The cost of trade finance and the pricing of risk has stabilised or even fallen, but new research shows that the need for some form of security is still widely felt. PAUL MELLY examines why that is the case

The cost of trade finance and the pricing of risk has stabilised or even fallen, but new research shows that the need for some form of security is still widely felt. PAUL MELLY examines why that is the case

In a climate of cautious economic recovery, concerns about risk have abated. But, nevertheless, there has been little change in the degree to which business feels the need to resort to products that offer protection against risk, the International Chamber of Commerce (ICC) 2014 Global Survey of Trade Finance (Rethinking Trade and Finance), has found. While business activity is now edging up, traders and banks do not yet feel this is a moment to let their guard drop.

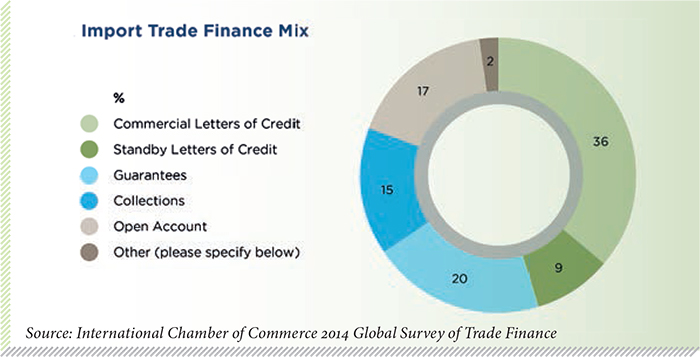

For imports, the slow but steady decline in use of commercial letters of credit continued – sinking to just 36 per cent of transactions, from 39 per cent last year and 44 per cent in 2012. But this was offset by a four-point rise in the use of import guarantees (20 per cent of transactions) and a small pick up in the use of standby letters of credit.

The world trade recovery is not yet vigorous and this, therefore, remains a buyer’s market. So exporters find themselves under pressure to sell on open-account terms, which are cheaper and simpler; moreover, the growing use of electronic communication means that traditional letters of credit, which are still largely paper-based, are seen as inefficient, particularly where there is an established trading relationship between the exporter and their customers.

But the need for some form of security is still widely felt – which explains the increased resort to alternatives.

Despite this trend, slightly more than half the 298 banks – across 127 countries – that responded to the survey reported an increase in the absolute volume of commercial letters of credit, even while their use declines in proportionate terms.

This may reflect the fact that world trade is growing once again, if only at a gentle two per cent per annum. It may be that when exporters deal with new customers or new markets, they still feel the need to take a “safety first” approach.

The survey is well placed to measure this because of the broad geographical spread of banks that responded: participation has risen markedly since 2010, when 161 banks in 75 countries took part.

While almost 30 per cent of this year’s respondents were Western European banks, some 40.1 per cent were in Asia, while 11.06 per cent were from the Middle East and North Africa (with the balance spread around the rest of the world).

Finance shortage for SMEs

Almost two thirds of respondents felt that banks could satisfy customers’ demands for trade credit – and half said that there was an increase in the availability of credit lines for corporate customers, with almost as many noting an increase in lines for financial institutions.

But behind this reassuring overall impression are indications of frustration and constraints in access to financing capacity, particularly for smaller businesses.

Some 41 per cent of respondents feel that there is a shortage of trade finance generally, while many SMEs, particularly in emerging markets, must continue to resort to local currency loans or overdrafts to finance both their export and their import transactions.

“This limiting situation is detrimental to the companies, their economies and their ability to trade through these challenging times,” the ICC points out.

With finance in short supply, especially for SMEs, many respondents now look to the multilateral development banks to fill the gap.

The ICC believes that the availability of finance will be significantly influenced by the way that regulators, and banks, around the world choose to interpret the new Basel III risk control regime. And that remains to be seen.

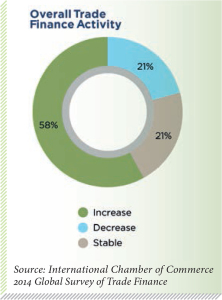

Still, at least the overall volume of trade finance activity appears to be growing. Last year some 67 per cent of respondents reported a rise in the demand for confirmation of letters of credit, and some 58.91 per cent of respondents have seen an increase.

However, the ICC cautions that this demand does not necessarily mean that the market is accelerating. Increased demand for letter of credit confirmation can sometimes signal greater engagement with new or higher risk markets, but it could equally reflect a perception among international traders that risk has increased or become more widespread.

Credit pressures ease

But there is more clearly positive news when it comes to the cost of covering trade risk – whether this is because risks have stabilised or because banks and insurers have become more technically adept at protecting against them.

In the wake of the international financial collapse of 2008-09, fees for trade risk coverage soared by what ICC describes as an “alarming” extent, as inter-bank lending collapsed, putting a huge squeeze on the availability of credit.

However, these pressures have now abated.

For collections, standby letters of credit and guarantees, more than 70 per cent of respondents reported that the past year has seen no change in the level of fees, and more than 80 per cent said that fees for import L/Cs had not changed.

Meanwhile, the proportions reporting that fees for these various products had increased – ranging from two per cent to 10 per cent – were significantly outstripped by the number of respondents reporting that fees had actually declined (ranging between nine per cent and 15 per cent, depending on the specific product).

The stabilisation or downward movement in pricing reflects a realisation on the part of banks that many of their client trading businesses have been forced to squeeze their profit margins in an effort to retain market share. But an equally powerful driver has been banks’ recognition of the attraction of trade finance as a solid short-term asset.

Trade finance is a good fee earner while the levels of risk that it entails relate to specific factors that can be assessed in a fairly rigorous manner – the value of the goods and services being financed and the levels of country and seller and buyer risk that the transaction involves.

Documentary errors still a problem

Documentary errors still a problem

However, one longstanding problem that has not gone away is the difficulty of ensuring that documentation for paper transactions is correct and that details match, where this is required.

There is a long history of payments being delayed because of errors in the wording of documents or the information provided in completing forms – despite bank warnings to businesses reminding them that they need to be rigorous if they want to ensure secure and timely payment.

The only comfort is that the rate at which the problem is spreading has slowed down a little. In the 2013 ICC survey, some 46 per cent of respondents reported that the number of documents refused upon first presentation had actually risen. This year the proportion reporting a further rise was only 33.96 per cent – but the rate of refusal is still going steadily up.

The ICC concludes that such operational problems with traditional paper transactions, and their relatively high cost, are fuelling greater interest in alternative electronic payment products such as the BPO (Banks Payments Obligation). There has also been greater take up of short-term credit insurance as a form of risk protection and increased use of factoring as a tool for financing export receivables.

Finally, there have been signs that fraud is becoming slightly less of a problem. Already in 2013 some 65 per cent of the respondents reported that the number of allegations of fraud had declined; and this year some 70 per cent said it had fallen.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East