Supply chain finance has been a growth area in recent years, yet there has been a growing feeling within the industry that its practitioners have – at times – been speaking in tongues. The new Standard Definitions for Techniques of Supply Chain Finance will hopefully go some way to address this confusion in supply chain finance terminology.

Supply chain finance (SCF) has boomed globally over recent years, bringing many benefits for both domestic and international trade – optimising the management of the working capital and liquidity invested in supply chain processes, and the transactions of other international trading partners, as well as mitigating financial risk. One thing that has been lacking, however, is the use of the same – clear and consistent – terminology.

For example, all of the following terms are used to describe the same technique or solution: ‘payables finance’, ‘reverse factoring’, ‘confirming’, ‘approved payables finance’, ‘confirmed payables’, ‘trade payables management’, ‘supplier finance’, and sometimes just ‘supply chain finance’. Of course, this can make supply chain finance extremely confusing not just for those who come to it for the first time, but also for everyone in the industry.

It has also hindered communication between individuals across the trade industry, and may well have inhibited many who could have benefitted from supply chain finance from obtaining the support they required.

For this reason, the International Chamber of Commerce (ICC) Banking Commission, BAFT, the Euro Banking Association (EBA), Factors Chain International (FCI), and the International Trade and Forfaiting Association (ITFA) recently published a standardized set of definitions of all the main terms and core techniques of supply chain finance, launched at the ICC Academy’s 2016 Supply Chain Finance Summit.

The Evolution of Supply Chain Finance

So what is supply chain finance? The expression “supply chain finance” today covers a wide range of products, programmes and solutions in the financing of commerce, including international trade. It addresses the needs of buyers and sellers, especially when trading on open account terms, in the increasingly complex supply chains in which they are involved. It uses a broad range of established and evolving techniques – often employing a technology platform – for the provision of finance and the management of risk.

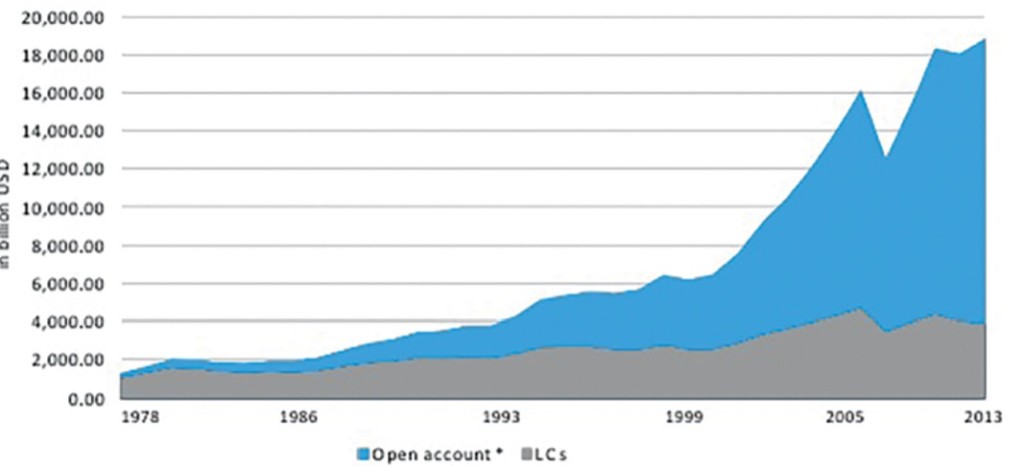

The use of SCF solutions has experienced vigorous growth over recent years, compared to the slower growth in the use of more traditional types of trade finance such as letters of credit. To a large extent this is due to the fact that SCF lends itself to being used in open account trades – where the buyer pays within an agreed time after the goods have been delivered.

Both by volume, and as a proportion of trade generally, open account trade has increased exponentially across the globe over the past decade (see chart), and it is by no means any longer confined to trades between parties with established trading relationships, or to trades into low-risk markets. Already today more than 80% of the total world trade volume (export) is settled by clean payment, and this is expected to grow even further in the future.

Figure 1: Development foreign trade (exports) from 1978 until 2013

Source: Unicredit Group – 2015

As such, there is a growing appetite – and market – for SCF. However, there has also been a growing consensus that, until now, it lacked clear and consistent terminology to designate its various products and techniques.

Standard Definitions for Techniques of Supply Chain Finance

It is against this background that the Global Supply Chain Finance Forum was established in 2014, as an initiative of the various sponsoring industry associations facilitated by the International Chamber of Commerce (ICC) Banking Commission, in order to develop, publish and champion a set of commonly agreed standard market definitions for Supply Chain Finance and for SCF-related techniques.

The Standard Definitions for the Techniques of Supply Chain Finance now published are the result of a lengthy period of inclusive and consensus-based industry collaboration under the oversight of an international multi-industry steering group. They are based on the views and feedback of a large and representative number of industry specialists and other interested parties, and were subject to detailed peer review. Those drafting it see it as a living document which will evolve further as it incorporates further standardisation and other development activity.

The document includes detailed definitions and descriptions of eight core techniques of SCF, each with an illustrative transaction flow, and also of the Bank Payment Obligation as an enabling framework for SCF. Single headline names are used to identify SCF techniques, with commonly encountered synonyms separately listed.

Freely available to everyone across the globe, the terminologies can and should be adopted and used not just by finance providers and their corporate, commercial and SME clients, but also by all those involved in every aspect of SCF, including investors, regulators, legal practitioners, information technology and infrastructure providers, and all other trade finance related communities. Crucially, the clarity and consistency provided by the terminologies means the industry can stop grappling with definitions and focus on progressing and evolving.

The Road Ahead for SCF

That said, while publication of the terminologies will hopefully be a milestone on the road to the further development of SCF, it is really only a first step.

The next challenge comes with driving their adoption. Old habits die hard, and organisations and individuals alike must be convinced that adopting them will bring them real benefits in their practical everyday trading lives.

The Drafting Group believes it has produced a solid base on which further progress may be built. Now it is up to the various stakeholder communities to test-drive the terminologies provided and get familiar with how they work in practice. Hopefully this will help extend the benefits of SCF to increasing numbers of traders everywhere.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East