An increasing proportion of the Middle East’s international trade is being conducted on open account, with a corresponding decline in the use of letters of credit. FARAZ HAIDER, of Citi, looks at what can be done by exporters (and their banks) to reduce the risks of trading on open account.

As global trade continues to recover, banks are playing an important role in financing it. They are providing a range of traditional instruments, such as letters of credit, as well as a variety of new and enhanced product offerings. Even for companies trading on open account, banks are becoming increasingly important providers of supporting finance and risk mitigation techniques.

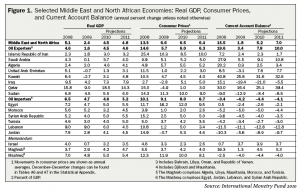

The Middle East has made a good recovery from the global recession, though prospects vary from country to country. According to the International Monetary Fund’s World Economic Outlook, the MENA region is projected to have real GDP growth this year of 4.5 per cent, rising to 4.9 per cent next year.

Qatar, rich in natural gas, is the region’s most dynamic economy, with an expected GDP growth rate of 18.5 per cent in 2010 (see Figure 1). It is followed by Iraq (7.3 per cent), Lebanon (six per cent), Sudan (5.5 per cent), Egypt and Syria (both five per cent) and Algeria (4.6 per cent). By contrast, the United Arab Emirates will struggle to reach 1.3 per cent growth this year.

Two key factors are moulding the shape of the Middle East’s recovery. One is continued higher world demand and prices for hydrocarbon products, which are boosting exports. The other is government spending on infrastructure and other projects to in order to diversify. But recovery still looks sluggish in some countries, such as Kuwait and the UAE , because of “vulnerable financial sectors and weak real estate markets”, notes the IMF.

Trade trends

During the recession, global trade volumes declined at rates not seen since the end of World War Two. “This decline can be attributed to a confluence of related events, including the worldwide depressed demand for goods and services, lower commodity prices, and extremely limited availability of trade finance as a result of the banking industry’s efforts to protect itself from heightened credit and country risk,” writes TowerGroup banking analyst Susan Feinberg. The decline was exacerbated by severe capital and liquidity constraints.

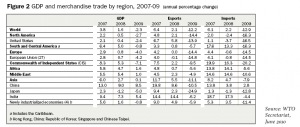

The World Trade Organisation (WTO), in its World Trade Report 2010, published in July, calculated that in 2009 world trade declined by 22.6 per cent in US dollar terms and 12.2 per cent in volume terms. This year has seen a good recovery, however, the WTO “predicts that” there will be further recovery, that should reverse some but not all of the impact of the trade collapse.

What of Middle East trade? The region’s exports fell 4.9 per cent by volume in 2009, the lowest fall of any region, according to the WTO (see Figure 2). Imports fell 10.6 per cent by volume, which was less than that experienced by Europe, the Americas and the CIS, but greater than that experienced by Africa, China and India.

With the higher risks of trading in a recession, some Middle Eastern exporters selling on open account moved back to traditional trade finance instruments such as letters of credit (l/cs), documentary collections and bank guarantees to reduce the nonpayment /credit risks. Governments in some developing countries, to monitor and curb the use of foreign exchange, also made it mandatory for all imports to be bought on l/c terms. Even intra-company sales from a parent to a subsidiary, where there is no credit risk, had to be moved on an l/c basis.

But obtaining traditional trade finance became more difficult and expensive to access due to the credit-impaired environment, shortage of liquidity and higher corporate risk profiles. Now that world trade has returned to some semblance of normality, l/cs and other traditional instruments have become more readily available with pricing consistently dropping. Yet because export risks have fallen, open account trading is starting to grow in popularity again.

Although many trade banks have reported an increasing number of clients looking to move certain high-risk activity from open account to traditional trade instruments, the limited availability of such facilities combined with higher fees imposed by banks has not resulted in an overall increase in usage of traditional trading.

The latest SWIFT volumes, which are now widely used across the industry as a proxy for “global and intra-regional” trade flow analysis, show that only about 10 per cent of the value of world trade is conducted through l/cs, collections and guarantees, and about 90 per cent still takes place on open account– about the same proportions as three years ago.

The banker’s role

Exporting on open account still involves banks, of course, even if only to carry out a straight forward electronic transfer from the importer’s to the exporter’s account. But banking services for firms trading on open account go far beyond simple payments, and increasingly move into the realm of finance and risk mitigation.

A short-term loan is an obvious way for a supplier to bridge the gap between export order and payment. Furthermore, if the exporter’s customer is a multinational with a high credit rating, the loan can be provided at a lower interest rate, as the bank will base its credit risk assessment partly on the importer’s standing. Also useful is the banker’s acceptance, which is effectively a loan to the importer to buy the goods or services being imported. These are some of the tools now being used to supplement open account trade flows and banks are playing an active part.

Banks can also help large manufacturers provide extended trade credit terms to their distributors. Instead of distributors having to pay for the goods within, say, 45 days, for example, they could be given extended payment terms, with the manufacturer funding the gap by borrowing from the bank.

Account receivables financing, invoice discounting, supplier finance, forfaiting (and other similar methods) are other important ways in which banks can help small-and-medium-sized (SME) exporters receive payment early and insure against the risk of non-payment.

Reverse factoring, also known as supplier finance, is buyer centric and has proved particularly popular in recent years. It is so called because the buyer, rather than the supplier, initiates the service, and the bank’s focus is, therefore, on the buyer rather than on the supplier. Typically the buyer will be a large, often multinational, company, so the bank’s credit risk ultimately resides with the highly creditworthy buyer not the SME supplier.

Key benefits of supplier finance for the exporter are several:

- Access to flexible finance tailored to sales and cashflow requirements

- Relatively low-cost finance, because of the high-quality security

- No need to provide the factor with exhaustive credit information on numerous importers

- Predictable cashflows

- Conversion of accounts receivable to cash.

The benefits for the importer are manifold as well:

- Direct support of suppliers in terms of improved financing costs

- Increased supplier loyalty

- Well-financed suppliers can offer more attractive credit terms to the buyer

- Efficient payments because electronic banking platforms are put in place

- Improved cashflow controls through accounts payable.

Other trade instruments

The shortage in supply, and relatively high price, of letters of credit and other traditional trade finance instruments is a major concern for the G20. Last year, G20 members pledged to make another $250bn available for short-term trade finance in 2009 and 2010.

However, the Basel II rules stipulating how much capital banks need to set aside to support their trade finance activities need to be relaxed if more funds are to be released. Under these rules, banks’ capital allocation requirements treat trade finance facilities as high-risk, unsecured loans with a maturity floor of one year, rather than treat them as the lowerrisk, short-term, self-liquidating transactions that they are.

For as long as these rules remain, banks will have to ration the supply of trade finance to prevent it eating into their capital base, something that runs counter to the efforts being made by international organisations and national governments to stimulate global economic recovery. The International Chamber of Commerce, the Bankers’ Association for Finance and Trade International Financial Services Association and others are lobbying to get the rules relaxed.

Export credit

The activities of government-owned export credit agencies (ECAs) and private sector credit insurers has mushroomed in recent years in support of exporters, whether trading on open account or using letters of credit and other traditional instruments.

Most ECAs provide cover only for their own countries’ exporters, but the role of multi-lateral ECAs, which provide cover to exporters from several nations, and development finance institutions (DFIs) is on the increase.

Key ECAs and multi-lateral ECAs in the region include the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), which is part of the Islamic Development Bank; the Arab Investment and Export Credit Guarantee Corporation; and the African Export-Import Bank. They are expanding their efforts to provide support for larger regional trade f lows through newer offerings and larger programme limits.

Traditionally, ECA and private export credit insurance cover was only – or mainly – available for long-term credit, but many ECAs have introduced, or stepped up, programmes providing short-term credit insurance, especially where private insurance for short-term export credit has declined. This has proved invaluable for some exporters unable to find any other form of risk mitigation.

Website support

Trade finance and services are an important part of Citi’s offering globally. As well as providing traditional l/cs, and documentary collections services, it offers a range of risk mitigation and finance solutions suitable for companies trading on open account. It also works with ECAs and private credit insurers around the world to facilitate exports.

A recent innovation is Citi’s Trade University, a monthly series of web-based seminars. They provide clients with information on trade trends, documentation, finance and regulatory compliance.

With a market-leading network spanning the globe, coupled with award-winning technology platforms, Citi is well equipped to capture its Middle Eastern clients’ end-to-end international trade flows.

Faraz Haider is head of trade, Middle East, treasury and trade solutions, Global Transaction Services, Citi

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East