Overall, corporate banking and trade finance in Saudi Arabia had a record quarter in Q1 2013, against all key measures following a bumper year in 2012 for the fifth consecutive year. CAROLINE MAGINN, trade partner at CMM, presents some KSA Tajara Monitor extracts

Further to a bumper year in 2012 when, whilst banks were prudent against a backdrop of evolving uncertainties, there was an encouraging level of confidence and growth in the extension of credit to corporates domestically. Credit to trade-related economic activities grew by 13.6 per cent to SAR 541bn in 2012.

Here, we pick out some of the higher level information from the latest full CMM KSA Tajara Monitor reports. The actual reports contain detail at a much more in-depth and granular level and are available by subscription either via this magazine or directly from Cash Management Matters.

The KSA has been one of the best performing G20 economies in recent years with a strong rate of real GDP growth, ranking third behind China and India during 2008-2012, according to the IMF mission statement (20 May 2013). The rising contribution of the private sector and the on-going investment and economic diversification at the heart of the government’s strategy this growth looks to continue.

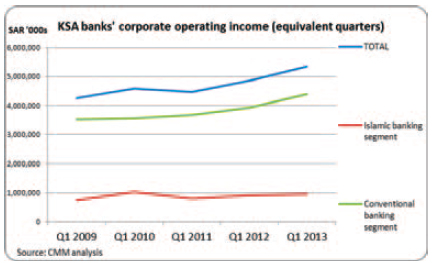

Accordingly, in terms of contribution to total bank’s balance sheets and P&Ls, corporate banking has continued to be a cornerstone in 2012 and, now through to 2013, contributing between 30-40 per cent of key financial components. Trade finance, at the heart of corporates’ needs has also had a record quarter for Q1 2013, and is expected to translate into robust earnings for full-year 2013. This continues the growth trajectory for the seventh consecutive year since CMM began the analysis.

There is further evidence of a marked upward demand and market growth for an Islamic corporate offering as well as in the overall market; this is a major engine of growth. Both the conventional banks with an Islamic window and the purely Islamic banks would do well to take note of this demand and invest to improve their all-round corporate and trade finance banking offerings. This is not a trivial challenge and informed investment will determine the future value added from and returns to banks from serving this business segment.

Riyad Bank still leads the overall CMM Corporate Banking and Trade Finance League Table with a slight recovery from their score at year-end 2012. SABB continue to make strong progress in Q1 2013 and their score of 23.94 would have seen them in the lead position in the year end 2012 annual table.

SABB does lead in terms of the relative importance of trade-related contingent liabilities which outstrip, in terms of value, their corporate assets book. The relative importance of corporate assets to total assets is most notable at Alinma Bank, Saudi Hollandi Bank and Banque Saudi Fransi, where they represent more than 50 per cent of their respective totals.

Corporate liabilities remain the most important segment for Riyad Bank with 60 per cent of total, with Bank AlJazira and Arab National Bank around the 50 per cent mark. Saudi Hollandi Bank’s corporate segment is responsible for more than 70 per cent of its total operating income; for both Banque Saudi Fransi and Alinma Bank it contributes more than half. The importance of the segment is even more evident in terms of net income with the same three banks at the top.

Total KSA banks’ corporate assets continued their steady quarterly growth in Q1 2013, up 3 per cent from year-end 2012 to SAR 679bn. Banque Saudi Fransi, National Commercial Bank and Riyad Bank, between them, account for more than 50 per cent of the total market.

Corporate liabilities rose by SAR 77bn to SAR 602bn from the equivalent Q1 2012, with National Commercial Bank a clear market leader with 19 per cent of the overall total and Al Rajhi Bank (+72 per cent), Alinma Bank (+85 per cent) and Saudi Investment Bank (+66 per cent) all gaining substantially year-on-year.

In the same period total corporate operating income rose by nearly SAR 0.5bn with the top five banks, Riyad Bank, National Commercial Bank, SABB, Samba and Banque Saudi Fransi all showing well in excess of SAR 600mn in operating revenues. Arab National Bank (+ 30 per cent) and Alinma Bank (+36 per cent) also showed marked year-on-year increases.

Total corporate net income showed an 11 per cent increase in Q1 2013 from last year’s figure to SAR3.3bn. Riyad Bank again reported first quarter net income over SAR 0.5bn for the third first quarter in succession and nine of the twelve banks reported over SAR 150mn net revenues.

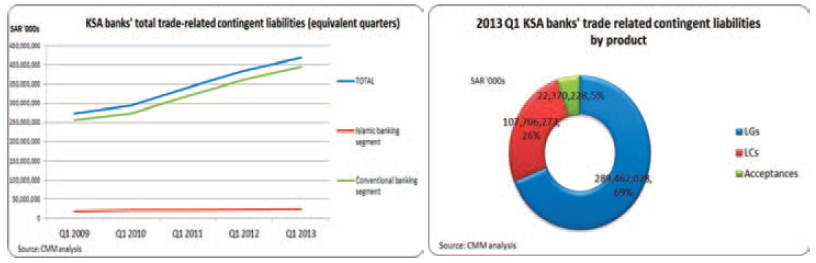

Total trade-related contingent liabilities continued their marked upwards momentum. Five banks, SABB, Arab National Bank, Saudi Hollandi Bank, Saudi Investment Bank and Bank AlBilad showed around a 25 per cent increase from the equivalent quarter last year.

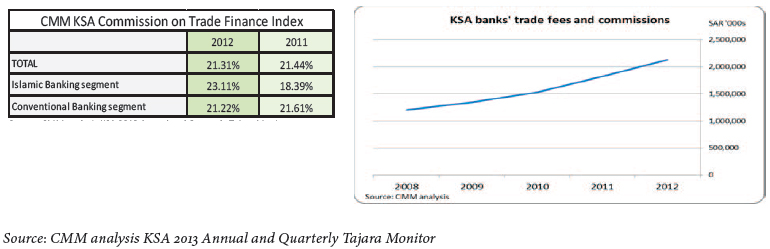

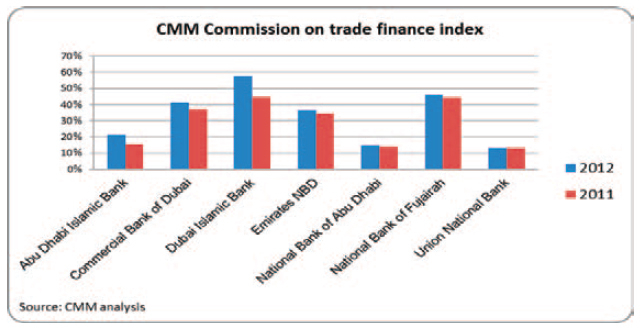

Unsurprisingly, therefore, trade fees and commissions reached a new peak as did the return on associated capital which we tracked for the first time this year in the CMM Commission on Trade Finance Index.

Trade finance’s attractive returns in the Kingdom outstrip those of many other business lines and score very well in terms of low volatility non-interest rate sensitive earnings which have an intrinsic appeal for Islamic as well as conventional banks.

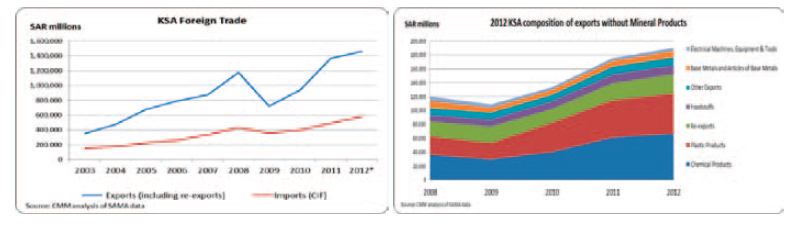

In terms of outright trade, provisional figures from the CDSI and published by SAMA, showed that total KSA trade for 2012 breached SAR 2 trillion, an increase of nearly 10 per cent on 2011. Imports rose 18 per cent to SAR 543bn and exports by 6.5 per cent to nearly SAR 1.5 trillion.

Whilst mineral products obviously still dominate the flows, all categories showed growth and the second tier of chemicals, plastics and re-exports all increased above the overall market and in terms of their contributions to the percentage of total.

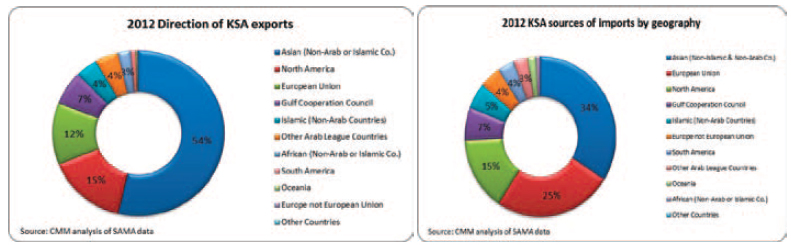

In terms of geography, Asia still accounts for more than half of exports at 54 per cent although, of the three major trading blocks, its lead has been slightly eroded by both North America and the European Union. Lower down the table, Africa (non-Arab or Islamic) showed strong relative growth, as did Oceania and Europe (not European Union) at the foot of the list.

Machinery, transport equipment and base metals continue to dominate the imports by industry section accounting for 58 per cent of overall imports and each of these three sectors showed double-digit year-on-year growth in 2012.

In geographical terms, the big three of Asia (non-Islamic & non-Arab) (+23 per cent), the European Union (+11 per cent) and North America (+28 per cent) account for nearly 75 per cent of all imports. All geographical categories showed growth apart from South America and Other Countries. Double digit growth was seen from the GCC, Islamic (non-Arab), Europe (not European Union) and Oceania.

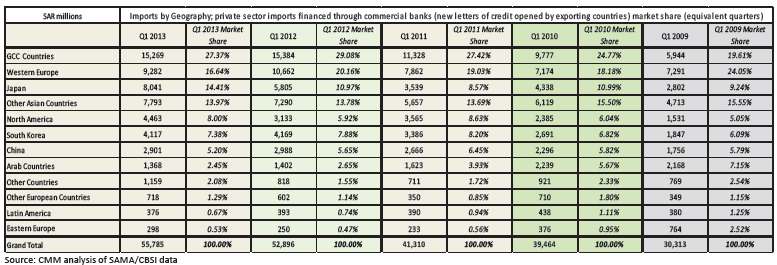

In relation to trade flows and trade finance, GCC countries continue to lead the geographical sectors pertaining to imports financed through commercial banks (new letters of credit opened by exporting countries) whilst Japan, as the leading individual country which is reported showed further strong growth year-on-year. This underscores the demand amongst the region’s banks for pan-regional operating capability or strong reciprocal correspondent relationships to serve both the GCC and Asian flows. The Japanese export flows are mirrored by some substantive long term equity investments particularly in oil and gas related sectors.

The UAE saw a welcome upturn in confidence and corporate banking and trade finance especially among the Tajara Benchmark Banks who grew their collective market share and profitability in corporate banking and trade finance.

Last year the UAE saw a welcome upturn in consumer confidence, trade related activity and high actual and planned government spending with growth in imports, exports and GDP respectively. The forecast is for GDP at four per cent for 2013 up from 3.0 per cent in 2012 and is expected to exceed five per cent within the next five years.

Whilst external credit assessment institutions point to 2014 being a pivotal year in terms of revealing the soundness of the Dubai World re-structuring with $20bn dollars of debt falling due and some banks with sizeable individual exposures, recovery showed signs of being well underway in 2012 and now 2013.

In the real estate sector and tourism, services and trade sectors positive progression was in evidence. Banks showed significantly improved profits and the stock market returned positive gains after several years of decline.

In absolute terms, banks grew their lending to trade related economic activities by seven per cent to AED 479bn in 2012. This underscores the confidence in, and stability of, the fundamentals when it comes to corporate banking and trade finance and reflects a welcome upturn in lending against trade-related economic activities.

The Construction sector, at AED 129bn accounting for 27 per cent, was the lead sector followed by Government at AED 121bn, accounting for 25 per cent, Trade (AED 106bn; 22 per cent) and Manufacturing (AED 46bn; 10 per cent).

Importantly also, banks capital adequacy remained prudent under the supervision of the Central Bank and significantly above Basel requirements with banks demonstrating positive liquidity and a turnaround in debt provisioning.

The trade story board across even the non-oil based Emirates’ economies is very positive at a granular level with apparent traction in a number of sustainable initiatives.

For example, Fujairah is leveraging its status as the second largest bunkering in the world and rising status as a marine hub. It is continuing long-term investments to that end, including the pipe-line connecting it with Abu Dhabi. Additionally, it is establishing Hilal City to host 35,000 labour workers for the sizeable expatriate community, developing its tourism and shopping, leisure and airport facilities to capitalise on its unique natural beauty. Added to the above, several of its listed companies are making long-term investments in clean manufacturing in not traditionally glamorous products such as cement and textiles with sizeable production capacity that can translate into sustainable domestic and export receipts for the future.

This activity is being supported on a day-to-day basis by smaller banks such as National Bank of Fujairah, which whilst not having the profile of bigger national banks such as NBAD, are focused on trade finance at the heart of their corporate banking proposition contributing significantly to the sustainable economic future and employment statistics in their part of the Emirates and beyond and grooming the next generation of Emirati leaders.

In summary, therefore, UAE can be seen to be making the most of its natural resources and creating new tourism and industrial niches that reward scrutiny and research.

Corporate banking and trade finance remained core to banks in the UAE last year with the corporate segment accounting, as it did, for 39 per cent of total assets at AED 596bn, 34 per cent of total liabilities at AED473bn, 37 per cent of total operating income at AED 19bn and 43 per cent of net operating profit at AED 8.5bn and LGs and LCs accounting for in excess of 52 per cent of corporate segment assets.

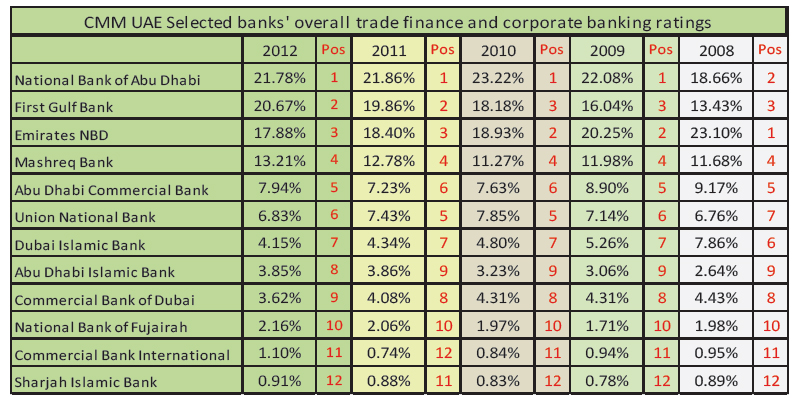

In a focused response to this corporate banking and trade finance at some of the selected banks covered by CMM, UAE Tajara Monitor recorded a very encouraging year and positive relative market-share gains.

This bulge bracket of CMM Trade Finance and Corporate Banking Improvers for the financial year 2012 included:

- First Gulf Bank

- Mashreq Bank

- Abu Dhabi Commercial Bank

- National Bank of Fujairah

- Commercial Bank International

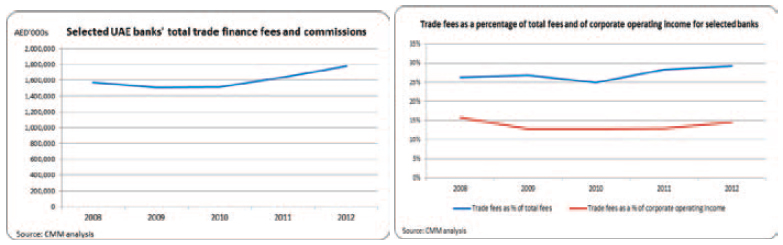

Trade finance, although flat in the overall market, had a strong positive trajectory at our UAE Tajara Monitor selected banks, bouncing back to above 2009 levels, and recording excellent returns on capital.

In short, for banks in the UAE that are actively investing in the broad span of capabilities, products and competencies to deliver excellence in trade finance at this time of much market innovation, there are demonstrable benefits for prioritising trade finance.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East