Dear Reader, The Phoenicians well over a millennium ago were known far and wide as an enterprising, seafaring civilisation never beset by boundaries. And the same applies today with their descendants in Lebanon, as much a global trading hub as it has always been. In this issue, we report on a special BNY Mellon-hosted roundtable at which Cash & Trade …

Read More »Issue 34 July / August 2015

UAE now a leader in online trading technology

The UAE in the past four years has become a leader in developing e-trading and investment technology, which is now used by banks and investment companies around the world. At ABTEC, the region’s premier online trading technology show, the Abu Dhabi financial services company ADS Securities revealed that on a daily basis billions of dollars are now traded on platforms …

Read More »Electronic payments: the future

Industry experts and innovators in the payment sector gathered at the 2015 Visa Middle East and North Africa Innovation Forum held in Istanbul to share their perspectives on technological evolutions in the world of electronic payments. The forum particularly focused on the future of the payments landscape, changing financial service models, and how Visa’s operations help bolster the businesses of …

Read More »The challenge for corporate governance

Chartered accountants organisation ICAEW has called for organisations to improve corporate governance policies and practices in order to tackle the challenges of today’s business environment. In a speech to the Dubai Global Convention on Leadership for Business Excellence and Innovation, the institute’s deputy president, Andrew Ratcliffe, emphasised to government officials and business leaders that companies should rethink how they behave …

Read More »SWIFT expands reach of compliance register

SWIFT has announced that the KYC (Know Your Customer) Registry is now available to fund distributors and custodians. A statement said, “In response to an identified need within its community, SWIFT is extending the reach of the KYC Registry beyond correspondent banking to support Know Your Customer compliance requirements for funds distribution and custody services. “The registry offers a unique …

Read More »Cheque clearing time slashed

In its continuous efforts to provide the latest banking services, Al Ahli bank of Kuwait has started implementing a new electronic cheque clearing system in Kuwait. It says that this will improve customer experience by reducing the cheque clearing from three days to one working day. A statement from the bank added that not only would this increase efficiency “but …

Read More »Surge in ICIEC business

The annual report of the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) showed a growth in export credit and political risk insurance business volume. During the year 2014, the corporation facilitated $4.3bn of exports and investments for its member countries, representing an increase of 29 per cent compared to previous year. Commenting on the results, Eng …

Read More »New academy puts banking and trade finance first

The International Chamber of Commerce (ICC) has launched the ICC Academy – “setting a new standard for professional education”. Delivered via a digital platform, it will provide rigorous, relevant and applicable business education – “encouraging individuals to reach their highest potential with respect to professional competency and ethical conduct”. The ICC Academy will draw on ICC expertise in specialist fields …

Read More »Global trade event for Dubai

The UAE Ministry of Economy has signed a Memorandum of Understanding with Malaysian company KW Group Sdn Bhd, organisers of Global Trade Development Week. His Excellency Sultan bin Saeed Al Mansoori, UAE Minister for Economy, is the patron of this event and has pledged to support and partner with the event for the next three years. Therefore, Global Trade Development …

Read More »Call for ‘greater diversity’ from banks

One contracting giant at the leading edge of project work would like to see changes in the way bankers cater for the requirements of major players in the sector. PAUL MELLY reports From airports and office towers to high-speed rail lines, housing schemes, hospitals and power plants, Al Arrab Contracting Company (ACC) is engaged in projects across Saudi Arabia. At …

Read More »Lebanon: a pillar of strength

Lebanon remains a beacon of light in a sadly troubled region, partly due to the strength and reliability of its banking sector. As trade flows shift, regulatory requirements increase and regional uncertainties continue, Cash & Trade sat down with a number of Lebanese banks at a BNY Mellon-hosted roundtable in Beirut Cash & Trade: The Phoenicia Hotel here in Beirut …

Read More »World must rise to trade financing challenge

The hope that global growth will be driven by emerging economies suggests that the lack of adequate (and affordable) levels of trade financing is something that requires urgent commercial and political attention. ALEXANDER MALAKET, president of OPUS Advisory Services International Inc. and author of Financing Trade and International Supply Chains, looks at the issues. While the biggest mandate for treasury …

Read More »The key drivers of GCC trade finance growth

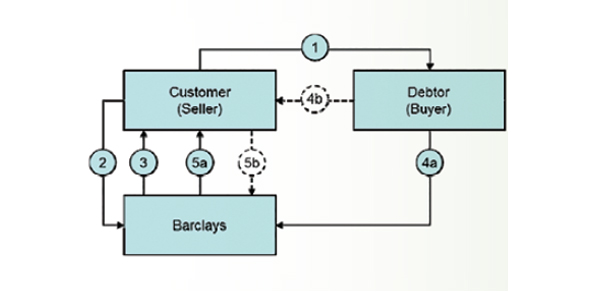

Open account trade has been growing in GCC markets during the past few years. As a result, some of the more sophisticated companies have started to move to non-recourse receivables finance programmes and benefit from best working capital practices prevalent in more developed regions in the world. This trend is expected to continue and even accelerate as a result of …

Read More »Records all round…

CAROLINE MAGINN looks at a triumphant year for UAE banks Trade finance and corporate banking enjoyed a robust year in the UAE in 2014 with our 12 selected banks reporting overall record figures in trade-related contingent liabilities, corporate assets, liabilities, operating income and profit. This was reflected also in trade finance fees and commissions where the seven banks who report …

Read More »Market may be seeking critical mass

Mushtak Parker looks at a slight slackening of Sukuk activity and raises some question as to what might be behind it given the flurry of issuances that occurred in the first five months of this year A wash with a surfeit of liquidity in the two key regional markets of the Gulf Cooperation Council (GCC) countries and South East Asia, especially …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East