Caroline Maginn, trade partner at CMM, looks at a positive picture in the KSA

Trade finance and corporate banking are on the up in Saudi Arabia thanks to strong, double-digit growth in both imports and exports in the Kingdom and continued positive intermediation by Saudi banks in the trade flows.

This is confirmed by Cash Management Matters (CMM), which as part of its aim to create transparency in the trade finance market-place in the KSA has set out the results of its 2011 research in its Tajara Monitor publication.

Trade finance and corporate banking closed 2011 on a very positive note. Each of the key relevant performance measures for the 12 KSA banks posted growth from the previous year, as analysed in more detail in the full Tajara Monitor report.

- Corporate Assets + 8%

- Corporate Liabilities + 9%

- Corporate Operating Income + 5%

- Corporate Net operating income +40%

- Trade Contingent Liabilities +13%

- Trade Fees & Commissions + 14%

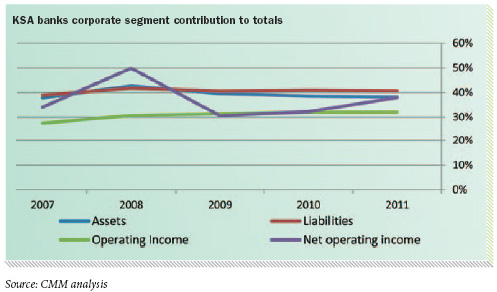

During continued global market uncertainty, corporate banking remained a prime business segment for banks within Saudi Arabia; when measured as a percentage of assets, liabilities, operating and net operating income. It is the Number One business segment for eight out of the 12 banks within the KSA ahead of retail, treasury and investment banking and brokerage.

Overall, for 2011, the corporate banking segment accounted for 38% of total assets at SAR 574bn; 41% of total liabilities at SAR 522bn; 32% of total operating income at SAR 19bn; and a dramatically improved 38% of net income at SAR 12bn.

The trade flow growth was export led with an increase of 45% in the value of exports over the previous year closing at an estimated SAR 1,367bn, above the prior recent peak in 2008 of SAR 1,175bn. Imports also performed strongly at SAR 493bn; up 23% on 2010 and also above the prior recent peak of 2008.

KSA bank intermediation via letters of credit and guarantees in support of these trade flows continued apace. The level of guarantees grew by 11% and the level of letters of credit and acceptances grew by 18%.

Overall trade finance continued its strong positive trajectory of the past five years in 2011 and grew by 13% from 2010, exceeding the growth in corporate assets, liabilities and operating income.

Trade finance continues to be a lead product for banks serving corporates as evidenced by the largely trade-related contingent liabilities that rose further to equate with 64% of corporate assets at year-end 2011 for the overall market. This trend reflects that there is a continuing increased commitment from banks to support the rising demand for trade finance even during these times of credit tightening. Seasoned bankers recognise that supporting a customer’s profitable trade business is a key to the financial and operating welfare of corporates in the short- to long-term.

Furthermore, it is significant to note that whilst total banks’ fees and commissions rose by 4% between 2008 and 2011, trade fees rose during the same period by 45%.This growth was also reflected in the trade-related fees and commissions which grew by 14% year-on-year; confirming trade finance as the engine of growth in corporate banking.

The level of bank intermediation required in total trade flows has been at or above 20% in recent years when measured purely on the basis of letter of credit and guarantee activity. This is significantly higher when the level of bank trade related finance; foreign exchange and cash management are taken into account and estimated to be consistently above 30%. It is not anticipated that demand will decrease in the near term due to the on-going high levels of government spending reflected in the 2012 budget and the political and economic uncertainties regionally and internationally. On the contrary, the demand is likely to increase and the challenge for the banks will be to retain their confidence and commitment to provide the needed levels of trade liquidity.

The precedent set by the banks is a favourable indicator of their good intent in this regard as they have collectively maintained the level of trade liquidity at above SAR 280 billion over the past three years rising to SAR 367bn in 2011. However there may be additional burdens on providers of trade finance in future in the form of the extra capital required to support trade finance according to the increased capital provisioning presently envisaged by Basel III, as discussed in more detail in the full Tajara report.

Letters of guarantee continued to be the major trade finance product in the KSA in 2011 widely used as they are for a broad range of import and export transactions and domestic and international trade. The market in letters of guarantee grew to SAR 259bn up by 11% on the previous year and they continued to represent approximately 70% of the total market.

The market in letters of credit and acceptances was also buoyant in 2011 growing more sharply than guarantees at above 18% to reach SAR 108bn.

Whereas in previous years the market at the longer end of the maturity range had trended continually upwards there was a shrinkage in the “1-5 years” range in 2011 and in the “above 5 year” range. The growth in 2011 was entirely at the shorter end of the spectrum in the “within 3 months” band.

Corporate assets grew again in 2011 from SAR 531bn in 2010 to SAR 574bn registering a much stronger growth rate of 8% than the 3% registered in the previous year. This reflects the underlying strong performance in the KSA economy and the benefits of the government investment policy which spread growth prospects across a diverse range of government and private sectors. Excepting the Consumer sector the biggest sectors in the overall banks loans and advances markets were Commerce, Manufacturing and Building and Construction each with on-going general corporate and trade specific liquidity needs. The rising level of bank activity in corporates’ commercial and financial flows is reflected in the asset growth.

Overall growth in corporate liabilities accelerated again in 2011 when they grew to SAR 522bn up from SAR 481bn in 2010. This reflected a year-on-year growth of 9% and narrowed the gap further between corporate segment assets and liabilities. Traditionally important on the asset side of the balance sheet the corporate segment has been growing in importance for several years now and this trend is set to continue as the private sector liquidity will benefit from continued high government infrastructure investment and privatisation.

The growth rate of corporate operating income accelerated from 2% to 5% last year bringing total corporate operating income for the market segment to SAR 19bn. This is the fourth consecutive year of growth notwithstanding the regional and global uncertainties since 2007. The corporate segment is of prime earnings importance to banks in the KSA as the lead segment contributor to earnings at seven out of twelve banks and the second most important contributor at a further four banks. There were significantly more changes in rankings in this corporate league table than in any of the other league tables. Roughly half of the banks improved relative market-share whilst the other half lost ground. This illustrates how competitive and dynamic the playing field is when it comes to the earnings generation which is a key driver for ultimate profitability. All banks in the table bar four (Al Rajhi Bank, Bank Al Jazira, National Commercial Bank and Samba) enjoyed improved revenues in 2011 over prior year.

At SAR 12bn total net revenue for the corporate segment was augmented by over SAR 3bn over the previous year. The growth rate accelerated sharply to 40% up from 8% in 2010 bringing welcome news to banks. Each of the twelve banks in the league table benefitted from improved net operating income as a result of improvement in revenue generation by some but more generally on the back of reduced expenses as credit provisions dropped sharply.

Analysis of the income associated with trade finance continues to be limited by the fact that the top 2 banks in trade finance (Riyad Bank and National Commercial Bank) bundle their letter of credit, guarantee and trade finance earnings with other income streams as does Al Rajhi Bank the leading Islamic trade finance bank. This means we cannot track the total overall market earnings from this important business activity. However we can deduce the overall growth trend in relation to trade finance by looking at the results of the nine banks who do report trade finance related fees in a segregated manner. The reported trade fees and commissions for the nine reporting banks reached SAR 1.747bn in 2011 up from SAR 1.527bn in 2010 and SAR 0.9bn in 2007. Earnings from the overall trade finance market in the Kingdom are conservatively estimated to be in excess of SAR 3bn.

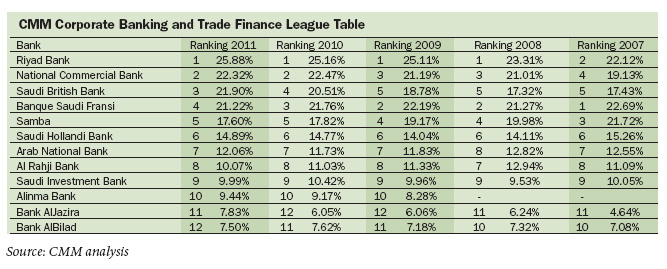

This year’s Tajara Monitor reveals that in 2011 Riyad Bank proved its staying power in trade finance and firmly held on to its lead position in the CMM Corporate Banking and Trade Finance League Table for the fourth consecutive year.

Whilst it has been challenged by other banks in different years to different degrees, it has broadened the gap between itself and its closest competitor National Commercial Bank. In 2011 it lengthened its leadership position to comfortably in excess of 3 percentage points. At the top of the table apart from Riyad Bank, only the Saudi British Bank improved its relative market-share and league table ranking in 2011, when it swapped fourth for third position with Banque Saudi Fransi. Banque Saudi Fransi, like Samba, lost relative market-share in 2011.

In the middle of the table, Saudi Hollandi Bank and Arab National Bank both improved their market-shares and maintained their rankings, whilst Al Rajhi Bank lost market-share but maintained its ranking.

Lower down, the Saudi Investment Bank maintained its ranking but lost market share. Alinma Bank continued to improve its share building further on its impressive start and Bank Al Jazira reversed the negative trend in its share and ranking to take over from Bank AlBilad in eleventh position.

The collective performance of the Islamic banks improved once again with the progress of winners such as Bank Al Jazira and Alinma Bank outweighing the attrition at Al Rajhi Bank and Bank AlBilad. Conventional banks are also increasing their focus on meeting the rising demand for Islamic corporate banking and trade facilities.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East