SMEs are having a hard time of it because of the financial crisis and credit squeeze. LIZ SALECKA looks at their problems in accessing short-term bank finance

Across the Gulf States, the financial crisis and resulting credit squeeze have had major implications for mid-market companies and small-to-medium sized (SME) family-owned businesses, which have since found it much harder to access short-term bank finance to fill any gaps in their cashflows.

This has put pressure on company finance managers and treasurers to manage cash resources more effectively and ensure adequate levels of working capital to keep their businesses running smoothly. However, while many companies have been able to turn to family and business connections for capital injections when needed, there has also been a movement towards longer payment terms to address cashflow imbalances.

For SMEs in particular, the credit squeeze has proved particularly testing because many banks are now basing their lending decisions on companies’ financial standing – and are more focused on meeting the needs of their larger corporate clients.

“Although banks in the region are now more liquid, they have continued to pick and choose the companies they want to lend to,” explains Haytham El Maayergi, head of transaction banking, UAE, at Standard Chartered Bank. “As a result, smaller businesses may seek to raise capital from relatives or family.”

He add that another option open to them was to approach other sources such as export credit agencies, which can support banks in the provision of long-term funding to businesses.

The extent of the dilemma facing SMEs is confirmed by Dubai-headquarted Al Jowder, which since it formation in 2005 has grown into a leading provider of support services and products.

Stringent criteria

Syeba Razwi, financial manager, Al Jowder, explains that the biggest issue SMEs face is that banks’ provision of credit facilities is now based totally on the strength of a company’s balance sheets.

“It is a very difficult situation for most SMEs nowadays, and you need to have high credibility to get a loan. Banks are first and foremost asking to see companies’ financial documents and the assets that they hold,” she says, pointing out that Al Jowder has not yet discussed any form of receivables financing with its banks.

“For companies with an established business, the situation is not too bad. But for those companies that are finding it hard to get business in, they are really struggling financially,” she continues. “Generally, a lot of mid-market and SME companies are now closing down because of this situation.”

However, at Banaja Holdings, a leading pharmaceuticals, consumer healthcare, medical and logistics company, based in Jeddah, Aiman Hamadallah, vice-president finance Aiman Hamadallah believes that bank finance is becoming easier to obtain – both by mid-market corporates and SMEs – although banks are still placing a strong emphasis on credit ratings and the provision of financial information.

“After the tight credit market in the last two to three years following the economic crisis, banks have gradually eased their reluctance to lend – especially to the mid-sized firms and SMEs, which cannot leverage as much as the ‘big name’ companies,” he says. “Depending on the borrowing purpose and the company’s credit rating, mid-sized establishments and SMEs can approach many local banks to provide them with specific types of facilities.”

And he adds: “It helps to have a good track record with the banks and to provide complete financial information.”

The situation faced by many SMEs across the Gulf States has also been eased by that fact that many larger corporates have recognised the challenges their smaller suppliers face and are now actively offering them cheaper financing, based on their supply chain relationship.

Large anchor companies in supply chains, which have easier access to bank facilities at better terms, are starting to use the provision of credit to their suppliers as a marketing tool.

“If a supplier wants to access funding, it can approach the anchor company, which then asks its bank to lend funds. The anchor company then offers finance to the supplier at a lower rate than it would have been charged by the bank directly. This is an arbitrage situation in which a big anchor company is passing on benefits to its suppliers,” explains El Maayergi. “A lot of local companies in this region are small – but for those that are hooked to an anchor company credit can be easier to obtain.”

For many mid-market companies, the credit squeeze has also brought challenges, and led to major changes in the way they manage both their cash and working capital.

A series of workshops held for local companies in Gulf States including Dubai, Bahrain and Qatar recently revealed that local treasurers’ priorities have changed significantly since the financial crisis, and that managing cashflows more effectively, supporting smaller suppliers, and mitigating counterparty risks are now their key objectives.

“In the past when treasurers had a gap in their working capital, instead of looking at what had gone wrong, they simply took out an overdraft or a short-term loan. Now they need to go through their working capital piece by piece and consider lengthening payment terms or shortening receivables terms to make sure they are self-financing,” says El Maayergi. “The key buzzword today is freeing cashflows. The other thing that is high in most treasurers’ priorities is being able to forecast their cashflows so that their working capital is more predictable.”

In line with this, many local companies are also starting to recognise that they must unlock the cash tied up in both their receivables and inventory to fuel their business operations and growth – and are approaching their banks for solutions, which will help them to achieve this.

Banaja Holdings is a key example of a company that uses receivables financing to not only fund its business operations, but also to pay suppliers promptly and offer its own customers more time to meet their commitments.

“Receivables financing improves cashflows by providing an immediate source of capital for operations and enables a company to reduce payables and pay down debts earlier, without having to wait for collection or payment. By paying suppliers early, it can also avail us with cash discounts,” explains Hamadallah. “It also gives increased flexibility to extend payment terms to customers – which can translate into more sales.

“A good example is receivables discounting facilities arranged to liquidate large government and institutional receivables for sales of pharmaceutical goods, healthcare and medical supplies.”

He, nevertheless, points out that receivables financing can be harder to arrange than short-term bank facilities as it requires greater security, more documentation, more negotiation and closer monitoring.

Although global banks have led in the provision of structured financing, local banks such as the Saudi British Bank and Abu Dhabi Commercial Bank are developing products that leverage on working capital. This is a welcome move for many local companies, which to date have not found that the same facilities are as readily available to them from global banks.

“Structured financing from global banks is difficult for SMEs and mid-sized companies because of the stringent terms and conditions imposed on them,” concludes Hamadallah.

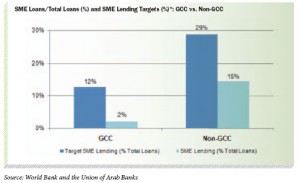

GCC lending to SMEs is at a low

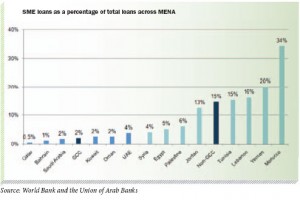

SME lending is particularly low in Gulf Cooperation Council countries, accounting for only two per cent of total lending in comparison to 14 per cent in non-GCC countries, with the lowest levels witnessed in Qatar (0.5 per cent), Bahrain (one per cent), Saudi Arabia (two per cent), Kuwait (two per cent) Oman (two per cent) and then UAE (four per cent).

Moreover, SME lending as a percentage of total bank lending in both GCC and non-GCC countries is well below banks’ own targets of 12 per cent and 29 per cent respectively, according to a major survey conducted by the Union of Arab Banks and the World Bank.

The survey, which followed World Bank findings that only 20 per cent of SMEs in the MENA region as a whole have a loan or line of credit from a financial institution, also revealed that:

- banks consider a lack of SME transparency and weak financial infrastructure, such as a paucity of credit information and poor creditor rights, as the main obstacles to offering SME finance

- state-owned banks play an equally important role in SME lending, and are less selective in their strategies when offering finance. They have a lower ratio of collateralised loans to SMEs but a higher share of investment lending

- programmes to induce banks to lend more to SMEs, such as exemptions on reserve requirements, credit subsidies and partial credit guarantee schemes, have helped to promote SME lending.

“Strengthening credit information systems and creditor rights should remain a priority item and while credit guarantee schemes may play an important role, it is essential to ensure that these schemes are well-designed and cost-effective,” explains Roberto Rocha, a member of the World Bank in MENA, and the report’s author.

“Allowing the entry of international and regional banks showing leadership in SME finance can also improve competition and produce positive direct and indirect effects in the market for SME lending.”

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East