Due to the partnership model inherent in Shariah-compliant business models, Islamic banks traditionally enjoy a slightly more secure risk position than the majority of conventional banks regionally and worldwide. However, as investment in physical expansion and growth in the Middle East region continues its upward climb, and Islamic banking attracts more customers, the banks will find themselves susceptible to increased …

Read More »issue 02 March / April 2010

Service versus revenue:the banks’ dilemma

Maki Vekinis of Cash Management Matters (CMM) sets out to explain what appears to be a paradox The aim of this article is to address the cash management paradox – ie, why do banks offer a proposition that reduces core revenue? With Middle East-based banks focusing on alternative revenue streams through the offering of transaction banking products – following on the …

Read More »Integrated treasury solutions: the trends

The convergence of cash management and trade finance is a banking trend that Islamic bankers are increasingly taking note of. here, SHAHERYAR ALI discusses the concept of a shariah-compliant integrated treasury offering. The past decade has seen two extraordinary banking trends, especially in the Middle East. The first has been the growth of Islamic banking, brought about by a pent-up …

Read More »Making a mark

NBAD’s bond issue was an expression of its desire to set a standard for the Gulf region, explains Mahmood Al-Aradi (pictured), the bank’s head of financial markets. The National Bank of Abu Dhabi (NBAD) wanted to set a benchmark for the region and the UAE in returning to the funding markets with a $750m bond issue this spring, according to …

Read More »Big backing for bank bond

An impressive one-off or a pointer to the return of international confidence in Gulf banking? Paul MellY looks at the recent NBAD bond issue. A herald of financial recovery in the UAE – or a special case that tells us nothing about the wider prospects for other local institutions? That’s the question being asked about the success of the National …

Read More »Transaction banking: the bid to upgrade

Following a recent roundtable event hosted by BNY Mellon in Istanbul, CIHAT TAKUNYACI, the firm’s treasury services representative for Turkey, discusses transaction banking in the Turkish market. Turkey’s strategic geographic position between europe and the Middle east has sparked (continuing) growth in Turkish-Middle eastern trade flows. however, do Turkey’s local banks have what it takes, in terms of local transaction …

Read More »How to be better off at no extra cost

Delving into the mechanics of credit and collections, payables management and inventory levels can pay dividends. Susan A. Hillman and Daniel L. Blumen , of Treasury Alliance Group LLC, explain how to get access to free cash. A defining trend of the past decade has been the work that multinationals have done to centralise liquidity, risk management and banking for …

Read More »Trade finance backing for MENA businesses

A number of funding and grantee schemes have now been established to help regional companies sell internationally. PAUL MELLY report Powered by the resilience of the global oil market, Middle Eastern economies are already raising their sights towards the prospect of recovery, even while the outlook for most world regions remains uncertain. But while the hydrocarbons sector will continue to …

Read More »Oil joint ventures:the refining touches

Asia’s insatiable appetite for oil and gas has provided large and lucrative export markets for Middle eastern energy companies,which they have further capitalised on by building refineries and other facilities there. setting up business in asian countries creates numerous banking, cash management and regulatory challenges for treasury departments, but they can be resolved, explains LANCE T. KAWAGUCHI (pictured) of Citi. …

Read More »First for NBAD

The National Bank of abu dhabi (NBad) has been granted a licence by the emirates securities and Commodities authority (sCa) enabling it to practice the “securities Custody” activities of securities listed on local markets – making the bank the first to achieve this feat. According to the “securities Custody” transaction, an investor may entrust his securities in the custody of …

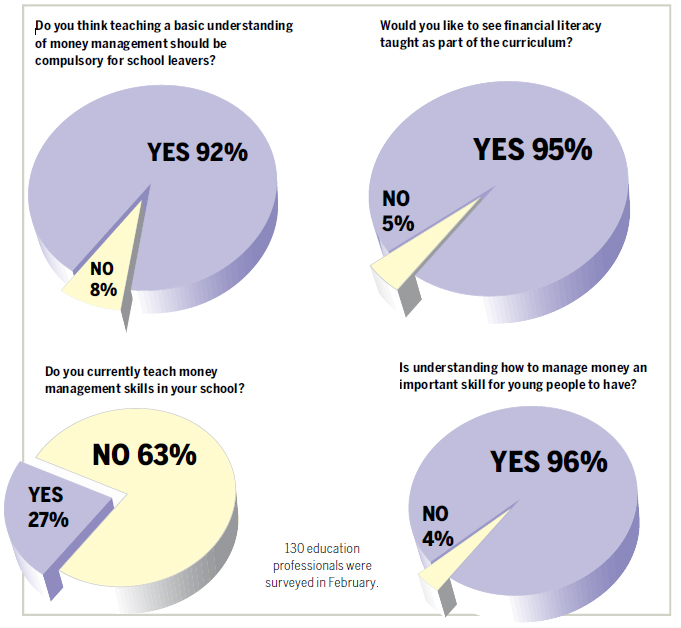

Read More »Finance should be taught at schools

Teachers believe financial literacy should be compulsory for all school leavers, according to a survey carried out by Visa, a leading payment solutions provider. An overwhelming number of GCC education professionals polled “believe that basic financial literacy skills are essential for young people today and would like to see the fundamentals of money management taught in schools”. Lama Kabbani, corporate …

Read More »‘Fast track’ clearance for Dubai Customs

Dubai in March launched Mirsal2, a comprehensive electronic Customs declaration system that facilitates legitimate trade movement. It accelerates business procedures and advances quality service delivery standards. Dubai Customs developed Mirsal2 in-house over a period of two years. It was designed in line with client and strategic stakeholder needs. It aims to further service delivery standards, reinforce cooperation with partners and …

Read More »SWIFT accolade for EastNets

eastNets, a provider of compliance and payments solutions, has again been awarded the swiftready services label after passing the renewal criteria for 2010. The certification validates eastNets’ capability to perform implementation, integration and upgrade services in 2010 for SWIFT products and solutions that include alliance access, alliance entry, alliance starter set, alliance rMa, alliance Gateway, alliance Webstation, CCI screenflow over …

Read More »Extra shine for DGCX

dubai Gold & Commodities exchange (dGCX) recorded a 133 per cent rise in volume in the first quarter of 2010, with 495,059 futures contracts traded, valued at $29.6m. Volume in the January-March period rose on the back of strong demand for currencies, gold and WTI crude oil futures, which recorded volumes of 361,760, 112,077 and 13,457 contracts respectively. Volumes in …

Read More »Five-year plan talks with Turkey

In March the National Bank of Kuwait (NBK), the highest rated in the Middle East, hosted a first-of-its-kind meeting with a high level Turkish business delegation. Shaikha Al Bahar, the bank’s deputy CEO, said that the initiative and decision for such a gathering was taken by both H.H. the Amir, Sheikh Sabah Al Ahmad Al Jaber Al Sabah and H.E. …

Read More »Investors keep an eye on the Middle East

HS BC hosted more than 150 fund managers, investors and bankers at a conference in Dubai in March. The audience came from all over the world to hear HS BC’s top team of global and regional economists and analysts discuss and debate the future with traders and bankers. The message that emerging markets’ growth will outpace mature markets came across …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East