The dominance of transactions involving Tawarruq and Murabaha syndication and its variants in cash management and trade finance will continue unabated in 2015 in the absence of other products.

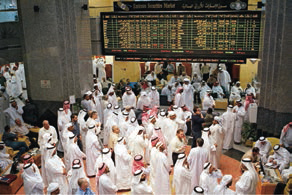

Commodity Murabaha trading is done through exchanges such as the London Metals Exchange (LME), Bursa Suq Al Sila with its palm oil contracts based platform and the NASDAQ Dubai Murabaha Platform, which provides Islamic financing services to a rapidly growing number of individual and institutional customers.

Thus far the NASDAQ Dubai Murabaha Platform, which was launched only in April last year by Nasdaq Dubai and Emirates Islamic Bank, had already executed transactions worth AED21bn in a mere seven months, thus underlying the demand for such a platform.

The latest Islamic financial entity, the UAE-based Aafaq, carried out its first transaction on the platform in December. Dubai has ambitions for the platform to enhance the emirate as the international centre for processing Shariah-compliant financing.

According to Sheikh Faisal Saoud Bin Khalid Alqassimi, managing director of Aafaq, “the NASDAQ Dubai Murabaha Platform is a very attractive alternative to many other Islamic financing solutions, which can be subject to unexpected price movements, spreads and delays as well as poor liquidity. We are making use of the platform to offer our clients solutions for a variety of purposes, from personal finance to funds for company expansion”.

The platform makes use of Shariah-compliant certificates that have been developed for the underlying assets of the financing transactions. Islamic banks, Islamic windows of conventional banks, and Islamic finance companies and their clients can make use of the platform through trading certificates.

Similarly, there was a flurry of big-ticket Islamic debt finance deals to end the year. The International Islamic Trade Finance Corporation, the trade fund of the IDB Group, signed a Guarantee Agreement with the Tunisian Ministry of Economy and Finance, and a $300m Murabaha Agreement with the Tunisian Refining Industries Company.

Emaar Saudi Arabia, which is the main contractor of the King Abdullah Economic City in the Kingdom, signed a SR2bn ($533m) Murabaha facility with the Saudi Arabian British Bank, to support the ongoing development of the residential and industrial sectors of the city and related infrastructure.

In the meantime, Abu Dhabi Islamic Bank arranged a $420m (AED1.55bn) Islamic ship financing facility for Zakher Marine International Inc for its new ship-building programme, including 15 vessels and three self-elevating accommodation barges.

At the same time, Dubai Islamic Bank arranged a $230m Ijara facility for Air Arabia, the budget airline owned by Sharjah, to finance the delivery of six new Airbus A320 aircraft in 2015. The delivery started in January with one aircraft to be delivered every two months.

“The aviation sector for any country forms a critical piece not just in supporting logistics, trade and tourism but also in giving a boost to the overall economy. Partnering with entities such as Air Arabia, which bring about an innovative mix of quality and affordability to the travel and tourism sector, is closely aligned to our own strategic agenda of increasing the penetration of Islamic finance across all sectors of the economy,” explained Dr Adnan Chilwan, CEO of Dubai Islamic Bank, in a statement. n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East