A survey of banks in the region reveals the growing importance of the corporate segment to the fortunes of the banking sector as the search widens for new areas of profit

A survey of banks in the region reveals the growing importance of the corporate segment to the fortunes of the banking sector as the search widens for new areas of profit

By Caroline Maginn – CMM Trade partner

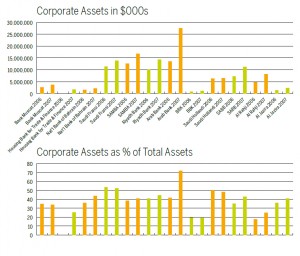

How important to the region’s banks is the corporate banking segment?

In both the absolute and percentage levels of corporate assets, the corporate segment has increased amongst the banks sampled. This reflects the growing focus on the corporate segment in terms of overall bank business, most markedly in the case of Arab Bank and Saudi banks as a whole, confirming a growing consensus among the region’s corporate bankers that investment had been unduly focused on the retail and brokerage segments. The importance of a presence in Saudi Arabia for any bank with ambitions to grow its regional corporate business is underscored by the relative size of the market there compared with other GCC countries. With the exception of Saudi Fransi and Saudi Hollandi, corporate assets as a percentage of total assets increased across the banks sampled. Interestingly, both these banks also grew the absolute level of corporate assets. (The size and percentage contribution of corporate assets with Arab Bank’s total asset base rose by roughly 50% in each case.)

- Corporate banking in focus

How important is the corporate bank segment as a contributor to bank liquidity?

As demonstrated by the tables, right, the absolute level of corporate liabilities grew uniformly across the sampled banks, clearly illustrating the importance of this segment as a contributor to bank liquidity.Consequently corporate liabilities will attract increasing attention from banks’ senior management during the current economic turmoil. Corporate liabilities as a percentage of total liabilities shrank for all banks in the sample, except SAMBA, Arab Bank and Saudi Hollandi, and contributed to a third or more of total liabilities for all banks except BBK, Al Rajhi and Al Jazira. SAMBA leads the banks sampled in terms of total corporate liabilities and their growth, followed by Riyadh Bank and Arab Bank. Attracting stable or growing levels of corporate liabilities is highly dependent on strong cash management and money market propositions. This should create a compelling imperative for senior management to invest in building capabilities and product propositions in these areas.

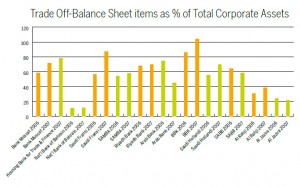

How important is trade in the context of total corporate assets?

Trade contra items represent a significant percentage of total corporate assets in the majority of cases. Our conclusion is that trade business should be a central aim for any bank building its corporate business segment. The year-on-year trend was positive in terms of the growth of the trade contribution to the corporate business for all banks except Al Jazira, SABB and Arab Bank. Cash & Trade forecasts that the increasing importance of trade finance as a percentage of the corporate banking segment will continue.

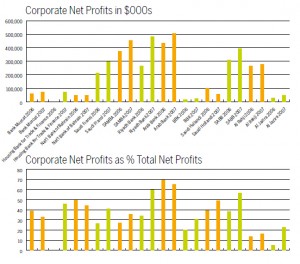

How important is the corporate segment to banks’ net profitability?

The data in the tables, right, indicate that corporate net profit grew year-onyear for all banks in the sample. Except for Al Jazira and Al Rajhi Bank, the percentage of this corporate profit as a contribution to total profits exceeded 30%. In the case of Arab Bank, Riyadh Bank and SABB, corporate profits contributed to more than half the banks’ total profits. This again emphasises the importance of focussing on the corporate segment, in particular cash management and trade. Cash & Trade will publish updated information for 2008 when it becomes available, but we confidentally anticipate that the fall in brokerage and investment income will reveal that the corporate segment is becoming an increasingly important element of banking operations.

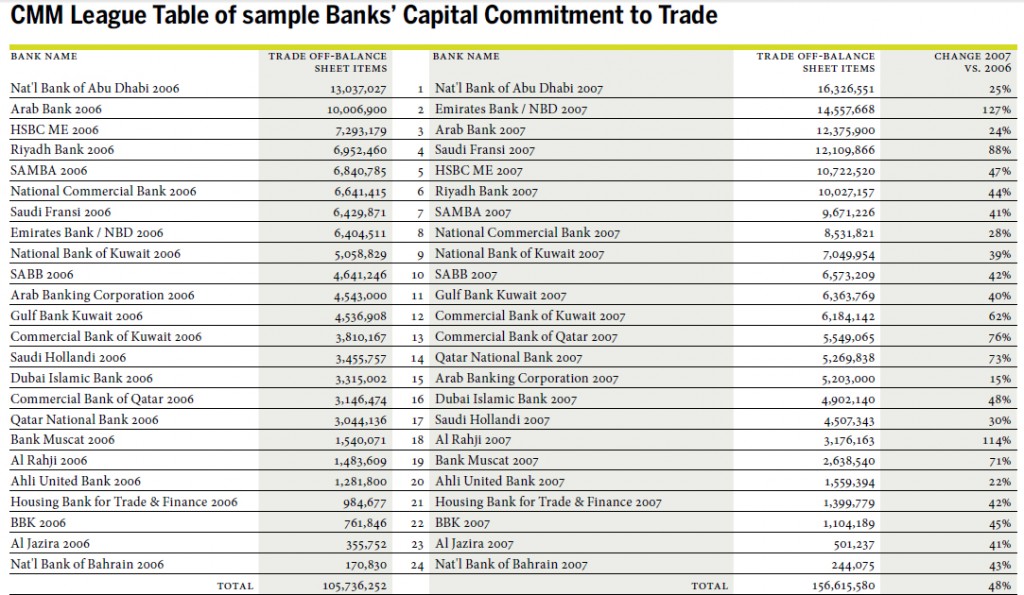

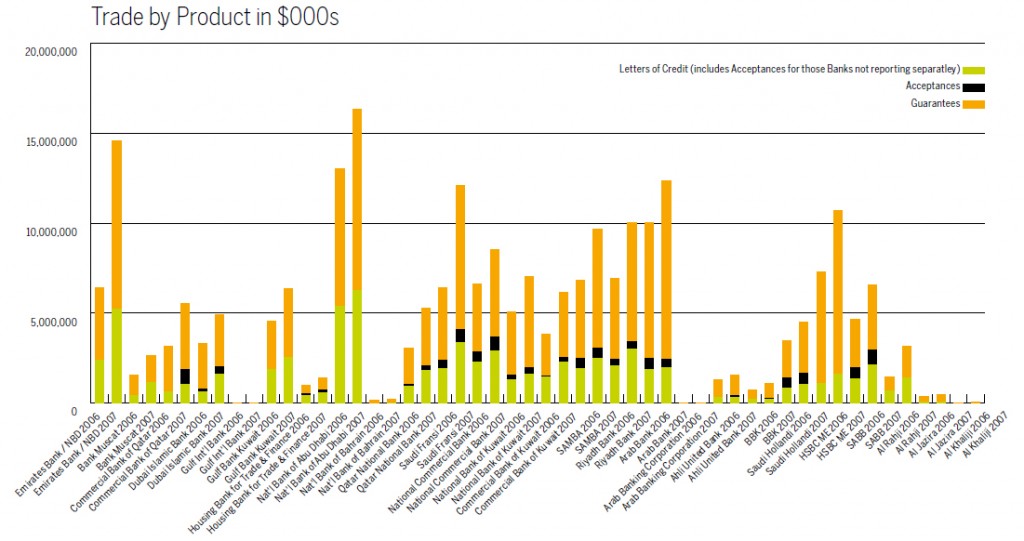

What are the growth trends of trade finance?

The level of trade finance grew for all banks in the sample year, making it a win-win product for all banks. In particular, Emirates and Saudi Al Fransi virtually doubled their trade related contingents and liabilities. Guarantees represent the dominant product for all banks in the sample, followed by letters of credit and acceptances. Arab Bank and HSBC Middle East show the highest portfolio concentrations on guarantees, which are more capital intensive than letters of credit. The growth in trade finance, year-onyear, is highest for guarantees (51%) followed by letters of credit (47%) and acceptances (47%). The overall growth across the product line as a whole is impressive at 47% and contrasts favourably with trends in other product lines that have actually seen declines. Trade finance looks set to remain an attractive area for investment.

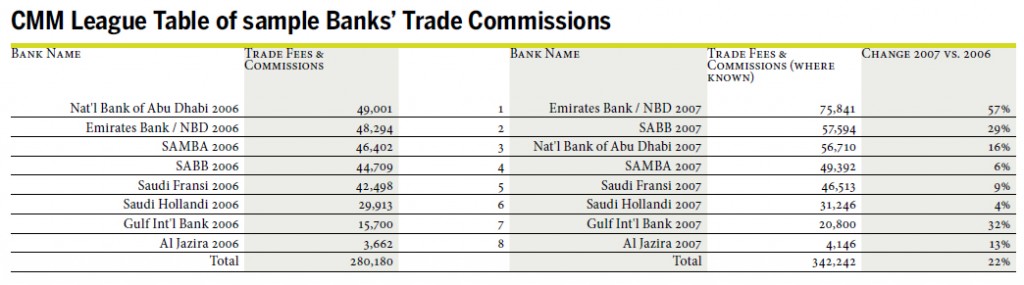

What is the corporate segment’s dependency on income from trade?

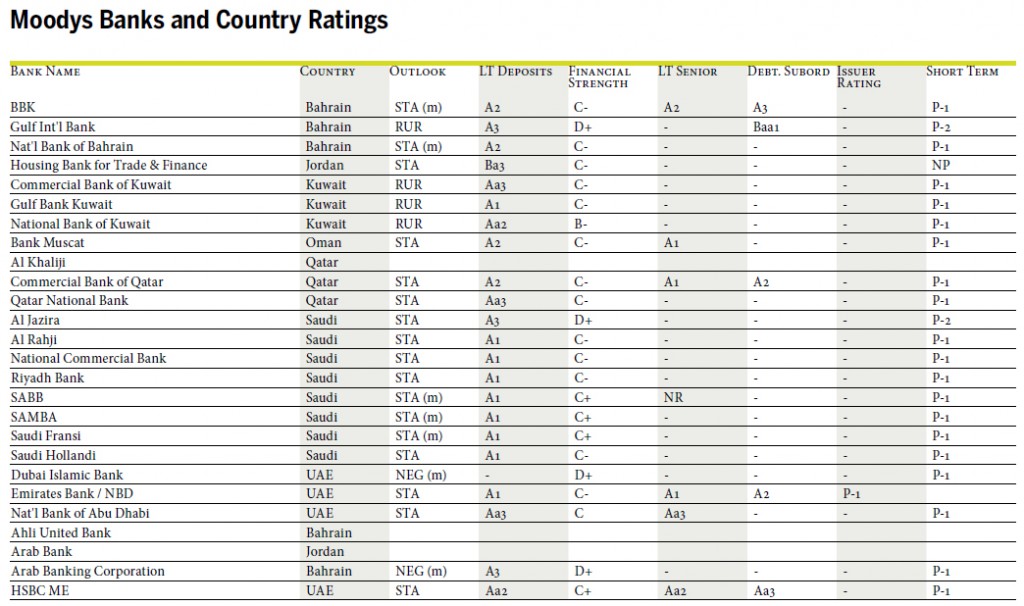

The significance of trade income to total corporate income is hugely variable across the sample ranging from in excess of 50% for Saudi Hollandi to between 10% and 20% for other banks in the sample as illustrated right. In light of the current global economic slowdown, what is the inherent credit quality of the region’s banks? Broadly speaking, there is stability in the region’s banking sector compared with the situation globally and this should continue to enjoy the confidence of the international banks, corporations and retail customers, representing a safe haven for their funds and providing the liquidity to support trade credit business and sound cash management operations. The table, right, illustrates the position as of March 2009 for their short and long term ratings as determined by Moodys, the respected external credit assessment institution.

However, it is important for customers to actively monitor the situation and collect local intelligence as external credit assessment institutions are not infallible.

However while a stable outlook applies to most banks, the outlooks for Dubai Islamic Bank and GIB are negative.

CMM League Table of sample Banks’ Capital Commitment to Trade

Moodys Banks and Country Ratings

CMM League Table of sample Banks’ Trade Commissions

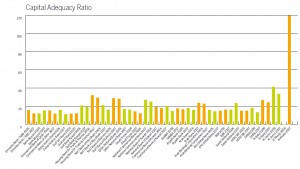

Have the region’s banks the capital adequacy and scope to invest further in their core businesses?

The data indicates that the region’s banks are generally well capitalised with ratios comfortably in excess of those required by Basel II regulations. With the exception of Bank Muscat, Gulf International Bank, Ahli United and BBK, all the banks in the sample improved their use of capital, contributing to improved returns for shareholders.

Not withstanding this trend, capital adequacy among banks in the region remains robust and prudent within the guidelines of the individual Central Banks that have successfully balanced the interests of shareholders and depositors to maintain systemic liquidity and investor confidence. This means that banks have the scope to invest further in their core businesses, ideally those characterised as low both in risk and the volatility of their earnings, with a focus on fees and commissions growth. The cash management and trade segment meets all of these criteria and given the growth in these product income streams and their contributions to the overall balance sheet, and despite the current economic turmoil, the cash management and trade segment warrants the attention of senior management in setting or revising future business strategies in light of the continuing global uncertainties.

Cash & Trade look forward to the release of the 2007-8 comparative analysis once a meaningful range of annual reports are made available by the region’s banks.

Source: CMM Analysis of individual Bank Annual reports and notes

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East