SWIFT’s latest RMB Tracker shows that 57 countries have crossed the 10% RMB threshold

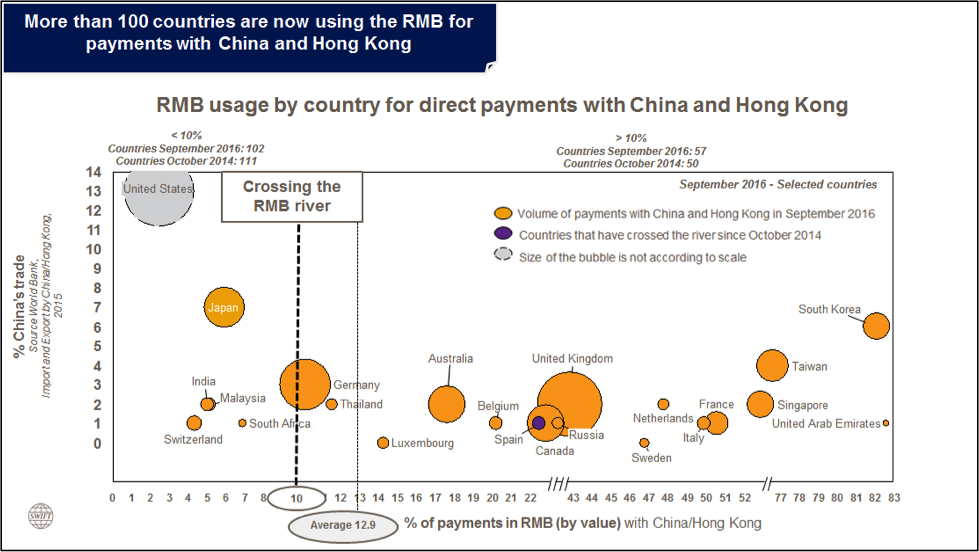

Brussels, 27 October 2016 – The latest RMB Tracker shows that during the last two years (October 2014 – September 2016), seven new countries are now using the RMB for more than 10% of their direct payments by value with China and Hong Kong, bringing the total to 57 countries worldwide. The 10% milestone, also known as ‘crossing the RMB river’, is a threshold set by SWIFT to measure the adoption of RMB payments by value with China and Hong Kong compared to other currencies. Among the 101 countries using the RMB for payments, the weight of these payments by value reached 12.9%, giving the currency a nearly 2% increase since October 2014 (11.2%).

Brussels, 27 October 2016 – The latest RMB Tracker shows that during the last two years (October 2014 – September 2016), seven new countries are now using the RMB for more than 10% of their direct payments by value with China and Hong Kong, bringing the total to 57 countries worldwide. The 10% milestone, also known as ‘crossing the RMB river’, is a threshold set by SWIFT to measure the adoption of RMB payments by value with China and Hong Kong compared to other currencies. Among the 101 countries using the RMB for payments, the weight of these payments by value reached 12.9%, giving the currency a nearly 2% increase since October 2014 (11.2%).

Although seven more countries are “crossing the RMB river” than in October 2014, these new nations are – with the exception of Spain – smaller trade partners for China, like Bolivia, Colombia, Mozambique, Namibia, Kuwait and Georgia.

“Over the last two years, we have witnessed a continued increase in RMB usage for direct payments with China and Hong Kong, with most of the growth coming from early adopters and main RMB clearing centres, such as Singapore, the United Kingdom and South Korea,” says Astrid Thorsen, Head of Business Intelligence Solutions, SWIFT. “On the other hand, two of the largest economies in the world[1] and important trade partners with China, United States and Japan, still show low RMB adoption. The latest announcement related to the appointment of the first RMB clearing centre in the United States should positively impact the country’s RMB usage.”

Overall, the RMB kept its position as the fifth most active currency for global payments by value, with an increased share of 2.03%, compared to 1.86% last month. In September 2016, the value of RMB global payments value increased by 10.02% compared to August 2016, which is higher than the average growth of 0.93% for all currencies.

-####-

About SWIFT and RMB Internationalisation

Since 2010, SWIFT has actively supported its customers and the financial industry regarding RMB internationalisation through various publications and reports. Through its Business Intelligence Solutions team, SWIFT publishes key adoption statistics in the RMB Tracker, insights on the implications of RMB internationalisation, perspectives on RMB clearing and offshore clearing guidelines, supports bank’s commercial RMB product launches and provides in-depth analysis and business intelligence, as well as engaging with offshore clearing centres and the Chinese financial community to support the further internationalisation of the RMB.

The SWIFT network fully supports global RMB transactions, and its messaging services enable Chinese character transportation via Chinese Commercial Code (CCC) in FIN or via Chinese characters in MX (ISO 20022 messages). It offers a suite of dedicated RMB business intelligence products and services to support financial institutions and corporates. In addition, SWIFT collaborates with the community to publish the Offshore and Cross-Border RMB Best Practice Guidelines, which facilitate standardised RMB back office operations.

Please click here for more information about RMB Internationalisation or join our new ‘Business Intelligence Transaction Banking’ LinkedIn group.

For more information, visit www.swift.com.

About SWIFT

SWIFT is a global member-owned cooperative and the world’s leading provider of secure financial messaging services.

We provide our community with a platform for messaging and standards for communicating, and we offer products and services to facilitate access and integration, identification, analysis and financial crime compliance.

Our messaging platform, products and services connect more than 11,000 banking and securities organisations, market infrastructures and corporate customers in more than 200 countries and territories, enabling them to communicate securely and exchange standardised financial messages in a reliable way. As their trusted provider, we facilitate global and local financial flows, support trade and commerce all around the world; we relentlessly pursue operational excellence and continually seek ways to lower costs, reduce risks and eliminate operational inefficiencies.

Headquartered in Belgium, SWIFT’s international governance and oversight reinforces the neutral, global character of its cooperative structure. SWIFT’s global office network ensures an active presence in all the major financial centres.

For more information, visit www.swift.com or follow us on Twitter: @swiftcommunity and LinkedIn: SWIFT

Please contact Randa Mazzawi or Mayssa Makhlouf on: +971 4 3403005, swift@boroujconsulting.com

Disclaimer

SWIFT does not guarantee the fitness for purpose, completeness, or accuracy of the RMB Tracker, and reserves the right to rectify past RMB Tracker data. SWIFT provides the RMB Tracker on an ‘as is’ basis, and for information purposes only. As a mere informative publication, the RMB Tracker is not meant to provide any recommendation or advice. Any person consulting the RMB Tracker remains solely and fully responsible for all decisions based, in full or in part, on RMB Tracker data. SWIFT disclaims all liability regarding a person’s use of the RMB Tracker. The RMB Tracker is a SWIFT publication.

SWIFT © 2016. All rights reserved.

[1] Based on the Gross domestic product in 2015. Data from the World Bank.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East