When it comes to international business, MENA is punching below its weight. MELANIE LOVATT looks at why that is and what could be done to correct the position

MENA countries have furthered their integration into the global trade system over the past decade, but they still have considerable work to do to improve their position. Of course, crude oil is by and large the region’s calling card to the rest of the world, and helps open doors for other products and services. But in trade terms it is punching below its weight and many impediments remain. With the right initiatives, some of these could be swept away quickly. But there are also deeper-seated problems that will be more difficult to fix.

Some of the region’s countries have yet to become members of the World Trade Organisation (see table) and the GCC has still not concluded a free trade agreement with the EU, which is its biggest trading partner (trade between the two climbed to €145bn in 2012). Algeria, Egypt, Jordan, Morocco and Tunisia hold Euro-Mediterranean association agreements with the EU, but Lebanon and the Palestinian Authority are party to an interim agreement, and Syria to a co-operation agreement.

Progress needs to be made not simply to facilitate trade outside the region, but also to overcome barriers to trade between MENA neighbours. An Arab customs union is set to go live next year, and a full common market is planned for a 2020 rollout. This has the potential to create an EU-style bloc. But the fact that the GCC customs union has yet to be fully implemented after years of haggling does not bode well for wider integration. The GCC union is a vital first step in removing double customs duties which are keeping a lid on many transactions – especially in the field of e-commerce. “For many Arab countries, regional trade accounts for less that 10 per cent of total trade,” World Bank experts told Cash&Trade (see World Bank Q&A article on page 14).

Kheireddine Ramoul, at UNCTAD’s Trade Negotiations and Commercial Diplomacy Branch, Division on International Trade in Goods and Services and Commodities, notes that while some countries that recently joined the WTO, such as Saudi Arabia Oman, Jordan and Yemen, had to go through extensive trade and economic reforms to meet accession requirements, some that were already members and those which are still out of the WTO system, seem to be reluctant to introduce any significant changes to trade, finance and banking systems.

While civil unrest has been an impediment in some cases, there has also been a lack of external pressure and incentive, he said, noting that his views are his own, and do not necessarily reflect UNCTAD’s official position.

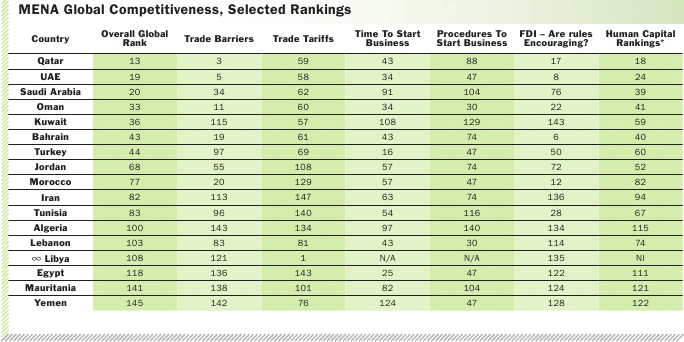

Trade barriers and trade tariffs are harming MENA countries’ global competitiveness and while some countries have shown considerable improvement in this area, there are many laggards in need of urgent reform. Of course, for some tackling this problem will have to wait.

Egypt, which is in the throes of political change, and Iraq, which is beset by sectarian tensions, will need to address security issues before trade reform takes its place on the agenda. The same applies even more so to Syria, which is ravaged by civil war and subject to international sanctions.

High hopes for AFTIAS…

But for MENA countries not subject to political upheaval, trade reform needs to take centre stage. “While MENA’s economies have great (international and intra-regional) trade promise, insufficient regional and global integration have restricted the region’s economic growth, resulting in fewer employment opportunities, and unfulfilled potential,” explained Dominic Broom, head of sales and relationship management, BNY Mellon Treasury Services, EMEA.

Mellon Treasury Services, EMEA

“Efforts to align policies and tariffs can serve to remove physical and economic barriers to trade, allowing the region to become more competitive and, in turn, attract inward investment and create jobs and wealth,” he adds.

A step in the right direction was taken when the Aid For Trade Initiative For The Arab States (AFTIAS) was set up. Officially launched in November 2013, it aims to enhance trade and economic co-operation amongst the Arab states while at the same time generating more jobs.

The project will mobilise additional resources in order to focus on employment for women and the region’s growing young population. “AFTIAS also intends to review and assess areas in which there is the possibility for investment and growth, including transport, energy, communication and pipeline infrastructure, much of which is very poorly integrated at regional level,” notes Broom. He points out that trade in services is also a potential growth area – in MENA and internationally – and it is expected that AFTIAS will include plans to promote this burgeoning area of opportunity.

Broom believes that a focus on breaking down the barriers that hinder the physical movement of goods would help the region’s domestic markets to move goods more freely across borders. “Physical inter-connectivity can be difficult in the region (particularly since the Arab Spring), a fact that can be exacerbated by complex border controls, and limited ground transportation infrastructure. Poor co-ordination between bordering countries can also create shipment delays,” he adds.

AFTIAS aims to corral resources from an array of agencies, and there is hope that this “all hands on deck” approach will yield results. It is being implemented by the Saudi Arabia-based Islamic Development Bank (IDB), its trade unit, the Islamic Trade Finance Corp (ITFC), five UN agencies (UNDP, ITC, UNCTAD, UNIDO and ILO), League of Arab States, GCC, Agadir Technical Unit and Maghreb Arab Union, and seven donors (Saudi Arabia, Kuwait, Egypt, and Sweden, in addition to the UNDP, IDB, and ITFC).

Governed by a project board composed of the donors and implementing agencies, it is chaired by the ITFC’s CEO, Waleed al-Wohaib. At its launch he explained that AFTIAS aims to attract both technical and financial support from international financial institutions and donor countries in order to enhance trade capacity.

The ITFC itself was set up as recently as 2008 to consolidate the IDB’s trade financing activities under a single unit. It has deployed public and private funding, and technical expertise in Shari’a compliant trade finance to businesses and governments in countries that are part of the Organisation of Islamic Co-operation (OIC) of which MENA countries are members.

For example, in July last year it provided a $358m Murabaha financing facility to help Jordan’s national electricity company purchase crude oil and petroleum products. Of this amount, $200m was syndicated to 16 banks and financial institutions. The transaction helped reduce the government’s arrears to Jordan Petroleum Refinery Company.

Since it was started ITFC has provided $18bn for trade finance, and total number of transaction approvals have reached $28bn. While the ITFC can consider all types of Shari’ah compliant trade financing, it says that the most widely used are Murabaha, instalment sales and Istisna’a. It is looking at using more methods in the future, including leasing, Bai Salam, Wakalah and Ja’ala.

Initiative starts to stutter…

Unfortunately, AFTIAS already appears to be running into problems. UNCTAD’s Kheireddine Ramoul comments that there appears to be a lack of political will and commitment from some donors. He says that the UN agencies have fully cooperated and supported the AFTIAS, completing all the required technical work and then submitting this plan for its adoption in November last year.

At that point, an agreement was reached to start implementation on 1 January this year on a “fast track modality” to give a number of “quick wins (deliverables) during the first phase, which lasts through 2014. “But so far,” says Ramoul, “the allocation of the necessary funding to the respective agencies was not effected.” He complains that no activity was launched as planned, and reveals that the whole initiative is now in “stalemate.”

If they do get it moving again, the ITFC and the other organisations that are supporting the new AFTIAS initiative have their work cut out for them. “AFTIAS comes at a time when most Arab states are undergoing challenging geo-political and/or socio-economic transitions, and difficult in-country circumstances may dampen optimism and hamper the initiative’s momentum, despite its great intentions and significance,” said Dominic Broom.

Slippage by oil importers

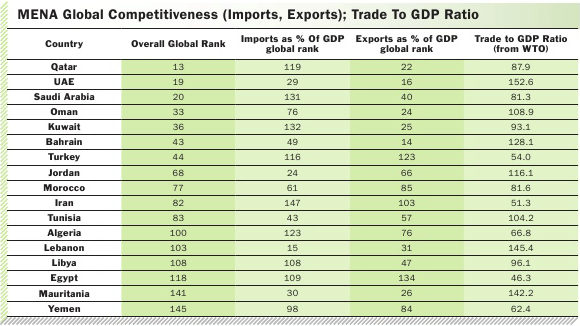

Trade tends to be more restricted in the countries that are not supported by petrodollars. “Trade has not been a significant engine of growth in the MENA oil importers,” warned the IMF in its November 2013 Regional Economic Outlook: Middle East and Central Asia. “The ratio of exports to GDP is significantly below the average for emerging markets and developing countries and the gap has widened,” said the report. It noted that trade patterns, particularly in North Africa, remain oriented toward Europe, and the region has “benefited little from the high growth of emerging markets”.

Although some countries, such as Lebanon, have relatively low tariffs, or have taken steps to lower them (such as Morocco and Tunisia), the region’s average tariff remains high, said the IMF (see Global Competitiveness table). The fund said that the transition towards higher value-added exports has been slow, in part due to low foreign direct investment (FDI). But the gains to be made from deeper trade integration are considerable. It asserts that raising the MENA region’s openness to the level of emerging Asian countries could increase GDP growth by as much as a full percentage point.

Too many partial agreements

A World Bank working paper on Assessing MENA’s Trade Agreements published in August 2012 also identified problems. It said that while intra-regional agreements are estimated to perform about as well as standard trade agreements, those with the EU, US and Turkey have typically done less. The paper cautions against “more of the same” noting that the EU-MENA and US-MENA agreements that are in force have in practice had a marginal impact.

There are “too many overlapping and partial agreements and this ‘spaghetti bowl’ will serve as a distraction of scarce trade negotiating resources”, said the paper. It concluded that regional integration can help MENA countries stimulate trade and investment, but that the largest gains are likely to come from domestic reforms.

Jomaih & Shell Lubricating Oil Compan

Imran Ahmed, CFO at Al Jomaih & Shell Lubricating Oil Company, based in Saudi Arabia, agrees. He believes that while tackling trade barriers is important, changing the underlying business environment will bring the biggest pay-off. He commented that within MENA many entrepreneurs want to make easy money by trading goods, rather than invest in the technology and expertise to produce high-end products that can be exported. Those with considerable hydrocarbon wealth are not fully capitalising on a big advantage – their low energy costs.

Gulf countries, and particularly Saudi Arabia, have tried to add value to their exports by moving further “downstream” the energy chain and manufacturing petrochemicals and plastics. But often these efforts are driven by large government-owned companies and SMEs are not fulfilling their potential as exporters.

The banking system needs to provide better support to entrepreneurs, which would help grow trade volumes, said Ahmed. He commented that in Saudi Arabia, for example, banks tend to extend workable trade credit to big companies, with SMEs often overlooked or charged much higher rates.

With respect to banks, the high concentration of global banking providers in the GCC countries – where there has been an abundance of investment opportunities – has inadvertently given rise to a significant gap in regional banking technology sophistication, says Dominic Broom.

“Collaborative unions between the region’s indigenous banks and global operators could help to bridge this gap,” he notes, pointing out that “as a result, local banks will be in a stronger position to support the uptick in trade that AFTIAS hopes to spark.”

In MENA borders are not the easiest to cross, and there is a lack of clarity on regulations, so if trade agreements like AFTIAS can change the duty structure and promote technology within MENA it will be on the right track, he asserts.

“It’s a good initiative and it could have an impact at the macro level, but the underlying business environment needs to be right in order to support trade,” he expounds.

Regarding trade reforms in 2014, he said, “It has to be noted that several countries that recently joined the WTO (KSA, Oman, Jordan and Yemen) had to go through extensive trade and economic reforms to meet the WTO accession requirements. Others that were already original Members of the WTO and those which are still out of the WTO system, seem to be reluctant to introduce any significant changes in their trade, financial and banking system.

“There appear to be several reasons for this, including, among others, the on-going political circumstances and a lack of external pressure and incentives. Regional trade integration efforts have also, so far, failed to induce any meaningful reforms for almost the same reasons.”

So whether AFTIAS is able to fulfil its objectives, or becomes just another strand of pasta in the bowl remains to be seen. The initiative is only just being implemented. While hopes are high that a multi-agency approach will make a difference, there is still much for the governments of each country to do in order to foster the right environment for the free enterprise that will not only help grow GDP, but add to the list of products that can be exported. n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East