Banks have played a demonstrably positive role in the real economy and broader society in Qatar during recent years. This is particularly evidenced by their increased provision of trade finance. Caroline Maginn, Trade Partner at Cash Management Matters (CMM), explains

In a final look at the specifics of trade finance in the main GCC countries ahead of the conclusion of the full year reporting for 2011, we highlight some of the findings of the Qatar 2011 Tajara Monitor. This publication was new to the market and follows along the precedents set by CMM in the KSA, the UAE and Kuwait. The aim of the Tajara series is to bring greater transparency to trade finance in the GCC.

In Qatar banks provided trade finance facilities to both small and large corporate and financial institution clients domestically and internationally to different degrees. The local banks continue to be the cornerstone of trade finance in Qatar but are joined by a strong group of foreign banks. The latter have identified Qatar as a growing and lucrative market of strategic significance within the MENA region and they provide coverage both from on- and off-shore. According to CMM estimates the foreign banks accounted for an aggregate share of around 30 per cent of the total market in 2007 rising to about 40 per cent in 2010.

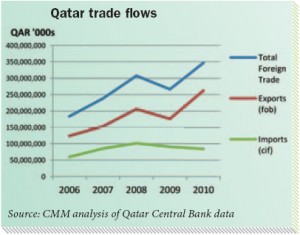

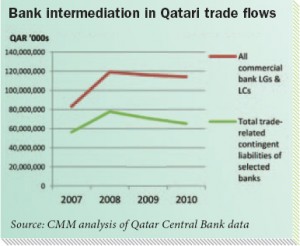

Qatar’s exports, in 2010, increased to more than QARs 262bn. Whilst naturally boosted by a rise in fuel prices, total exports also benefitted from an upwards of 50 per cent increase in the “non-hydrocarbon” goods flows. This reflects Qatar’s successful diversification strategy. Imports were largely flat at QAR 85bn. During the same period, the level of trade finance products levelled at QARs 114bn down from the peak of QARs 119bn in 2008 but up from the QAR83bn level of 2007( pre-the-currently-on-going global crisis).

The level of bank intermediation required in total trade flows has been constantly well above 30 per cent in recent years. It is not anticipated that demand will decrease in the near term due to the on-going political and economic uncertainties regionally and internationally. On the contrary, the demand is likely to increase and the challenge for the banks will be to retain their confidence in and commitment to provide the needed levels of trade liquidity.

The precedent set by the banks is a favourable indicator of their good intent in this regard as they have collectively maintained the level of trade liquidity at above QARs 114bn over the past three years. However, there will be additional burdens on providers of trade finance in future in the form of the extra capital required to support it according to the increased capital provisioning presently envisaged by Basel III, as discussed in more detail in the last edition of Cash&Trade.

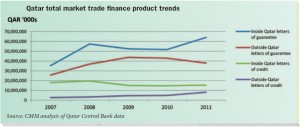

As in other GCC countries, guarantees continued to be the major trade instrument in Qatar and the one with the strongest growth. The main sub-product in the letter of guarantee category in Qatar is the performance bond followed by advance payment bonds, bid bonds and then other assorted guarantees, including minor values for loan and shipping guarantees. It is relevant to note that the letter of credit offering in Qatar is still skewed toward imports as the ratio of import to export letters of credit in Qatar is typically a ratio of greater than 10:1. The trends and values of each sub-product are analysed in more detail in the full Monitor.

Whilst in Qatar trade finance is regarded as a bread and butter business and is intuitively understood by banks to be one of their important corporate banking business lines, the true complexities, dimensions and scale of trade finance are not as widely understood as they should be. This is perhaps not surprising as it is only in recent years that banks in Qatar have started to identify corporate banking as a whole as a discrete business segment in their financial reporting.

As of 2010, only three of the eight traditional and Islamic local banks registered with the Qatar Central Bank and covered in the Monitor, report on the corporate business as a distinct segment. Other banks continue to group retail together with corporate as one segment.

Some banks in Qatar have begun to rise to the challenge of upgrading their capabilities in trade finance through the launch of on-line offerings for trade, the establishment of trade and working capital finance units and, inter alia, the establishment of specialist services for government contractors. The latter are key to support the day-to-day trading activities of corporates and also the many infrastructure projects underway in Qatar, including oil and gas related activities as well as several major international sporting events projects.

The banks are in the process of trying to address the importance of overseas reach for trade to cater for both ends of the transaction either through organic growth, select regional/ global partnerships or, more simply, through amassing as many correspondent bank relationships as they can. These options are seldom exclusively applied and, practically, banks are forging different blends of the three solutions to improve the accuracy, speed and responsiveness of the trade operations.

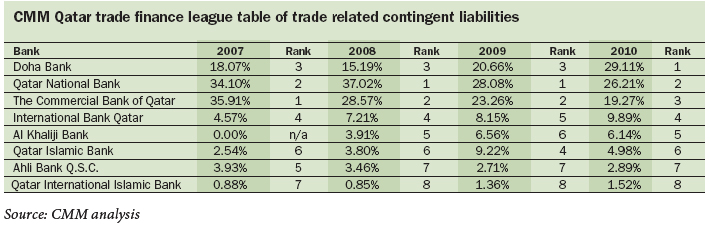

When we come to look at the banks driving the provision of trade liquidity in Qatar, it is interesting to note that some have made significant inroads in trade finance. In recent years, Doha Bank has taken over from the, by many measures, larger institutions – Qatar National Bank and Commercial Bank of Qatar – in total trade related contingent liabilities.

Doha Bank’s position at the top of the league table is worthy of some specific brief notes. The bank’s progression has been strong and consistent over the past four years, as illustrated.

Apart from the extra capital it has provided to trade finance, it has delivered customised trade financing to international and domestic contractors and supply chain finance to SMEs. These initiatives have characterised its commitment to deliver trade finance excellence tailored to meet particular client needs.

Unlike some banks in the region, it has not been inclined to divest its business away from the admittedly demanding corporate banking segment with a sometimes problematic credit cycle but has instead embraced this as a continuing positive business focus at the centre of its overall strategy.

A further example of this occurred in 2010, when it restructured a significant piece of a QAR115m problem loan portfolio it had on its books into a QAR30m committed revolving trade finance facility thereby ostensibly continuing to provide trade liquidity in an adverse credit situation.

Hence whilst QNB held its lead position in letters of credit, Doha Bank both eroded its share of LCs and had a significantly larger portfolio of letters of guarantee. The International Bank of Qatar and Khaliji Bank have also made good gains during the same period.

The strong start made by Al Khaliji is proving that there is increasing demand for new providers of trade finance in the market.

In Qatar, as in other GCC countries, corporates have not been complacent in their choice of bank partner to facilitate their trade business. This is reflected in the market share changes in recent years with some marked winners and losers amongst banks as referred to in this article.

(The detailed analysis of Doha Bank’s performance and that of other banks is available in the full Monitor).

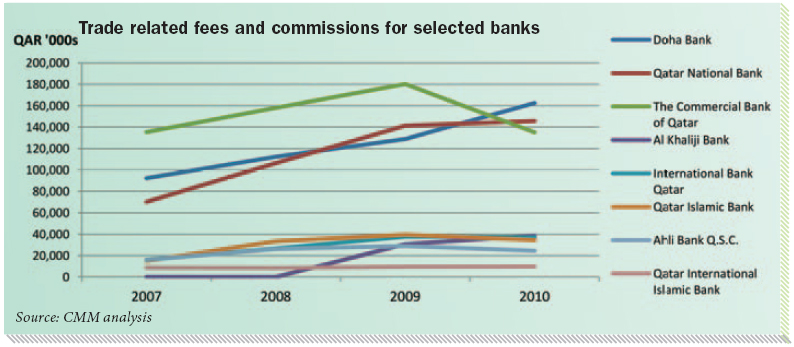

As Qatari banks have continued to play the role of trusted intermediary – and have provided a range of trade finance products – their efforts have not gone financially unrewarded. Unlike the case with some other business lines, there has been a positive trajectory in trade finance income. The contribution of trade-related fees and commissions towards total fees and commissions has also risen, in some cases representing in excess of 40 per cent.

Doha Bank heads the Trade Fees and Commissions Table with trade commissions of more than QAR 162m in 2010, up from QAR 92m in 2009. In second position, Qatar National Bank saw a nominal increase of three per cent year on year and Qatar Commercial Bank saw a decline in trade commissions. Similar mixed fortunes were experienced by banks further down the table. This is analysed in more detail in the full Monitor with reference to the largely trade-related indirect facility fees and commissions.

It is very important that banks continue to engage actively in their support of trade finance in Qatar and that they do so in a transparent manner. Without the roles played by Qatari and foreign banks, which are facilitated by the ICC, there would be a real risk of disruption in the supply and exchange of goods and the associated financial cycle.

Additionally, banks need to continue to invest in enhancing their trade finance offerings. This should, and can, be with a view to improve efficiency in this notoriously fraught area of banking where exceptions, discrepancies and delays are the norm. In this manner, the banks active in Qatar can tangibly reduce the cost of goods purchased and increase the profit on goods sold, thereby enhancing the economy as a whole. n

The scope of the GCC Tajara Monitors is presently limited to the indigenous banks that by and large make their annual and interim reports with details of their letters of credit guarantees and acceptance levels freely available. This is due to the fact that foreign banks, although active in trade finance across the GCC, do not publicly disclose their country specific financial positions and on-and-off balance sheet reporting for trade finance or corporate banking as a whole. If foreign banks would disclose details of their trade finance portfolios at an aggregate trade product level at a GCC country level, they could be compared in the Monitors on a level playing field with the national banks without compromising client confidentiality.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East