It’s believed that ‘unleashing the full potential of payments, trade finance and more unified corporate transaction banking channels and services’ are key to future growth strategy, according to a global survey

Continued unification of trade finance, cash management and payments in global transaction banking (GTB) business units presents banks with both opportunities and challenges, according to the fourth survey conducted by international business consultants Misys, working with Finextra Research to evaluate the state of the global transaction banking sector

It says that banks are extending new services in reaction to key market drivers, such as currency and counterparty risk, but the fundamentals of GTB are still causing headaches, with banks missing out on latent growth opportunities. While marginal growth is seen from value-added transaction services, banks have identified that unleashing the full potential of payments, trade finance and more unified corporate transaction banking channels and services are key to their future growth strategy and in particular the enablement of greater international and cross-border payment capabilities.

On the whole, the survey found,that banks were looking to get their house in order first, to capitalise on core business lines before executing on their longer-term aim to deliver non-traditional value added services, for example new supply chain finance services or products enabled by real-time payments.

New revenue streams have come from the delivery of more reactive value-added services that address market volatility and risk, rather than innovative new services that will provide competitive advantage and differentiation in the longer term.

In summary, Misys said its key findings were:

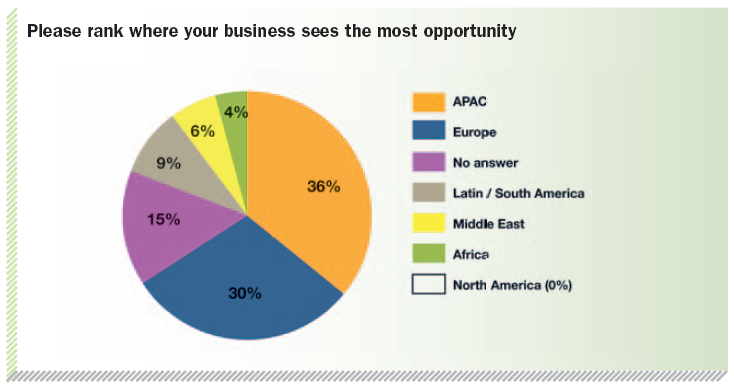

- most growth potential for global transaction banking is seen as coming from the Asia Pacific region

- banks are striving to satisfy corporate demands, but hampered by lack of automation and operational inefficiencies. They are looking to new, non-traditional services but focusing first on core business

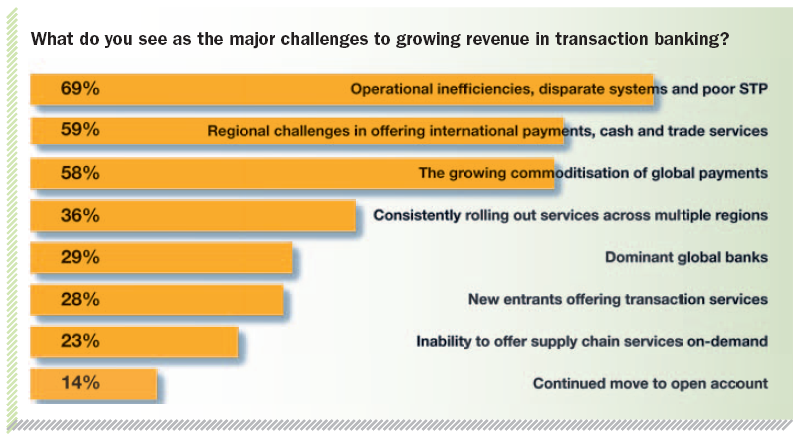

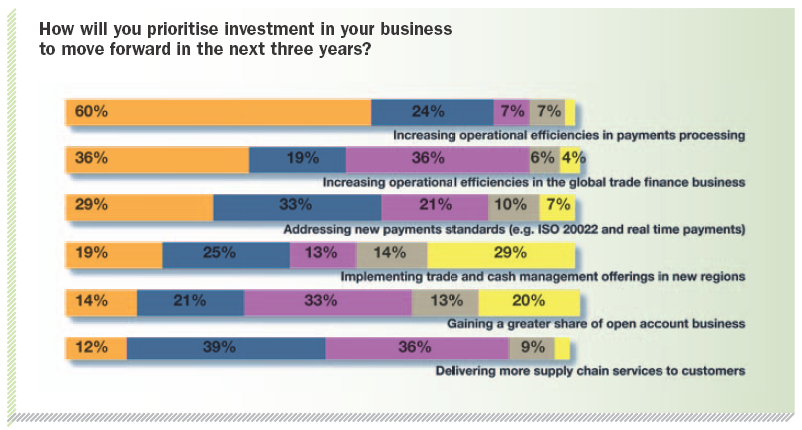

- 69 per cent said that the main challenge to growth remains operational inefficiencies across core transaction banking systems. While business lines have consolidated, systems have not. Eighty-four per cent said that increasing payments processing efficiency was one of their top two priorities for investment, and for 56 per cent investing in streamlining trade finance business was one of their top two priorities

- while unified cash, trade and payments was seen as key to growth, 75 per cent said rolling out unified services in new regions was difficult and a barrier to growth

- cross-border payments processing is seen as the top priority for investment and growth

- only 12 per cent of those banks surveyed offer the full breadth of online banking services.

Services and opportunity

The wave of consolidation of previously standalone business units within global transaction banks is largely complete. The report established that 81 per cent of surveyed institutions had created a transaction banking group that combined cash management and trade finance, at least at an operational level.

It added, “It’s now clear that most banks operating internationally in this space have gone down the same route. But they need to make their proposition more cohesive for corporate customers by focusing efforts both internally and externally. Internally they must achieve operational integration of systems, managers and other staff. Externally, they must develop and effectively present their capabilities and be able to deliver on their ‘one stop shop’ promises.

“The move to a global transaction banking (GTB) umbrella has had an impact in terms of operational efficiency and customer service. However, the structure is maturing, particularly within large banking groups, and now there is a push to add more services to capitalise on new revenue streams by reacting to new market drivers. The consolidation of banking disciplines within the GTB business has also revealed that growth and client retention can not be achieved only through new services, but also through a greater drive to streamline and join up existing transaction banking offerings.”

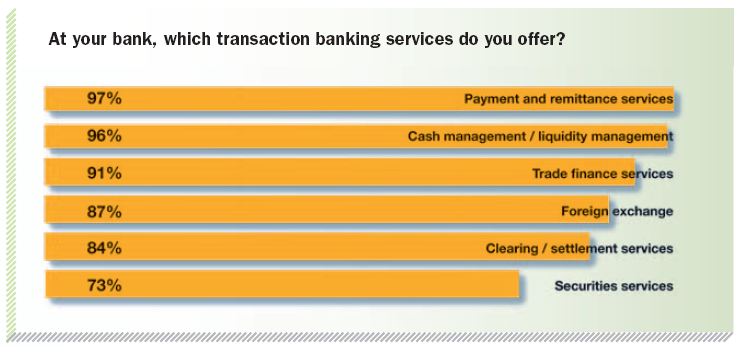

From previous surveys, Misys said it was evident that most banks have more unified offerings for cash management, trade and payments and it now wanted to see how far the trend was extending into packaging other products and services together in a single business unit for servicing corporate clients.

Certainly, it added, “it was evident that, increasingly, foreign exchange, clearing and settlement and securities services are being offered as banks look to generate new revenue streams and meet client demand”.

Opportunities for growth

Overall, most respondents said they saw the Asia Pacific (APAC) region as providing the best growth potential for their business.

All APAC banks saw the most opportunity within APAC, reflecting not only that these banks are looking close to home for new business in markets they understand, but also the dynamism in the region.

European banks were more split in their focus: 55 per cent were pursuing growth opportunity in Europe, with 25 per cent looking to APAC, 12 per cent to Latin America and eight per cent to the Middle East and Africa.

No respondents, even the six per cent for whom it is their home market, said that North America was their biggest opportunity for growth. But as respondents were asked to rank the regions 1-5 in terms of opportunity North America was the most popular second choice, at 31 per cent.

In the multinational and large corporate sectors in North America, transaction banking business is dominated by a few big players, but this result shows that banks outside the region are still keeping an eye on opportunities there, even if it’s not their primary focus.

Products and services for growth

For the top priority region identified in the previous question Misys asked which products/services those banks saw as being most important to enabling growth.

Overall figures show cross-border payments processing as the most important. But breaking it down by region, this is far more important for those targeting APAC than those targeting Europe.

Eighty-nine per cent of those targeting growth in APAC chose this as a critical product offering, “which makes sense given the greater economic and monetary fragmentation in the region compared to Europe with its more cohesive ties and more mature cross-border payments infrastructure”.

Across all respondents, second and third in terms of importance were supply chain finance and working capital optimisation – and, thereafter, online trade services and cash management.

Cross-border risk mitigation

Risk mitigation for cross-border trade and asset liability management is another area where Misys saw differences in perceived importance depending on which region was being targeted for growth. For example, 55 per cent of those seeking growth in APAC deemed this an important offering.

Misys added that it was clear that large corporates were becoming more demanding. “Many multinationals already have access to a full range of transaction banking and financial supply chain services from their main relationship banks. But often these have been tailor-made by the bank, and aren’t standardised offerings that can be delivered on a greater scale.

“For banks looking to win more clients, particularly in the growing SME sector, being able to deliver new services in a standard fashion and back them up with scalable back-office infrastructure is crucial. Trade and supply chain financing for SMEs is a high-volume, low-value business and realising growth and capitalising on opportunity here demands greater efficiencies in banks’ trade finance operations.”

The major concerns

Operational inefficiencies, disparate systems and poor straight-through processing remain the major challenges to growing revenue in transaction banking.

“Unlike the challenge posed by external regulatory pressures, this is entirely within the scope of banks to tackle and improve. While IT system complexity is a factor, organisational and business process management also plays an important part.

“As well as being seen as the greatest potential for growth, increasing operational efficiency in payments processing is by far the most pressing area for investment among survey respondents,” says the survey.

“The growing commoditisation of payments is another challenge emerging more strongly, with 58 per cent of respondents highlighting it this year, compared with 46 per cent last year. As it becomes harder to differentiate with standard payment products and services, banks are under increasing pressure to achieve greater efficiency in existing areas – and scale them at a regional or global level – while also directing resources to new product development and delivery.”

Facing up to regional challenges

Regional challenges can take the form of regulation, different market practices and the nature of corporate clients and trade dynamics.

And they were considered a hindrance to growth for 59 per cent of respondents, including all banks from the Middle East and Africa, while 55 per cent of European banks and 50 per cent of APAC banks saw regional issues as a challenge to revenue growth.

Of those that considered online trade services and cash management a key product for ensuring growth in their target market, 75 per cent considered regional challenges in offering international payments, cash and trade services a hurdle to revenue growth.

Financial supply chain services

The definition of supply chain finance varies from bank to bank. Today, many leading banks in the space that offers supply chain finance programmes see this as meaning the delivery of approved payables financing.

The survey said, “It is clear that these fundamental elements of supply chain finance are the most in demand today and banks are looking to walk before they run when it comes to offering additional services. Still, more than half saw expanding the services they currently offer to corporates as a top two priority.

“Delivering additional value-added supply chain financing tools, such as early payment/dynamic discounting, factoring and bulk financing demand the right technical architecture, real-time purchase-order and invoice information, straight-through-processing capabilities and integration with corporates’ own ERP systems. These services are still seen as the future of supply chain finance rather than the established norm.”

Move to enhanced services

A prime example of this gradual move to enhanced services in the supply chain is the continued slow but steady uptake of the Bank Payment Obligation (BPO) and move to data matching via the Trade Services Utility (TSU), according to the report.

“Banks will increasingly see new services as an opportunity to attract new customers and differentiate from the competition, particularly in the SME sector, where more flexible financing and risk mitigation has been a growing concern. Uptake of the BPO so far has mostly been in APAC, so banks outside of the region looking to service corporates in APAC are keeping an eye on the growth of corporate demand for BPO in the region.

“But the market is still in the process of offering the basics. The level of perceived demand from the corporate sector for invoice discounting and approved payables finance is higher than the percentage of banks that are currently or imminently offering these services. This indicates a potential opportunity for those banks that have yet to begin offering core supply chain finance services.”

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East