The world of global payments is undergoing fundamental change, reshaped by technology and redefined by regulation, the emergence of new economic powers, and changes in the global currency landscape. Most importantly, payments will be refocused from a commoditised proposition to a strategic, value-adding solution. Therefore, it’s time for banks in the MENA region to gear up if they wish to be part of the payments market in 2020, says BANA AKKAD AZHARI, head of relationship management, MENA, Treasury Services, BNY Mellon

The world of global payments is undergoing fundamental change, reshaped by technology and redefined by regulation, the emergence of new economic powers, and changes in the global currency landscape. Most importantly, payments will be refocused from a commoditised proposition to a strategic, value-adding solution. Therefore, it’s time for banks in the MENA region to gear up if they wish to be part of the payments market in 2020, says BANA AKKAD AZHARI, head of relationship management, MENA, Treasury Services, BNY Mellon

The world of global payments is currently undergoing a fundamental transformation with long-term implications. Indeed, in 2020, it will look very unlike it does today. If we project further forward still, the payments market “end-state” is likely to be a landscape rich with capability and added value, featuring user-friendly technologies with wide-spread adoption.

The capabilities and expectations of retail and corporate consumers are likely to be far more aligned, global settlement and clearing systems will be at an advanced stage of integration and platform-agnostic channels will allow maximum access and flexibility for end-users almost everywhere. Payments will be delivered in real-time, accompanied by information-rich analytics. They will also offer overall increased visibility in response to more uniform regulatory requirements.

We are already seeing some of these changes today, with both deeply transformative, and also convergent, developments altering the market. Key to understanding all of them is a changed conception of what a payment is. Payments are no longer being regarded merely as commoditised “utility” transfers of value, transactional and tactical in nature. Rather, payments can be decidedly more strategic when viewed in context of the broad scope of “payment-proximate” activities.

Such activities provide a significant opportunity to add demonstrable and differentiated value. Indeed, this is already beginning to happen: banks are already offering strategic financing options or risk mitigation support when settling trade payments for instance, as well as linking data-rich analytics to these payments.

Certainly, technology is ushering in changes, some of which are unsettling traditional bank payment providers. Non-bank competitors – such as PayPal – are attracting growing numbers of customers, while social media companies and online retailers such as Amazon, Google and Facebook are also seeking a foothold in the payments space, leveraging their existing vast client networks. These new providers are likely to have an increasingly important role to play, especially in the consumer and small business segments, and in high-growth, low-infrastructure developing economies.

Global demographic changes are also changing trade and investment flows across the globe. Financial resources are being redistributed towards developing economies and intra-regional trade flows are increasing.

Furthermore, growing demand for consumer goods and services from the burgeoning middle classes in emerging economies, such as China and Indonesia, are jostling with increased outflows from developed markets seeking investment opportunities to fund their increasing populations of retirees.

On the corporate side, it is likely that SMEs – historically underserved by the financial services sector – will be offered new solutions based on cost-effective technology platforms by alternative providers very similar to those offered to younger consumers on the retail side.

These fundamental market transformations, therefore, necessitate a swift and proactive response if banks’ payments businesses are to retain their market-leading position. Some banks are already responding to these challenges – searching for innovative strategic alliances and adapting to the evolving expectations of importers and exporters, or developing new propositions aimed at creating value around global remittance solutions. For others, it is time for a wake-up call.

Payments progress in the Middle East

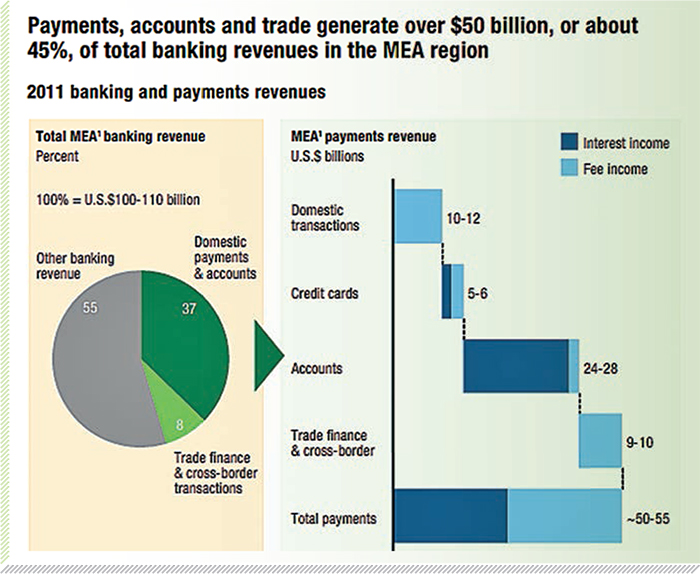

In the Middle East, payments – both domestic and cross-border – are a significant part of banks’ activities (see chart below) and, therefore, worthwhile retaining and expanding. Yet the pace and direction of change is, of course, subject to regional pressures as well as global ones.

Putting Growth Back on the Banking Agenda, McKinsey & Company and SWIFT, 2013 The Middle East’s widely vaunted conservatism in banking and business has, on the whole, been beneficial to banks operating in the region. They have enjoyed strong government backing, high capital adequacy ratios, low international credit exposure, strong liquidity positions and access to cheap funds, during a period when much of the rest of the world has still been feeling the fall-out of the financial crisis. Yet this conservatism – which also impacts governmental and regulatory authorities’ influence, as well as customer expectations – must be factored in to any payments strategy in order for it to be successful.

A distinctive feature across the MENA region is the power and level of active engagement by central banks and other regulatory authorities. The impact of this on some developments – such as the growth in activity of non-bank competitors in the payment space – may, therefore, be less pronounced, if regulators across the region continue to require that Know Your Customer (KYC) and Know Your Customer’s Customer (KYCC) activities go through the banking system.

These particular regional pressures could, therefore, help keep banks in the region at the forefront of certain types of business and cushion them against some of the threats prevalent elsewhere.

For example, while it is true that the cash management expectations of corporate clients are becoming increasingly sophisticated, there is at the same time still a degree of reluctance – particularly among traditional family-run companies – to implement electronic banking fully given security concerns and the threat of cybercrime. Obviously, this will have an impact on the region’s rate of adoption of new technology.

Governmental and/or regulatory authority approval may be needed in many cases to help facilitate a shift here. Yet this is possible. Take, for instance, the recently announced project integrating the Middle East Payment Services (MEPS) consortium of Arab Banks to the Central Bank of Jordan, providing a mobile payments service to end-users, banks and businesses across Jordan.

Forward planning

However, like all regions, the payments landscape in the Middle East is by no means uniform. Balancing traditional conservatism is the effort of the United Arab Emirates (UAE) to blaze a trail by introducing both new technology and new market solutions. Besides profiling itself as a global centre for Islamic banking, Dubai is also gearing up to become a regional hub for renminbi (RMB) clearing, recognising the significance of growing trade and investment links with China for the region’s banking sector, which is already offering cross-border trade settlements in RMB via the major international banks.

Dubai Trade’s (the cross-border facilitator’s) active promotion of the adoption of the ICC/SWIFT Bank Payment Obligation (BPO) as an alternative means of settlement in international trade is another important example of progressive thinking. While the majority of importers and exporters across the region continue to prefer traditional settlement mechanisms, such as documentary letters of credit, Dubai Trade recognises the BPO’s use of leading-edge technology and data-based transaction models which speed up the settlement process, reduce subjectivity, and offer wide scope for financing across the lifecycle of a trade transaction.

Elsewhere, the UAE’s mobile wallet project – expected to be operational by the end of 2015 and underpinned by the world’s first integrated digital payment platform supported by all banks operating in the country – is set to turbo-charge the Middle East’s adoption of mobile payments.

Future-proofing is the answer

One thing is certain: the global payments market is being transformed, and only market participants that are perceptive, flexible and proactive will continue to thrive. In order to succeed it will be necessary to take a more strategic view of payments, and develop new value-added solutions and products to serve consumers’ needs.

Devising a regional strategy in the context of a broader global approach is a good starting point. And investing in updating technology is essential to be able to deliver the services customers will want. This could be through internal investment, or by collaborating, or forming strategic alliances, with partners with complementary capabilities, be they non-bank competitors, or non-competing global providers.

Targeting flows related to demographics, identifying markets in which payments feature prominently (such as trade finance), and preparing for the increasingly cross-border and global nature of payments through multi-currency offerings, are all good strategies for success.

However, these are just some of the ways in which successful Middle East payment providers of the future may start to take on the challenges posed by the transforming market. Strategies that are tailored to individual business needs must, therefore, be developed – with solutions that are designed to ensure the business can thrive as the payments space evolves. What is clear is that banks must be alert to these changes and take action now, as the future of payments is already upon us.

The views expressed herein are those of the author only and do not reflect the views of BNY Mellon or any of its subsidiaries or affiliates. The material contained in this interview is intended for the purposes of general information only. This does not constitute treasury services advice, or any other business or legal advice, and it should not be used or relied upon as such.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East