As an up-date to a previous article about factoring, Cash&Trade decided to canvass opinion from the leading factors in MENA during what, arguably, has been the worst period of turmoil that the financial sector has seen for many years. Caroline Maginn, Cash Management Matters -CMM Trade Partner, reports

Far from collapsing, the factoring market has been resilient through the downturn and started to pick up visibly again this year within the MENA region

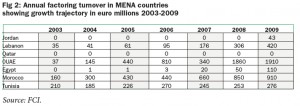

The growth has been particularly notable in the UAE. Dubai-based factoring companies have seen doubledigit growth this year on turnover and some reported growth throughout 2008 and 2009. This is very encouraging for corporates, which are increasingly accessing factoring to grow their trade and minimise the capital required to support it.

This growth is in spite of the fact that banks generally were under pressure to reduce assets and also that companies’ trade activity dipped in 2009 as they de-stocked given concerns about the overall economy.

Corporates have been able to use factoring to access finance earlier in the operating cycle and have been able to offer extended terms to clients on the back of factoring. This has helped them to trade more flexibly and to accommodate buyers during the downturn.

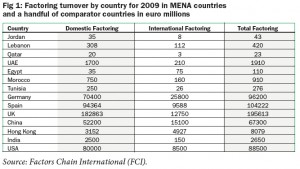

Overall, there is evidence of the market deepening and maturing to meet longstanding expectations and forecasts in the UAE. For example, factoring turnover reached just short of €2bn in 2009 and our forecast for 2010 is for further growth.

Generally improved experience and awareness in the market, as a result of the rising number of banks getting involved in factoring, has contributed to the growth.

It is worth noting that factoring, together with other trade receivables based finance, has been favoured for approval by banks over unsecured facilities such as overdraft or term loans. Generally, factors have found their portfolio quality has held up and that turnover is flat to increasing – so they are looking favourably at new business.

A further consideration is that factoring is largely driven by companies’ turnover and is not just a function of banks’ risk appetite. Sales activity at the latter is picking up again as market confidence is returning and companies are re-stocking to meet demand.

Market growth has been driven in part by diversification of export flows, such as the re-exports to other GCC countries, where companies are keen to sell on open account terms.

While companies may prefer the flexibility of overdraft, factoring is a welcome tool for liquidity, which can get more readily approved during times of tight credit. Hence the prospects are good, with a rise in turnover already in evidence in the year to-date and an increase in the number of clients.

The outlook is positive in the UAE, Bahrain, Oman and Qatar. Egypt is identified by many as a market with significant potential and Saudi Arabia could contribute exponentially to the overall market growth but has proven more problematic than some of the other MENA countries given a perception of regulatory hurdles and market practice.

It is worth noting that demand for a sharia’h compliant factoring offering is gathering pace. This is already reflected in the deal flows of some factors as factoring does, intrinsically, lend itself to sharia’h compliance if structured correctly.

Market practitioners – including CMM – long predicted a growth in factoring within the MENA region to mirror the trajectory in Asia and the broader acceptance of factoring there, as well as among the other main trading partners of MENA in the Americas and Europe, where in factoring is long established. It has now proven itself a useful tool either for importers or exporters wanting to trade on open account terms.

Sectors for whom factoring is most applicable include textiles, food products and electronics. Further, the range of small to very large companies is significant. Turnovers of companies using factoring range from one million dirhams to in excess of one billion and factors find that companies now approach them. So the learning curve for companies is shorter as market knowledge has deepened. Companies are at the sharp end, tend to have long memories and are increasingly risk adverse; hence demand for the risk mitigation supported by factoring will continue to grow.

Basel II will also kick in to have a positive effect when, subject to regulatory approval, banks may migrate to an internal ratings based approach that recognises the built-in credit enhancement in factoring and the sometimes favourable credit arbitrage between a company selling and its buyer(s).

Factoring, it is forecasted, will outpace the market growth in general financing of exports.

However, making the transition from more traditional trade terms requires a paradigm shift for companies, their banking partners and their buyers or suppliers, so it does not happen overnight and requires up-front investment of time and effort.

Still one of the biggest impediments to factoring is that companies resist the need to disclose the assignment of the receivables to their buyers, ideally for acknowledgement, to access without recourse factoring. However, times are changing as, demonstrably, both very large and small-to-medium sized businesses use factoring. There is a growing awareness that using factoring does not indicate that the seller has financial problems; hence the objection to disclosing assignment to buyers will diminish over time.

A further hurdle for companies to overcome is the outsourcing of collections. They prefer factors to call them in the event of delays and up to one out of two companies like to make at least the first call about late payments to buyers and ask the factor to notify them to handle this through their existing internal collections department. Factors often will accommodate this preference and understand it.

Factoring is a real partnership between the factor and the companies that it serves. Overly aggressive management of the collections process is not in the interest of a company wishing to maintain a good relationship with his buyers nor in the interest of the factor, which ultimately wishes to see the seller increase his turnover whilst benefiting from an orderly management of debts owed.

Seasoned factors recognise that a late receivable is not always a bad debt and, together with the companies they serve, they seek to recover debts whilst maintaining good relationships with the buyers where possible. By supporting extended payment terms in the first place, factors, like sellers, are recognising the period that buyers need, realistically, to effect payment.

Governments within the GCC have, importantly, also started to contribute to the market growth by acknowledging the assignment of receivables. This trend, if it becomes more widespread, will further contribute to growth.

Factoring is not the same as traditional banking as industry practitioners will be at some pains to explain. Indeed, if banks don’t understand the differences and set up their credit approval process and factoring operations and train their clients to take account of this, they are at best unsuccessful, and in the worst case expose themselves to loss and misrepresenting to clients what they can do for them. Clean loans against, supposedly, a bunch of invoices with no built in due diligence on or policing of payables performance is the biggest spoiler of the market and bad for everyone in the long run.

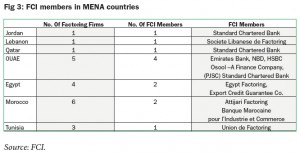

The roster of members in Factors Chain International within the region has grown but there are significant differences in the volume of business between the more seasoned companies that have committed the needed resources to develop factoring as a complementary offering to traditional trade products and the lesser ones that have dabbled in the market.

Companies should satisfy themselves that they are dealing with the seasoned factors and take comfort from, rather than be put off by, the due diligence that those doing it properly will undertake.

Seasoned practitioners have found the impact of initiatives parallel to factoring (eg credit insurance via private insurance companies such as Euler-Hermes, COFACE and Atradius and government backed export credit agencies such as ICIEC) very positive to the market. Credit insurance is found to be very complimentary to factoring and a great enabler of without recourse factoring, as reflected also in the article on ICIEC in this edition of the magazine.

The existence of underwriters on the ground within the region adds greatly to knowledge and transparency when it comes to buyer payment histories and creates depth of risk capacity in the market. The depth in the credit insurance market is returning, which is a boost to the overall trade finance market. Some factors have preferred partners when it comes to financing receivables that are insured. When it comes to deciding on whether or not to use factoring the experience in the market is that accessing finance is the key driver. But in recent times companies have been valuing credit protection and more generally the control and due diligence on their buyers that factoring collections services give them over their ledger and this has been much appreciated during the recent credit crisis. Owners like the control and transparency that factoring gives them over their sales.

With smaller, less sophisticated companies finance is the key with the value of collections and credit protection being valued by larger companies. SMEs, who may be thinly capitalised, value the source of liquidity that factoring affords them.

Factors’ experience of setting up in the business varies from company to company but generally factoring is arranged as a discrete and dedicated activity by the major banks either as a separate group within the corporate bank (sometimes under the transaction banking umbrella), or in a separate but partially, or fully owned, subsidiary.

Within the region, there has been a tendency so far to centralise activity in Dubai with satellite coverage in other markets such as Bahrain and Qatar. On the whole, the number of people involved has been stable or growing although sourcing sufficiently skilled resources has proved difficult with factors having combined strategies of recruiting staff from the early entrants to the market, importing talent from overseas and growing their own skills internally. Factoring generally attracts specialists or people with some trade experience who want to become specialists and are attracted by the varied nature of the product and customer requirements and the resulting mental stimulus.

Given the volume of work in managing the factoring business, all major firms have deployed IT frameworks to automate the flow as far as possible to improve speed and accuracy and ensure transparency on the status of receivables at all times. Some firms have deployed third party systems and others have implemented proprietary systems, sometimes those used by other parts of their network overseas.

Overall, factors in MENA have invested time, effort and money into putting the right resources in place to deliver a high quality service. Competitively, as a group, they have come a long way since the market started and are considered favourably to many of their peers in Asia and other more mature markets. When all is said and done, more companies in the region are now seeing the benefits of factoring to support their sales activity whether domestically or internationally. Prospects for further growth are strong and well founded.

Our thanks to Peter Ball of HSBC, Sharad Agarwal of Emirates NBD and Jeroen Kohnstamm of Factors Chain International, who contributed their insights into factoring in the region to this article.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East