Should the Middle East refocus attention on markets in Europe and the Americas, or continue to explore opportunities in

relatively new markets in Asia? ALEXANDER R. MALAKET, CITP, reviews developments in the trade activities of businesses in the Middle East at a time when some world economies have all but regained pre-crisis growth rates, while others continue to struggle against serious difficulties.

The answer to the “markets” question opposite is neither. But the time is right for a conscious and decisive setting of direction in terms of international business and trade priorities in the Middle East, and there is only limited time in which to set the optimal course.

The global balance of power is shifting, as is its nature, and trade and financial leverage is equally evolving to reflect the current realities of the international economic order.

Canada was an early proponent of efforts to acknowledge these realities in promoting greater international engagement at the level of the G-20 as a means of giving due voice to the interests and concerns of a broader group of stakeholders than represented in the G-8.

Such initiatives, coupled with the necessarily wide-ranging consultations related to the handling of the global economic crisis, reflect the shifting currents shaping the international political and economic order.

This is not to suggest that traditional powers have lost their opportunity for leadership, or that nations that, perhaps, enjoyed disproportionate influence in world affairs must be resigned to secondary roles in the future. However, it is to say that a passive attitude, or a wilfully blind assumption that the status quo will endure, is at best impractical and, at worse, negligent.

enjoyed disproportionate influence in world affairs must be resigned to secondary roles in the future. However, it is to say that a passive attitude, or a wilfully blind assumption that the status quo will endure, is at best impractical and, at worse, negligent.

In this context, regions and economies characterised by a range of situations – from the challenges of emerging markets to the potential linked to great wealth, such as the Middle East – must carefully assess and balance the realities of history against the potential in a changing global reality.

The arguments

While for a variety of reasons some might argue that businesses and political leaders in the Middle East and North Africa would be well served to shift their attentions East, away from colonial links and what some perceive as an unbalanced engagement with the Americas, others argue with equal conviction that those very connections, however imperfect, offer the best option for the foreseeable future.

Is it truly a question of choosing one over the other? The global crisis has shown beyond doubt that leading economies in Asia – including the “Two Titans”, China and India – have fuelled the momentum of recovery, being largely responsible for global growth forecasts of about five per cent in 2010, ahead of the IMF’s estimates, which were just over four per cent for the year.

The development of stronger regional trade flows in Asia, the Middle East and Africa is one outcome of the crisis, and a further indication of shifting currents in global business and economics. Bankers and finance executives in the Middle East reacted with some surprise as American and European officials sought to direct corrective measures on a global basis, after, as one executive in the Levant noted, “those cowboys got us all into this mess!”

Likewise, the positive profile gained by the disciplines and processes of Shari’a-based Islamic finance served as one among numerous indications of the importance of focusing on the fundamentals in banking and finance.

Islamic finance

The burgeoning interest of non-Arab and non-Islamic organisations and institutions in the opportunities related to Islamic finance, are, perhaps, a reflection of potential for greater engagement within trade and commerce across familiar borders and also those borders where pre-crisis levels of engagement were limited.

Thought leaders in international trade have for several years been noting a particular trend in international trade: the closer connection between import, export and foreign investment – both inward and outward.

While trade promotion specialists will recognise the debate about whether investment follows trade, or vice-versa, proponents of a view referred to as “integrative trade” suggest that global sourcing patterns are now such that exporters are often importers of components to be included in their final products, and that the relationship between trade and investment is now far less linear than might have been the case historically.

are often importers of components to be included in their final products, and that the relationship between trade and investment is now far less linear than might have been the case historically.

The integrative trade view links well with the activities of sovereign wealth funds (SWFs)in the Middle East and Asia – whether we consider the cash-rich SWFs in China, the United Arab Emirates, Saudi Arabia or elsewhere. The search for investment opportunities, and the drive – certainly in leading economies in the MENA region – to expand business to non-petroleum sectors, these dynamics together tend to argue in favour of maintaining existing commercial ties, while concurrently pursuing linkages in new markets in Asia and beyond, particularly for non-fuel goods and services.

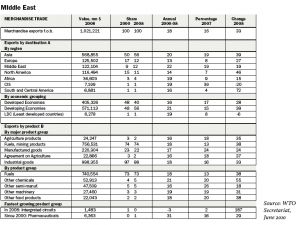

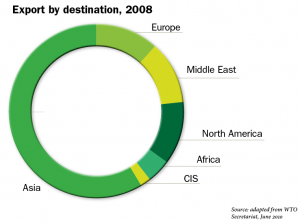

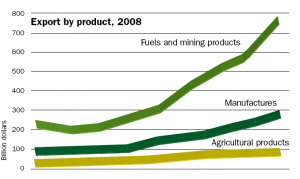

As illustrated below, Asia already accounts for a majority of exports originating from the Middle East – nearly 50 per cent of which are related to fuels and petroleum. However, intra-regional exports were significant in 2008, comparable in volume to exports to Europe and North America.

New opportunities

Central and South America, not traditionally markets targeted by businesses in the Middle East, present an opportunity in terms of growth related to nonpetroleum trade. Brazil is flexing its increasing regional and international influence, and Mexico is actively in search of new international linkages, as a counterweight to on-going challenges in the United States – a major trading partner under the North American Free Trade Agreement.

From the perspective of commercial and trade strategy, particularly given the strong desire of leading economies in the Middle East to diversify activities from petroleum-based exports, the imperative must be to develop new combinations of exportable goods and services with new target markets, while continuing to generate critical revenue flows through petroleum and petrochemical exports.

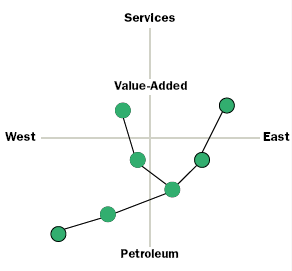

The trade and investment model that will best serve the Middle East will involve a two-pronged focus across two dimensions: continued development of petroleum export markets, targeting both traditional and new clients, together with a shift to non-resource, value-added export activity, again targeting traditional and non-traditional markets.

The development of the services sector, including the degree of export success in services, has for some time been a proxy to measure the degree of development of an economy and its trade focus. However, the global crisis has brought into sharp focus the advantages and value of “making things” – the critical importance of a healthy manufacturing sector and the need to be effectively engaged in “the real economy”.

In that context, while a push to develop service export capabilities is both necessary and desirable, economies in the Middle East are likely to benefit also from continuing – if selective – focus on “real” and value-added exports as a core element of a trade development model.

Geographically, those activities ought to target traditional markets in Europe and North America, as well as long-established trade relationships in India and elsewhere, while continuing to develop ties with China, and initiating a more robust engagement with selected markets in South America.

In addition to ongoing efforts to develop domestic capabilities – by supporting and enabling “champion” companies and industry sectors, and by continuing to support the development of local expertise and human resources – leading economies in the Middle East will benefit from a purposeful focus on the financing dimension of international commerce.

Along with a shift in sourcing and trading patterns, the global crisis has engendered a level of focus and attention on trade finance unlike anything seen in decades, if at all. One outcome of this unprecedented attention, and the liquidity crisis that underpins it is the return of trade finance as a competitive advantage in international commerce.

Historically, the ability of exporters to structure and propose competitive financing packages was a significant advantage and a powerful differentiator. In recent years, though, with inexpensive and easily obtained credit, exporters across the globe found that a financing package was assumed by many buyers to be part of the value proposition.

Re-focused finance

Under current conditions, trade finance is not only refocusing on its capabilities in risk mitigation, but also regaining its place as a competitive advantage. This is occurring in many markets, from developing and emerging economies, to those that are developed, and in a wide variety of industry sectors – from commodity trade to capital projects, to perishables and beyond.

While some economies in the Middle East are faced with a disproportionate influence wielded by non-local financial institutions and providers of trade finance, the crisis has highlighted the importance of a strong and healthy regional financial sector, as several nations impacted by the withdrawal of foreign institutions would attest.

Trade financiers in the MENA region must maintain capabilities relative to the use of traditional trade finance instruments and mechanisms such as documentary credits, while investing in the ability to transact on the basis of emerging supply chain finance programmes and various solutions related to open account trade.

The increasing acceptance of technology platforms and solutions around international banking, together with increasing integration with, and engagement in, the global financial system combine well to set an important foundation for the evolution of trade financing options in the Middle East and in North Africa.

Having acknowledged the importance of transparency, and worked to advance disciplines related to financial analysis, credit adjudication and regulatory regimes, the region is well-placed to support a tradebased recovery, in part, through effective combinations of trade financing solutions and capabilities.

The central role of export credit agencies in supporting and enabling trade finance has been widely acknowledged over the past two years, as has the critical role of international financial institutions such as the World Bank/IFC and the various regional institutions.

The African Development Bank established its trade finance programme relatively recently, and the Islamic Development Bank, through its affiliate, the International Islamic Trade Finance Corporation, has provided a range of solutions in support of intraregional trade, and enhanced commercial relations among member states.

Trade support

The role of such institutions as the export credit agencies in support of trade, and in enabling trade finance, has been of fundamental importance in many parts of the world – including the Middle East.

While certain programmes are aimed at banks and other providers of trade finance – in the form of riskmitigating guarantees – it is important for businesses to be well informed about the solutions available through these entities. Such programmes can make financing available in markets, or under conditions, where funding on pure commercial terms would be onerously expensive or simply impossible to obtain.

As businesses take a strategic view of international trade and think innovatively about the sectors – and the markets – where trade opportunities can be developed and made commercially viable, the contributions of effective trade finance and risk mitigation programmes provided through international financial institutions can be extremely valuable – and costeffective – as a means of securing necessary financing.

By extension, these programmes can enable businesses to target new markets and thereby support the trade development strategy proposed earlier – one that combines a continued engagement with traditional and familiar markets, and simultaneously allows for the pursuit of opportunities in less familiar markets across the globe.

The committed and visionary engagement of public sector organisations in the MENA region will be critical to the successful execution of a multi-pronged trade development strategy. Recently, government ministries and departments in various jurisdictions have been working to establish environments conducive to the successful development of new sectors of commercial activity, or the successful development of new international markets.

Dubai, with the creation several years ago of the Dubai Export Development Corporation, is illustrative of the level of interest in enhanced engagement in the international marketplace. The critical step in ensuring the success of such initiatives across the MENA region will be the degree of engagement and interaction – in the pursuit of shared objectives – with the private sector, and in particular with entrepreneurs and business leaders in search of opportunity, both in new sectors and/or in new markets.

The Middle East has a proud history of innovation and success in international commerce, and the decisions made by local businesses today will shape the region’s prospects in the future.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East