EVAN GOLDSTEIN, global head of renminbi solutions at Deutsche Bank, explores the growing prominence of the renminbi and the benefits and challenges of its use as a trade settlement and treasury management currency. While China’s renminbi (RMB) has been around for nearly 70 years since it was first introduced in 1948, its role in the international arena has been limited …

Read More »2014

Issue 30 November / December 2014

Letter from the editorial director

Dear Reader, Millions of potential customers await those banks prepared to put the effort into developing economies. The realisation that there are huge swathes of what are termed “the unbanked” has woken up banking operations in rapidly developing countries and they are now showing renewed interest in reaching out to those potential new account holders as the technological pace of …

Read More »World trade splutters back to life

International trade growth has dropped drastically compared to those years before the global financial crisis but is now hesitantly picking up, according to Global Survey 2014, the largest and most comprehensive International Chamber of Commerce (ICC) report to date, which includes data from 298 banks across 127 countries. Survey highlights include: Lack of available trade finance causing global trade growth …

Read More »UAE set to host global business blockbuster

The UAE is preparing to host Global Trade Development Week EMEA, which will see an unprecedented gathering of influential business and government leaders, entrepreneurs and academics from more than 70 countries. The event, which is the world’s largest trade facilitation, development, investment and customs programme, will be held in Emirates Towers, Dubai, from 27 until 29 October. “It is time …

Read More »Profits up at Arab Bank

Arab Bank Group’s net profit after tax and provisions during the first half of 2014 grew by seven per cent to $414.9m from $387.3m in the same period last year. Loans and advances also increased, by four per cent, to reach $23.7bn compared to $22.9bn on June 30, 2013. Also, customer deposits grew by $1.7bn to reach $34.4bn compared to …

Read More »New cross-border payments system

Bank of America Merrill Lynch has announced that a new payments capability is available on CashPro®Online, the company’s worldwide banking portal. Corporate and government clients of all sizes utilising CashPro can now transact low-value cross-currency payment into 29 countries, at the same time benefiting from reduced costs and improved efficiency. “We’re pleased to add this new capability to CashPro Payments …

Read More »Barclays beefs up its MENA team

Barclays continues to grow its MENA team with the appointment of Jeroen Reyes Stolker as head of trade and working capital for the Middle East. Reporting to Baihas Baghdadi, managing director, head of trade and working capital international at Barclays, Stolker will support clients with their business needs by providing end-to-end trade and working capital solutions.

Read More »New direct debit services partnership

Citi UAE, the leading provider of cash management and trade services in the MENA region, and Now Health International, an international health insurance provider with regional services in the UAE, have announced a partnership whereby Citi UAE will provide direct debit services to Now Health International as a collection channel for their insurance premiums. The direct debit solution will use …

Read More »How to reach out to the unbanked

The question of how banks can use digital technology and partnerships to facilitate the delivery of financial services on a sustainable basis to those on the lowest incomes will be the subject of a talk by the Microsoft founder at this year’s Sibos. PAUL MELLY looks at what’s on the agenda When Bill Gates gets up to make the closing …

Read More »Banking giant backs MENA’s Asian trade

For the finance teams in major businesses and the banks that serve them, the SIBOS conference is a key moment in the calendar — a launch-pad for new thinking on payment, treasury systems, cash management and technology. What is debated there has a direct impact on top Gulf companies trading internationally. PAUL MELLY reports on the issues at the heart …

Read More »Funding grows for Middle East trade sector

Export credit agencies are continuing to provide strong support to MENA projects as well as supplying classic trade financing products to the region. MELANIE LOVATT reports While there was no Sadara deal this year – last year export credit agencies (ECAs) provided more than 50 per cent of the giant $20bn Saudi Arabian petrochemical project’s $12.5bn debt – they stepped …

Read More »The trade finance lever now being pulled more frequently

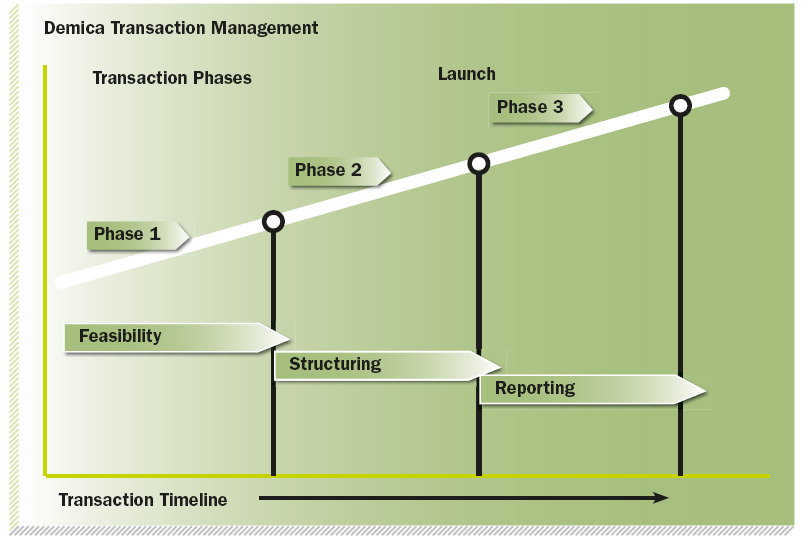

The annual growth rate for supply chain services averaged between 30 per cent and 40 per cent for global banking institutions in 2011-2013, according to a survey by international consultants Demica. In the atmosphere of tight corporate credit over the past few years, Supply Chain Finance (SCF) has become an increasingly attractive and important working capital management tool, according to …

Read More »Forward thinking pays dividends

Banks cite regulatory compliance as one of their top priorities, and most focus on current regulations such as Basel III. However, trends are showing change as regulators start to shift their focus forward. RICHARD HARTUNG speaks to John Foulley, director of financial services analytics at Oracle, to find out more about how banks can respond to the new environment In …

Read More »MENA’s corridors of power

The world’s Great and the Good of the financial world inevitably call in on the Islamic Development Bank Group when visiting Saudi Arabia. Since it started operations in 1975, the organisation has approved financing of development projects and intra-Islamic trade totalling some $100bn. But, as MUSHTAK PARKER explains, it now faces questions on what to do in the future These …

Read More »Wanted: millions of extra customers

Banks in rapidly developing economies are showing renewed interest in payment models for the unbanked as the technological pace of change in those markets accelerates rapidly compared with developed markets Over the coming decade the dynamics of payments markets in rapidly developing economies (RDEs) will shift dramatically toward the financial inclusion of the unbanked, the replacement of cash and cheques, …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East