Trade Finance continues to be a product of rising importance. CARLINE MAGINN – CMM, Trade Partner looks at all the latest trend

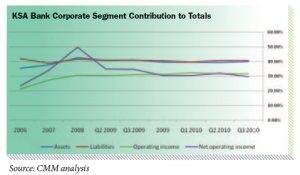

In Q3 2010, corporate operating income was up two per cent compared with the same period last year and up four per cent and 39 per cent on the same periods in 2008 and 2007 respectively.

cent on the same periods in 2008 and 2007 respectively.

Notwithstanding the positive signs of growth in the underlying revenue trajectory, corporate net operating income continued to be depressed by higher provisions for impairments compared with the same period in 2009 and registered a decline of 22 per cent compared with Q3 2009. however, some banks bucked the trends in both operating income and net operating income.

Overall corporate banking accounts this quarter for 40 per cent of each of total assets, 41 per cent of total liabilities and 30 per cent or more of total operating and net income. It is the no 1 business segment to nine out of 12 banks within the KSA when ranked against other business segments in terms of assets, liabilities, operating income and net operating income.

The systemic importance of the provision of liquidity to corporates, particularly during economic downturns, continues to be underscored by many governments and regulators.

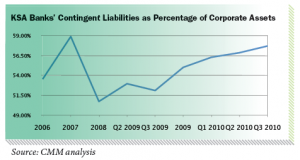

Trade finance continues to be a lead product to banks serving corporates as evidenced by the largely trade related contingent liabilities, which equated to 58 per cent of corporate assets in Q3 2010. Th is percentage is now up by a total of three points on this fi gure for year-end 2009.

This marks the fourth quarter in a row of growth and this trend refl ects that trade fi nance is a product of rising importance amongst the umbrella of services in corporate banking. Seasoned bankers recognise that supporting a customer’s profi table trade business is a key to the fi nancial and operating welfare of corporates in the short- to long-term.

As part of its aim to create transparency in the trade fi nance market-place, CMM publishes its 4th Tajara report. Th is research is up-dated throughout the year and anticipates the full year report for 2010, which will be released aft er full year annual reports are published by the banks in Saudi Arabia.

In the quarterly reports, CMM analyses the relative importance of corporate banking and trends and or market-shares of banks’ corporate assets, liabilities, income, expenses and the largely trade contingent liabilities. Th e report refers to supporting data and compares each quarter to its equivalent in the preceding year. It also analyses available data on import and export letters of credit both by geography and industry.

The objective of these reports is to track overall banking sector performance in relation to corporate banking and trade. Currently, we continue to track the performance of the 12 Saudi Banks that are licensed entities with the Saudi Arabian Monetary Agency (SAMA).

The full Tajara Q2 2010 report is available by subscription and enquiries should be made to the Editor at editor@cashandtrademagazine. com

Trade finance

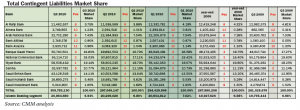

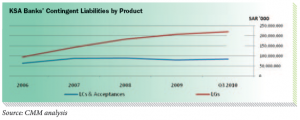

Overall banks’ commitment to trade fi nance increased, albeit modestly, in Q3 2010 to SAR 306bn as measured by the largely trade related contingent liabilities. Th is indicator has now recorded increases for each of the three quarters this year showing how robust trade fi nance is in value terms. Th is recent resilient performance of the total contingent liabilities compares well with previous years: SAR 273bn in 2008, SAR 231bn in 2007 and SAR 157bn in 2006.

Letters of guarantee continue to be the no 1 trade instrument accounting as they do for approximately 70 per cent of the largely trade related contingent liabilities.

Letters of credit, which saw a dip from the three-year peak in 2008, are continuing to show signs of recovery.

Acceptances also peaked in 2008, when letters of credit were at their highest level and they were used as a tool by exporters to the KSA to liquidate their trade receivables.

The league table positions remain unchanged from Q2 2010 with the exception of the bottom end of the table, where Alinma Bank recorded further progress and took over from Bank AlJazira in 10th position.

At the top end of the table, Riyad Bank and Banque Saudi Fransi experienced some small market-share attrition whilst both national Commercial Bank and Saudi British Bank achieved gains compared to Q2 2010.

The top four banks accounted for more than SAR 40bn each of the largely trade related items. Of these banks all maintained or increased capital committed to support trade. Th e top three trade banks account for in excess of 50 per cent of the total market.

In the product sub-league tables national Commercial Bank continues to lead in letters of credit and acceptances ahead of Banque Saudi Fransi, Riyad Bank and Saudi British Bank. In the guarantee table Riyad Bank leads from national Commercial Bank, Banque Saudi Fransi and Saudi British Bank.

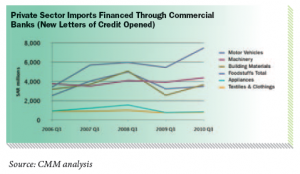

Private Sector Imports Financed Through Commercial Banks

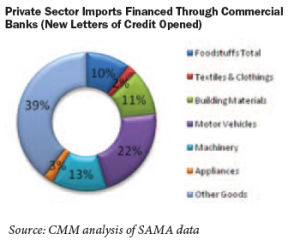

Overall this quarter the level of imports fi nanced was up on the equivalent period in 2009 if not yet recovered to the level in 2008 and was down on the performance in previous quarters this year.

After Other Goods, Motor Vehicles was the second most important category continuing to build on its Q2 and Q1 performance this year and outperforming the equivalent periods in both 2009 and 2008.

Machinery, although down on previous quarters, this year recorded growth against the equivalent periods in 2009 and 2008.

Each of other goods – building materials, foodstuff s, appliances and textiles and clothing – follow similar trends this quarter. They contracted from levels earlier this year but registered growth against Q3 2009 if not yet recovered to the Q3 2008 level.

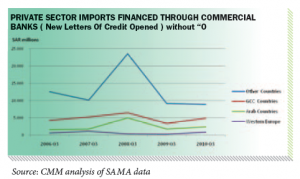

In terms of geography, Asia, the GCC and Europe continue to be the dominant trading partners. The GCC confirmed its lead over Europe this quarter emphasising its rising importance in trade finance. The GCC together with South Korean and north American related flows are the only ones to recover above their 2008 peak whilst those tied to Europe have decreased in value and relative importance.

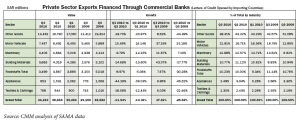

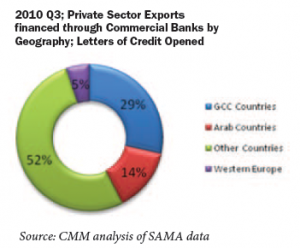

Private Sector Exports Financed Through Commercial Banks

Overall in Q3 export fi nance activity was down on previous quarters this year whilst showing recovery from the equivalent period in 2009 although not yet recovered to the level of 2008.

Outside of the broad other goods category, chemicals and plastics continue to be the most signifi cant identifi able sector.

In terms of geography, Asia, which is included in other countries, continues to dominate the export fl ows. It is worthy of note that it is the GCC partners who are again the second most important. Although they recorded a decrease on earlier quarters this year, they recorded an increase over the same period in 2009, if not back to the peak of 2008. Arab countries make up the third major partner flows and have risen for the third consecutive period this year.

Corporate assets

Overall corporate asset levels grew this quarter to a total of SAR 530bn, up from SAR 522bn at the end of the second quarter and SAR 523bn at year-end 2009, and slightly down by two per cent on Q3 2009.

The top three league table positions remain unchanged with Riyad Bank continuing to top the league table ahead of National Commercial Bank and Samba. All other positions, with the exception of that held by Alinma, remain unchanged. Alinma Bank flipped positions with Bank AlBilad to gain 11th from 12th position and recorded a further growth of one per cent market-share growth over Q2 2010.

Five out of 12 banks recorded corporate asset growth this quarter compared with Q2 – most notably Alinma Bank and National Commercial Bank – but some others recorded decreases.

During this period the Islamic segment of the market grew from SAR 79bn to just over SAR 83bn, demonstrating growth in value terms of five per cent. At the same time, it grew its market-share to 16 per cent, up from 15 per cent last quarter and 14 per cent at yearend. Alinma Bank drove the growth in this segment.

Corporate assets continue to be most important to Banque Saudi Fransi, Saudi Hollandi Bank and Riyad Bank for which they account for in excess of 50 per cent of total assets. This group is now joined by Alinma Bank, and, overall, since 2006, the trend has been for the segment to increase in importance.

Overall the market in corporate liabilities rose to SAR 461bn and continued to reflect growth, albeit small, on previous quarters this year and year-end 2009 and Q3 2009.

Riyad Bank continued to lead the league table with SAR 90bn and grew both its absolute level and market-share this quarter compared with Q2, although not compared with the same quarter in 2009.The top three banks account for a 50 per cent share of the total market. The market-place was dynamic and banks recorded mixed fortunes with regard to position and market-share. Some banks recorded gains and others losses of as much as one per cent or more.

National Commercial Bank continued to gain ground both on the last quarter and last year as did Al Rajhi Bank (inter alia). The Islamic segment share of the market gained a further percentage point on previous quarters – towards 12 per cent, up from a year-end share of 8.45 per cent in 2009.

In market-share terms, corporate liabilities have proved more volatile than corporate assets, with the market-share shifts this quarter and the even larger shifts of above two per cent since Q3 2009.

Overall, the corporate segment has continued to contribute consistently around 40 per cent of total bank liabilities within the KSA. Positive momentum and increased contribution from the segment over the past three years has been most marked at Banque Saudi Fransi for which the segment accounts for greater than 50 per cent of total from 41 per cent in 2006. It joins Riyad Bank, Saudi Investment Bank and Samba in the group for whom the segment accounts for around 50 per cent or more of total liabilities.

The relative importance of the corporate segment to Islamic banks also showed signs of growth. The corporate segment now accounts for 27 per cent of its total liabilities up from 25 per cent at Q3 2009.

Corporate operating income

At SAR 14bn for Q3, corporate operating income for the market as a whole continues to show growth, if small, as it did in previous quarters this year compared to the same periods in 2009.

Alinma Bank and Al Rajhi Bank made particular progress during this period compared with the previous year. Improvements are more widespread amongst banks when comparisons are extended to compare the Q3 results with those in 2008 and 2007.

For this quarter, Al Rajhi Bank flipped with Riyad Bank to second position compared to Q3 2009. However, each of the top four banks, Samba, Al Rajhi Bank, Riyad Bank and Saudi British Bank, experienced slight market-share attrition on the previous quarter (Q2 2010), with the mid-ranking banks in this sector edging upwards. For example, National Commercial Bank and Banque Saudi Fransi gained ground.

Six of the 12 reporting banks have a corporate segment that accounts for greater than 40 per cent of total operating income, which underscores the importance of the segment to the market as a whole.

It is important to note that the corporate segment continued to contribute above 30 per cent of total bank operating income within the KSA. Whilst not at the peak of 38 per cent seen in 2008, it is above the levels seen in 2006, 2007 and 2009.

The general trend has been an improved contribution from the corporate segment to total operating income since 2006.

Corporate net operating income

Overall corporate net income at SAR 6bn at the end of Q3 2010 was down by 22 per cent compared with the same period in 2009 as the results continued to be negatively impacted by impairment provisions that were largely greater than for the same period last year.

Notwithstanding the difficult market conditions, some banks reported improvements versus the same period last year – Alinma, Al Rajhi and Saudi Hollandi, for example.

The top six positions remained unchanged with Samba continuing to lead followed by Riyad Bank, Banque Saudi Fransi and Saudi British Bank. Each of the top three achieved market-share gains and, collectively, they accounted for close to 60 per cent of the total market.

Further down the table, National Commercial Bank climbed from ninth to seventh, flipping positions with Arab National Bank with an improved market-share. Alinma Bank also made market-share gains.

The corporate segment remains of core importance to the KSA banking sector and still contributes 30 per cent of banks’ total net operating profits, notwithstanding recent provisions for impairments. Whilst not at the peak contribution of 50 per cent seen in 2008, this is above the level of 2006.

The importance of the corporate segment to overall profitability is highest for Saudi Hollandi Bank, Saudi British Bank, Riyad Bank and Banque Saudi Fransi for which it accounts for more than 50 per cent of total operating profit.

In general, the net operating income contribution from the corporate segment has increased in importance to banks since 2006.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East