The ongoing market turmoil means that many local and regional banks are struggling to meet the increasinglysophisticated needs of their corporate clients, thus putting even the most established bank-corporate relationships at risk. DOMINIC BROOM discusses how a more collaborative approach to local and global bank partnerships could turn this situation around.

Working capital pressures combined with economic, market and regulatory forces are creating a shift towards increased fi nancial sector collaboration as an eff ective way to navigate the post-crisis fi nancial landscape.

While collaboration between financial sector service providers – particularly in its traditional forms, such as outsourcing – is a tried-and-tested method for local fi nancial institutions to overcome individual hurdles, dealing with today’s market challenges requires a more comprehensive and strategic partnership approach.

To say the least, banks – particularly many local and regional ones – are not having an easy time of it. The seemingly never-ending additional costs and work-load of regulatory compliance mean that keeping up with unprecedented corporate demands for local access to global-standard transaction banking solutions, which can deliver end-to-end transactional visibility and real-time data management, is nigh-on impossible. as a result, they run the risk of losing their local corporate business to global players and, thereby, becoming irrelevant in the world of global transaction banking.

New approach to partnership

The formation of collaborative partnerships between local and global banks could provide a viable way for the former to remain competitive, by gaining the ability to provide their corporate clients with the sophisticated solutions they need in a cost-eff ective and compliant manner.

Unlike existing types of partnership, which are oft en little more than a tick-box exercise in service provision, collaborative partnership refl ects the role that local banks can play in the modern working-capital cycle and can result in tangible value being created for all stakeholders involved: corporate client, local institution and global partner, alike. Th is value-driven model is important in today’s challenging market-place.

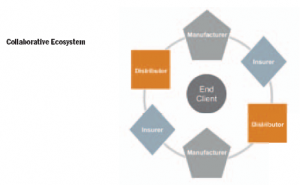

One form of collaborative partnership is what BNY Mellon calls the “manufacturer-distributor” model, whereby local institutions make use of the transaction capabilities and geographic footprint of the global “manufacturer” entity to leverage their home market knowledge and “distribute” treasury and transaction banking solutions that meet their domestic market needs.

The strength of this approach is that the emphasis on local knowledge – something that had oft en beenlost pre-crisis – means that it strives towards best-practice by being solutions-driven, which in turn requires taking a holistic approach to the needs of end-user clients, rather than being centred on “product-pushing”. as a result, the best of both worlds are combined to create real, ongoing value.

In order to gauge the appetite of the market for the manufacturer-distributor partnership concept, a recent BNY Mellon Treasury services white paper (Global transaction banking: evolution through collaboration) set out to determine the factors shaping treasury management today, the key drivers for partnership and the services or capabilities to be provided by a prospective fi nancial sector partner.

To this end, about 300 treasury services professionals across the Middle East, europe, asia Pacifi c and north american regions completed an online survey, and this data was combined with follow-up interviews and anecdotal evidence from regional roundtable discussions held in Germany, Turkey, Lebanon, dubai, spain and sweden throughout 2010.

In addition, nine country-specifi c observations (Germany, the Uae, Turkey, China, India, Japan, the Us, Canada and Mexico) were taken to evaluate both the current state of fi nancial sector collaboration in those markets and to assess the extent to which national regulatory and policy contexts support or hinder collaboration models.

The key research fi ndings were as follows:

- the availability of credit and the efficiency of credit management were identified as crucial points of concern across all surveyed regions

- a close second was access to market-leading and scalable technology

- ratings of the eff ectiveness of local treasury and transaction banking services providers indicate that local providers are seen as being most eff ective in providing payments solutions (according to 81 per cent of respondents), and least eff ective in providing solutions related to working capital management (as identifi ed by 49 per cent of respondents)

- fi ft y per cent of total corporate respondents rated their providers as “neutral” or worse in providing trade fi nance and foreign exchange

- from the bank perspective, 50 per cent of those surveyed indicated that their providers were “neutral” or worse in the provision of working capital management solutions, and nearly one third rated the provision of trade finance as “neutral” or worse.

It is clear from these responses that widespread improvement in the provision of solutions and services in all aspects of transaction banking is needed. Th e fi ndings also suggest that there is appetite across all regions to enter into partnerships as a means to adding value.

However, the enthusiasm for fi nancial sector partnership is not without some reservations – most notably competitor concerns. any local-global partnership will necessarily require high levels of trust, or a non-compete dynamic between the partners, which is largely missing from existing cost-driven outsourcing models.

More than a third of respondents to the survey noted that global institutions are increasing levels of competition in local markets, with more than 35 per cent stating that the impact was “great” or “significant”. Out of the total bank respondents, 86 per cent perceived a material level of impact by global institutions on the competitive landscape in domestic markets.

When assessing individual countries, it became clear that, rather than being the fi nal stage in the development of correspondent banking services, the manufacturer- distributor model marks a stage between a “single provider” market and a full-scale “collaborative ecosystem” of interlinked transaction services specialists.

Indeed, just as the manufacturer-distributor model marks an evolution from the modular outsourcing models, so it in turn can evolve into a full-scale, collaborative ecosystem of partners and clients, including members from outside the traditional finnancial sector. Th ere is no implication that any step in the collaboration spectrum is “better” than the other, rather it is a case of which level is optimal in a given market under current conditions.

Indeed, just as the manufacturer-distributor model marks an evolution from the modular outsourcing models, so it in turn can evolve into a full-scale, collaborative ecosystem of partners and clients, including members from outside the traditional finnancial sector. Th ere is no implication that any step in the collaboration spectrum is “better” than the other, rather it is a case of which level is optimal in a given market under current conditions.

- Turkey’s strategic position of infl uence in the Middle east lends itself to partnership. as it is an expanding market, with some local banks strugglingto meet the increasingly international needs of corporate clients, the advantage of collaboration models are clear. as a result, the market is likely to shift from conventional outsourcing to some variation of the manufacturer-distributor model

- the Uae exhibited a degree of partial outsourcing, though this is a relatively new development. however, as commercial activities continue to diversify (geographically and in terms of sector) and end-user client requirements develop accordingly, there may be a shift towards greater fi nancial sector collaboration

- though China was found to be at the level of single provider at present, the scope of activity of Chinese businesses in international markets will drive rapid movement towards more advanced collaboration models

- in the Us, various models of collaboration are wellknown and currently in practice. This suggests a level of readiness to develop models in the range of multilateral ecosystems.

Certainly, any collaborative partnership model – whether the manufacturer-distributor or collaborative ecosystem – should be based on shared values between organisations, and should result in increased value across the transaction cycle as well as full transparency and maximum effi ciency for end-user clients.

The prevalence of technology means that it does not act as a diff erentiator in itself between service providers – it is only when it is combined with a meeting of minds and an understanding of end-customer needs that partnerships are a true success. Organisations that can see the value in this client-centric approach, and are prepared to be broad-minded in terms of their business development, are those that will be the successes of the future. For more information, visit: bnymellon.com/treasury Dominic Broom is managing director and head of market development for BNY Mellon Treasury Services EMEA.

The views expressed herein are those of the author only and may not reflect the views of BNY Mellon. This does not constitute treasury services advice, or any other business or legal advice, and it should not be relied upon as such.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East