Open account trade has been growing in GCC markets during the past few years. As a result, some of the more sophisticated companies have started to move to non-recourse receivables finance programmes and benefit from best working capital practices prevalent in more developed regions in the world. This trend is expected to continue and even accelerate as a result of a possible reduction in liquidity levels and margin pressure in the region. International banks with a presence in the region and expertise in non-recourse receivables finance are well positioned to absorb a large proportion of this growth, says Jeroen Reyes-Stolker

When my family and I arrived in the Middle East last summer, after 15 years living and working in Europe, we encountered a very dynamic and fast moving place. However, from a corporate banking and trade finance perspective, I found a market dominated by traditional trade instruments such as documentary LC and trade loans. However, it is evident with increased financial sophistication, corporates are looking to alternatives to traditional trade products and weighting financing alternatives such as non-recourse receivables financing and credit insurance, which are relevant risk mitigants for open account trade. This trend is being noticed by financial institutions, corporates and technology providers.

Among the various alternatives, non-recourse receivables financing is evidencing strong growth and there are several market dynamics that are contributing to this growth:

Open Account Trade: Dramatic shift from traditional trade instruments, such as import LCs, advance payments or collections to open account terms with counterparties in recent years with close to 90 per cent of all global trade transactions now being on an open account basis, according to Swift

Increased Cross Border Financing: Receivables-based financing and factoring is a business with double-digit growth rates in most international markets. In 2013, the network of factoring associations organised around FCI (Factors Chain International) showed a volume increase of 13 per cent in domestic factoring and 25 per cent in international factoring (receivables finance data is included in these statistics). A growing number of corporations are seeking to sell or finance their foreign receivables. The increase in cross-border factoring and receivables financing solutions has again been driven by a rise in open account trade, especially from suppliers in the developing world, pushed by the major retailers/importers in the developed world, including the acceptance of factoring as a suitable alternative to traditional forms of trade finance

GCC showing the largest growth: Even if still a small market, the GCC region evidenced the largest growth rate (growing by six times from 2010 to 2014 based on the same FCI data published in 2013). However, Europe remains the largest factoring market in the world, accounting for 60 per cent of the world total with 4.3 per cent growth compared to the previous year. Asia and the Americas follow Europe as the next largest markets for factoring today

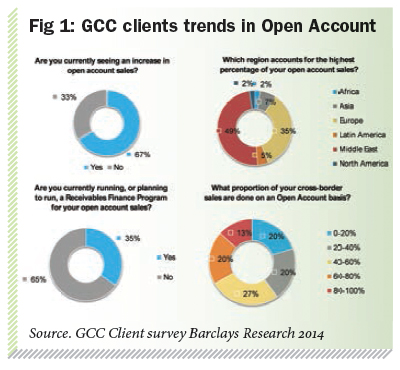

Growth driven by Multinationals: Strong indicators of growth in such programmes, especially in the multinational and cross-border space in which firms are replicating what they are doing in developed markets such as Europe. We are seeing increased appetite by corporates in the GCC, which are looking for “true” non-recourse financing programmes. This was reflected in a survey conducted by Barclays of clients at an ACT (Association of Corporate Treasurers) event held in Dubai in November 2014. The survey showed that 67 per cent of the corporates that attended the event (medium and large corporates) are seeing an increase in open account trade and 35 per cent of the companies showed that they were already running a receivables finance programme or were considering doing so in the near future (Figure 1). Intra-regional trade with Europe –Middle East and Intra Middle East are key regions for open account trade and selective receivables finance. It is important to take into consideration that these interviews were done before the oil price drop in the region. Therefore, results could be different if done today and this is something that I will cover in the next section of this article.

Strong Interest in Technology solutions for Open account trade: Interest for roll out of sophisticated technology solutions such as supply chain finance (strong debtors use such platforms to support their smaller suppliers to get better financing conditions) is significantly increasing compared to previous years. This is being reflected in the conversations with clients in the region as well as with some of the largest International providers of technology.

Oil prices and liquidity levels

The dramatic drop in oil price that occurred at the end of 2014 and beginning of 2015 will have a mixed effect on evolution of open account trade levels and adoption of receivables finance by corporates in the region. However, it is too early to say what the impact will be. Here are some of the key factors that will influence this market and should be considered going forward:

- Decrease of liquidity levels and lending appetite in GCC market: If current price levels continue governments in the region will need to use previous cash surpluses to manage their budget shortfalls and deal with their day-to-day commitments. Some of these liquid deposits are held with banks in the region and withdrawal of them will probably cause some tightening of lending to maintain appropriate levels of reserves

- Lending Margin increase: A decrease of overall liquidity levels in the market could be a first sign of potential margin increases in GCC markets which we suspect will kick in during 2015 and will continue into 2016. This is supported by some recent research published in Bloomberg in April. Citigroup MENA CEO declared, “We expect debt capital market and syndicated loan activity to be better this year given lower oil prices; increased activity is coming from financial institutions as they shore up liquidity and capacity for future needs.” (Atiq Ur Rehman – Bloomberg April 2015)

- Corporates looking for more innovative ways to finance themselves: Corporates expected to start to more proactively look at alternative financing solutions which do not necessarily imply direct balance sheet lending from banks. One alternative is to start to use strong credit ratings of clients (buyers) as an alternative to continue to benefit from lower pricing and therefore be able to continue to execute ambitious growth plans

- Payment terms changes: Increased pressure for sellers dealing with strong buyers to extend payment terms. This is especially the case in the oil sector and is caused by new suppliers from other regions trying to capture market share (ie, Venezuelan oil now looking for alternative markets as a result of US buying behaviour changes). Non-recourse receivables finance is a way for the seller to collect funds on time even with extended payment terms

- Back to basic LC structures?: An extended period of low oil prices could deteriorate growth levels in the region and credit quality of some of the corporate players in the market. As an example, the International Monetary Fund (IMF) has downgraded its growth forecast for MENA to 2.9 per cent –the organisation was originally predicting 3.9 per cent growth, but cited subdued oil prices and political conflicts in the region as key drivers for the revision. This could result in a decrease in confidence for suppliers selling into the region and a move back to more secured and liquid FI backed instruments.

Independent of the severity of the oil price drop crisis for the region, open account trade and selective receivables finance will continue to be relevant. Therefore, let’s continue to explore how corporates are benefiting from such products

Managing working capital

Receivables finance is a strategic source of finance for many global corporates, particularly when doing business internationally. The core benefits are as follows:

- Liquidity: Accelerates cashflow and provides additional liquidity

- Risk Management: Transfers the debtor default risk to bank, improving the client’s financial resilience and freeing up internal credit lines

- Improvement of financial ratios: The true sale of receivables (when done on a non-recourse basis) replaces working capital with cash, and enhances key financial performance indicators (eg, free cash flow)

- Advantages over other types of financing:

- Flexible, on demand funding: funds can be drawn based on seasonality of the business

- Increasing the financing volume during peak periods

- Leverages debtor credit lines

- Price arbitrage if creditworthiness of debtors is perceived to be better

- Efficiency and control: streamlines payment collection activities and working capital management across units and countries

- Extension of payment terms: magnetising receivables allows for extension of payment terms towards customers whilst not impacting the seller’s working capital.

Conclusion

Non-recourse receivables finance represents an alternative financing solution for large corporates that deal with strong trading partners. By implementing such programmes they should be able to continue to access funding at relatively competitive pricing independently of market changes caused by changes in the macroeconomic environment.

How Barclays is looking at the GCC market

Barclays launched a European and North American strategy some years ago to become a niche player in the receivable finance space. This was successfully implemented and as a result Barclays was able to participate and lead some large programmes in those regions. The next step for Barclays is to extend this strategy to other regions in which it is is seeing strong interest. Key markets for expansion of this strategy are the GCC countries as well as India and countries in Asia.

IN SUMMARY

- Open account trade growth in recent years, especially with key partners in GCC and Europe. This has caused some strong interest in Receivables Finance Programs. These trends are expected to continue as long as the region continues to show growth levels.

- Supply chain finance solutions being considered by strong buyers as a good alternative to support suppliers to get better financing conditions

- Corporates extending credit terms under open account RF programs based on strong debtor quality

- Oil price drop is shifting economic growth towards large importers of energy such as India. However, the GCC market should be able to continue with growth levels well above the average of most developed markets.

- Expecting some Liquidity pressure as a result of the oil price drop, which will probably move corporate and interbank lending margins slightly higher and will promote innovation in terms of products being used by corporates in the market

About the author

Jeroen Reyes-Stolker leads trade and working capital for the Middle East and India region at Barclays.

He joined Barclays in 2007 and has extensively worked in both cash management and trade finance at local, regional and global level. Before joining Barclays, Jeroen worked at Citi in London, for several years, as European business manager within the global transactional services unit and specialised in developing online working capital solutions for Citi´s global multinational client base.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East