president of OPUS Advisory Services International Inc., looks at why the ‘veil of complexity’ should be lifted The financing of international …

Read More »Bid to bolster growth for SMEs

UAE banks aid smaller firms Bid to bolster growth for SMEs Many of the Gulf’s banks are renewing their focus on small-and-medium-sized enterprises and believe that this often-neglected sector could provide a good vehicle for growth. MELANIE LOVATT looks at its prospects Studies show that SMEs in MENA have continued to lack access to financing but that is changing. A …

Read More »Emirate aims to become Islamic economy’s global capital

Dubai Islamic finance aspiration Emirate aims to become Islamic economy’s global capital MUSHTAK PARKER looks at how Dubai is ramping up its bid to be the hub of Islamic finance The ink had hardly dried on Law No 13 of 2013 – the enabling legislation which was issued last December by Sheikh Mohammad bin Rashid al Maktoum, Vice President and …

Read More »Profiting from the rise of Asia

New global trade flows Profiting from the rise of Asia The balance of global production and trade has swung back in Asia’s favour, ‘traversing another historic tipping point’. MICHAEL GUO and OLIVER DANY, of the Boston Consulting Group, look at how corporate treasurers and banks can capitalise on this fact Until about 1800, Asia contributed approximately 50 per cent of …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East