Trade finance: eliminating the mystery

International trade: ‘the time’s come for simplicity’

International trade and investment requires a way forward that is grounded in a nuanced and finessed understanding of international affairs, including business, trade and investment. ALEXANDER R. MALAKET, president of OPUS Advisory Services International Inc., looks at why the ‘veil of complexity’ should be lifted

The financing of international trade involves a particular discipline and a set of long-established products, practices and solutions that are, for their proven effectiveness and demonstrable longevity, rather poorly understood outside of a small cadre of global specialists and practitioners.

Trade finance, and its more recent complement (or “parent” category, depending on which definition one ascribes to), supply chain finance, have been facilitating and enabling trade for hundreds of years or longer, yet even seasoned bankers and senior finance executives have, commonly, no more than a rudimentary understanding of its nature and value proposition.

Some senior trade financiers will admit that this is largely the result of a “veil of mystery and complexity” that has evolved over time, and that practitioners have allowed to remain, as it served the preference of senior experts for doing business in the background, maintaining the confidentiality of clients, and keeping the business of trade finance as something of a club with a rather exclusive global membership, particularly at its most senior levels.

This veil of complexity and mystery is now very much an anachronism that is more harmful than helpful to the industry, and does little to serve the interests of end-clients, even less to advance the value proposition of trade finance as a critical enabler of international commerce, or related endeavours like trade-based international development.

Similarly, the complexity around trade finance has exacerbated challenges faced by industry leaders in advocating with global regulators, and more recently, in seeking to attract net inflows of capital (from non-bank sources) in a global attempt to address a financing gap estimated to be in the range of $1.6-2 trillion annually.

Trade and supply chain finance can be very complex and certainly requires a level of technical competency. However, at its core, this specialist form of finance involves some combination of four things, each to varying degrees depending on the nature of a particular trading relationship or transaction.

No matter how complex or straightforward, trade finance generally involves – and can be understood on the basis of – four core elements:

- the provision of secure and timely payment across borders

- the effective mitigation of risk

- the provision of some form of liquidity or financing for one or more parties

- the facilitation of information flow about the underlying goods or about the related financial transaction.

The mechanisms through which trade finance is provided – from traditional instruments such as documentary letters of credit, to emerging propositions under the banner of supply chain finance – run the gamut from well-established and globally trusted, to relatively new and in the process of being defined by the industry. Even with the spectrum of activity, it must be recognised that the importance of trade finance has now been globally acknowledged, and with that acknowledgment comes a level of responsibility for industry leaders to advocate effectively in support of a business that drives economic growth and prosperity in markets around the world.

The veil of mystery and complexity is not only unnecessary, it is fundamentally damaging to the industry and to clients. Far better in this post-crisis environment to try to communicate the core nature of trade finance, create some objective measure of its economic value, and, on that basis, to advocate in support of adequate financial and human resources to ensure levels of trade finance that might be required at a time when international commerce is key to global recovery, growth and prosperity.

The complexity – and perceived risk – around trade finance combine some level of reality and some degree of incorrect optics created in part by an absence of clarifying information, data or metrics. It has been very common for example, for finance and treasury professionals, and for bank risk and credit executives, to view trade finance as high-risk, when, in fact, the business is so well managed and risk-mitigated, that its risk profile is far below that of more familiar businesses such as mortgage lending or credit card operations.

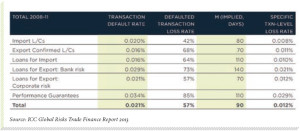

The Asian Development Bank began a critical effort – now continuing under the auspices of the International Chamber of Commerce Banking Commission in Paris – to quantify and demonstrate objectively the risk profile of trade finance at the product level, and, through the Trade Finance Default Register, has succeeded in illustrating the (very) low-risk nature of traditional trade finance.

In addition to assisting in effective advocacy with regulatory authorities, this effort has been instrumental in supporting trade financiers in their internal negotiations for access to capital in support of trade finance. This has the effect of enabling banks to better meet the needs of clients of all sizes, from SMEs to MNCs, as businesses seek liquidity and risk mitigation in support of their international aspirations.

Post-crisis regulatory and political dynamics have forced trade financiers to demonstrate, objectively, something that practitioners have known for years: that in fact, trade finance is a low-risk business that generates attractive annuity-like business for financial institutions, while sustaining global trade flows in the widest possible range of markets and commercial contexts across the globe.

The International Chamber of Commerce now produces an annual Trade Finance Global Risks Report that provides detailed analysis down to the product level, of the risk profile of the trade finance business, and adds immeasurably to the dialogue around this issue.

‘Financing, particularly under current economic conditions, is a strategic aspect of the conduct of business, especially across borders. Sales cycles, payment timeframes and timeliness associated with the conduct of business are invariably longer in international business and trade, and those extended timelines drive the requirement for an effective financing plan. Likewise, the ability of a company to package attractive financing represents a significant competitive advantage in the pursuit of opportunities in international markets. All else being equal, attractive financing can close the sale.

These macro-level observations about the nature, value and potential of trade finance must be linked directly to the commercial value of trade and supply chain finance to importers and exporters, and, ultimately, to the creation of economic value, growth and prosperity. While it is imperative for trade finance to be better “explained” outside a small group of specialists, that explanation cannot be academic in nature, but must be rooted in practical commercial and economic realities.

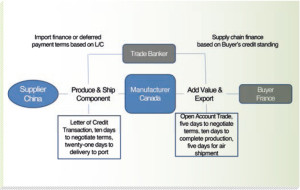

The evolution beyond long-established, traditional mechanisms such as letters of credit to the use of open account terms of trade, and the relative development of a proposition around the financing of international supply chains is illustrative. While a bilateral view of trade, focused on one buyer and one seller, has been effective for a very long time, practitioners are now looking increasingly at the overall ecosystem of relationships in global supply chains that enable and sustain trade flows.

Likewise, the business of financing international commerce is evolving in this direction, with positive implications for the availability of financing for businesses of all sizes, including SMEs.

Even as trade continues to be an important driver for growth, recovery and prosperity, the critical role of small businesses in creating economic value is increasingly acknowledged, and the opportunity to better serve SME suppliers that are critical to the effective functioning of global supply chains is of interest to policy makers and to trade financiers alike. The importance of supporting SMEs is reflected in the mandates of numerous leading export credit agencies, and in the core activities of international institutions, including those mandated with remits linked to international development and poverty reduction.

Trade – and trade finance – are fundamentally important in all of these dimensions, and the solutions, products and mechanisms of trade finance underpin a great deal of this type of activity.

The versatility of trade finance as a discipline can be appreciated by observing the range of markets, risk conditions and relationships in which these solutions are deployed. Volatile markets, companies of all sizes and levels of expertise and goods and services of all types benefit from trade finance solutions, and potentially, from structures that combine traditional mechanisms with supply chain finance solutions.

While the mechanisms related to the financing of international commerce have been brought sharply into focus by the global financial crisis, and their importance in enabling global trade flows is now discussed at the highest levels of business and government, the technical complexity of structuring effective transactions can be significant, even if the nature of the business can be encapsulated into the four elements noted earlier.

Despite this, the importance of sound advice is underestimated by clients and undervalued by financial institutions.

It is wise for businesses of all sizes to engage trade finance specialists in a dialogue about international trade activities as early and as frequently as possible, so that such specialists can assist in structuring appropriate financing and risk mitigation options in support of the success of a transaction and an overall trading relationship.

Companies seeking opportunity in international markets, especially SMEs with limited experience in cross-border commerce, can underestimate the adverse impact of longer payment timeframes on their company’s cashflow, or may underestimate the cost of financing and risk mitigation, effectively erasing any profit margin arising from a particular transaction.

A competent trade financier can provide invaluable advice in addition to assisting in the structuring of an appropriate solution to the financing needs of an importing or exporting client, or indeed, the needs of a series of commercial relationships in the context of a global supply chain.

The importance of trade and supply chain finance in supporting and enabling the conduct of international commerce – and by extension, in creating demonstrable economic value – is now well established and benefits from an unprecedented degree of visibility and profile.

This positive profile must be leveraged by specialists and practitioners to further advocate for trade finance, to continue to illustrate the value of this business to the global economy, and to attract a next generation of trade financiers to a business that clearly adds significant value across the globe.

As noted earlier, there are core principles to be understood and communicated, and there are high-level aspirations around the potential, value and impact of trade finance, however, it continues to be important to link such principles and aspirations to the practical, value-creating commercial activities supported by an esoteric but increasingly visible form of financing.

Trade finance is, as specialists have long claimed, a business that is connected directly to “real economy” commercial activity; it is low-risk, and it creates value in all markets and across the full spectrum of risk conditions imaginable, even in so-called “frontier markets” such as Myanmar, where the Asian Development Bank and others are already actively seeking ways to provide trade finance in anticipation of expanding trade flows.

Estimates from various sources suggest that 80-90 per cent of global merchandise trade flows, currently estimated to be worth about $18 trillion annually, is supported or enabled by some form or trade or supply chain finance. It is time for such a critical enabler of business, and a clear creator of economic value, to come out of the shadows.

In short, it is time for the veil of mystery and complexity that has long enveloped trade finance to be lifted, and for specialists and industry leaders to advocate and champion this business. n

Alexander R. Malaket is the author of Financing Trade and International Supply Chains. Visit www.gowerpublishing.com/isbn9781409454601

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East