Rigorous management coupled with conservative principles have allowed Invesco to demonstrate how its investment options provide security and preserve core values. PAUL MELLY reports. “Our primary focus is to ensure the safe return of each dollar – rather than to take risks to generate an excessive return on a dollar,” says Tim Jackson, institutional product director at Invesco Asset Management. …

Read More »2012

Instability pushes up call for more ‘safety’ insurance

The demand for export credit and investment guarantees has increased dramatically in the wake of the Arab Spring and the signs are this trend will continue in the foreseeable future. MUSHTAK PARKER casts an eye over the financial landscape “sovereign guarantees – no-one takes them seriously these days. They don’t mean much, especially in the wake of what has been …

Read More »Trade finance surge buoys Saudi banks’ corporate banking performance

Caroline Maginn, trade partner at CMM, looks at a positive picture in the KSA Trade finance and corporate banking are on the up in Saudi Arabia thanks to strong, double-digit growth in both imports and exports in the Kingdom and continued positive intermediation by Saudi banks in the trade flows. This is confirmed by Cash Management Matters (CMM), which as …

Read More »Trade between Asia and MENA set to expand

Discussions between 150 senior decision-makers in the international investment markets that focused on expanding economic links and boosting financial ties between Asia and the MENA region opened the inaugural Asia-Middle East Investment Summit in Singapore recently. Co-located with the 3rd Annual World Islamic Banking Conference:Asia Summit (WIBC Asia 2012), the event was inaugurated with a special welcome address by H …

Read More »Corporates move to ‘top-end’ solutions

Trade finance and treasury management in MENA is moving towards more sophistication. Syed-Kamran Zaidi, Deutsche Bank’s regional head of trade finance and cash management corporates, assesses the latest developments in the region There is no escaping the fact that these are uncertain times. The socio-political unrest in the Middle East combined with the ongoing turbulence in the global financial markets …

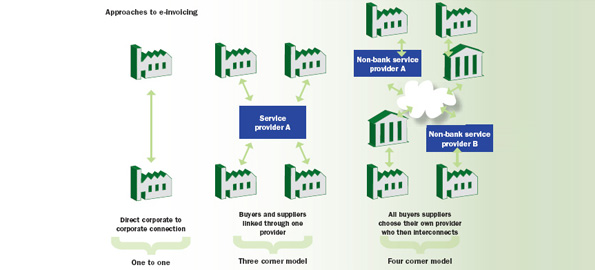

Read More »SWIFT makes e-invoicing easier

Corporate adoption of SWIFT has been a growing trend for many years, according to MARCUS HUGHES, director of business development, Bottomline Technologies The focus on SWIFT for corporates has been sharpened due to its new electronic invoicing (e-invoicing) initiative. Whilst there is general agreement on the payments and cash management benefits of joining SWIFT, adoption by corporates has generally been …

Read More »Issue 16 July / August 2012 – PDF

Letter from the editorial director

Dear Reader, The importance of managing cash effectively and having visibility and control over it cannot be overstated. For example, in the current climate careful timing over payments and receipts can be hugely beneficial, while the ability to minimise counterparty risk by rapidly moving cash to more stable banking partners is invaluable, especially in the event that the eurozone crisis …

Read More »How banking can buck up

“For many banks, the question has not been ‘how do I succeed’ but ‘how do I survive’? according to David Hamilton, president of SunGard’s banking business. Fundamentally, he explained, the global banking model had shifted and a transformation was occurring in how money was being managed as banks strove to re-build trust and create value for their shareholders. “A focus …

Read More »ICIEC backing goes above $3bn

More than $3bn in export credit insurance has been provided over the past year to member countries by the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC). This was revealed at its recent annual meeting in Khartoum. The annual report showed that this was an increase of 59 per cent compared to 2010, and financial results were …

Read More »SWIFT launches Sanctions Screening

SWIFT has announced the launch of Sanctions Screening, a centralised service for small- and medium-sized financial institutions in need of a cost-effective, easy route to compliance with sanctions regulations. It was developed to help those SMEs keep up with increasing regulatory obligations. Complying with evolving sanctions regulations and frequently updated lists has become more complex, costly and time-consuming for financial …

Read More »‘Alternative future for corporate funding’

Leading names from the world of international finance were at the third annual Falcon Group trade and corporate finance forum held at the Madinat Jumeirah Hotel, Dubai. Moderated by BBC World’s Nima Abu Wardeh, the forum brought global CEOs and CFOs together to hear speakers discuss crucial issues for corporate funding. Offering political, economic, banking and corporate perspectives, the list …

Read More »Banks in ‘Asia deal’

Standard Chartered has signed two agreements with Warba Bank to facilitate their transactions in Asia. The announcement comes in light of increased trade activity between MENA financial institutions and companies with Asia in general and China in particular. Warba Bank joined Standard Chartered’s “Asia Express Guaranteed Payments Programme”, which ensures delivery of funds to beneficiaries in Asia on the same …

Read More »Groundbreaking finance deal for oil

The International Islamic Trade Finance Corporation (ITFC), a member of the Islamic Development Bank Group, signed a $855m Import Finance Murabaha Agreement with The People’s Republic of Bangladesh (represented by the Energy & Mineral Resources Division) and Bangladesh Petroleum Corporation (BPC) for the import of crude oil and refined petroleum products. The agreement brings together a total of 28 financial …

Read More »The ‘21st century Silk Road’

Trade corridors between China and the MENA region carry huge economic growth potential for businesses, offering the greatest prospects in the commodity and energy sectors, HSBC said at its Middle East and North Africa (MENA) and China Forum held in the UAE recently. Emphasising the growth of China as a trading powerhouse, HSBC added that China is poised to become …

Read More »New glow for commercial banking

Transaction banking has never been viewed as an especially glamorous facet of the industry, with most young bankers eschewing careers in this area for high-rolling investment banking positions. Now, however, while investment banking headcount is being pared back, transaction banking is quietly booming.

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East