banking, international banking, Qatar National Bank Group

MENA is now looking favourably at SWIFT’s Bank Payment Obligation. LIZ SALECKA considers its advantages.

While SWIFT’s Bank Payment Obligation (BPO) has attracted significant interest in Asia, a positive picture is also emerging in the Middle East, where it is poised to provide a viable alternative to both open account trade and letters of credit.

The recent BPO deal, between BP Chemicals subsidiary BP Aromatics Belgium and buyer OCTAL Oman, has also given rise to strong suggestions that the BPO will be embraced by the oil, gas and petrochemicals sectors, thereby accelerating its adoption by some of the region’s largest exporters.

“Before we went on this journey, we did not single out the Middle East as a particular market that would be more suited to the BPO. However, we have found that it is easier to do a BPO here than, for example, in China,” says David Vermylen, global credit manager, Petrochemicals, BP Chemicals, which now plans further BPOs with other customers – including one based in UAE.

“I believe that this has a lot to do with the sophistication of corporate customers and also the corporate culture in the Middle East. There is a greater readiness to accept new things within this region.”

The alternative

According to Farooq Siddiqi, regional head of transaction banking, MENA, Standard Chartered Bank, the BPO will appeal most to Middle Eastern buyers and suppliers who are regular trading partners and have long-term, strategic relationships.

“At the end of the day – whether companies are trading on open account, using letters of credit or another type of quasi structure – the key factor will be their perception of the risk presented by their counterparties,” he says, pointing out that there will be situations where companies can switch from letters of credit to the BPO.

However, while the BPO is expected to reduce reliance on traditional trade instruments in Asia, in the Middle East it is likely to prove attractive to companies trading on an open account basis, which want to mitigate counterparty risks as well.

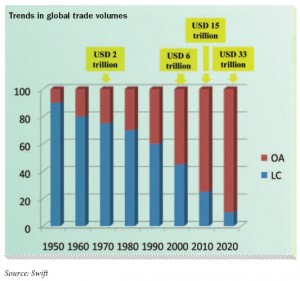

Forecasts from SWIFT, indicate that global trade volumes will grow to US$33 trillion by 2020 (see chart), with open account trade being used for more than 90 per cent of such transactions. However, local companies operating in the open account space will still need to address counterparty risks.

“In the long-run, I expect that the BPO will have a bigger role to play in the open account supply chain finance space than in the traditional trade area,” says Imre Gorzsas, assistant general manager, extended network and transaction banking, international banking, Qatar National Bank Group, who anticipates that use of the BPO will cut into the forecast share of open account trade.

He adds that the BPO will also serve as a very viable risk mitigation alternative to those companies trading on an open account basis, which currently may rely on private commercial credit insurers and government-supported export credit agencies to reduce counterparty risks.

Siddiqi also anticipates a movement from open account trade to the BPO. “Even where Middle Eastern companies are already exporting on an open account basis to the US or Europe, the opportunity exists to switch to the BPO,” he says. “When it comes to exports to Europe, some companies are currently revisiting their reliance on open account trade, and the BPO presents an alternative to this,” he says.

Big role in global trade

For Middle Eastern companies, the BPO is initially expected to play a major role in global trade transactions, as evidenced by the recent deal between BP Chemicals and OCTAL Oman.

Such transactions are growing at phenomenal rates, emphasised by figures that show a 465 per cent increase in Middle Eastern imports between 2001 and 2010, and a 442 per cent increase in exports for the corresponding period (see table).

“The Middle East is importing from Europe, China and the US and it is exporting to Asia and the US,” says Gorzsas, who believes that the BPO will appeal most to local exporters, particularly those exporting to Asia in the immediate future. “For the time-being, Asian banks are taking the lead on this initiative and they are already executing transactions in various places, including the Middle East.”

However, Gorzsas also anticipates scope for domestic BPO transactions in the longer-term. “While the BPO is more common in global and regional transactions for the time-being, it can address domestic needs as well – especially in the open account space,” he says.

Commodity sector to lead

There is also growing recognition that the BPO is particularly suitable for companies involved in the commodities space such as crude oil, gas, oil products and petrochemicals – most of which currently rely on letters of credit.

“There is a huge opportunity for the BPO to be used by Middle Eastern companies in the oil, gas and petrochemicals industries – especially where they are trading with regular counterparties,” says Siddiqi. “These types of businesses are often involved in long-term contractual business relationships, and these lend themselves to BPO structures,” he says, pointing out that OCTAL Oman was involved in a strategic, long-term relationship with BP Chemicals. “What we have also seen in the oil, gas and petrochemicals sectors is greater investment in, and take-up of, electronic banking solutions.”

At BP Chemicals, Vermylen also acknowledges the BPO’s attractions for his sector: “One of the main reasons why the BPO is attractive to commodity industries is that it offers speed – and this is of great importance in this market,” he says. “The other key point is that commodity markets are very competitive, and any way in which you can reduce your cost base will make you more competitive and enable greater profits. As a result, the BPO may turn out to be the best product for players in this industry to use.”

At BP Chemicals, Vermylen also acknowledges the BPO’s attractions for his sector: “One of the main reasons why the BPO is attractive to commodity industries is that it offers speed – and this is of great importance in this market,” he says. “The other key point is that commodity markets are very competitive, and any way in which you can reduce your cost base will make you more competitive and enable greater profits. As a result, the BPO may turn out to be the best product for players in this industry to use.”

Gorzsas, meanwhile, points out that the “large ticket nature” of trade transactions in the oil, gas and petrochemicals sector; the need for standardised trade documentation; and the requirement for appropriate commercial risk and country risk mitigation has meant that open account is less frequently used.

“Oil, gas and petrochemicals will probably be the biggest segment to embrace the BPO. These clients are very demanding when it comes to processing efficiency, and are also often regionalised – or globalised – and have sophisticated electronic systems,” he says. “Using paper-based solutions is very painful for them and this can result to delays in payment for large ticket transactions – which can prove costly.”

Local banks next

To date, membership of SWIFT’s BPO Group largely comprises global banks and regional banks – as well as Asian banks.

Qatar National Bank Group, one of the largest banks in the Middle East, with a footprint spanning 24 countries, has taken an initiative for the region by joining the BPO community, and Gorzsas firmly believes that other regional and local Middle Eastern banks will follow shortly.

One of the key drivers behind this is the collaboration between SWIFT and the International Chamber of Commerce (ICC) Banking Commission on the creation of industry-standardised rules for the BPO, which, once available, will see it become a globally accepted, industry-owned and technologically-neutral trade finance instrument.

“Significantly more Middle Eastern banks will adopt the BPO with accelerated speed once the ICC Banking Commission publishes the international standards for this instrument (URBPO), which is anticipated next year,” says Gorzsas. “The Commission’s authentication of the BPO will enhance the entire banking industry’s comfort with this instrument.”

He adds that, once volumes of BPO transactions conducted globally and regionally grow, this, too, will instigate its take-up by local banks in the Middle East.

“Once the BPO becomes a common business practice, banks will not have any other choice than to join the proposition to be able to serve their customers. This is true for both local and global banks,” he continues, pointing out that a BPO deal will have to be of a certain size for it to be of interest to global banks, creating an important opening for local Middle Eastern banks.

“The only question is ‘when is the right time to join the initiative’? Early adopters will definitely have a market advantage as these banks will be respected as leaders in innovation, while latecomers will probably take less investment risk.”

Similarly, Siddiqi notes that, although the large global banks may have taken the lead with the BPO, Middle Eastern banks – especially large regional banks – will take advantage of it, too. “There is even greater scope here if they are the bank involved on both sides of the transaction – and, for example, represent both the seller in Qatar and the buyer in the UAE,” he says.

The interest grows

Already, early bank joiners of the BPO initiative, such as Qatar National Bank Group, have witnessed interest and enthusiasm from their corporate customers during initial discussions about the BPO.

“Customers are always interested in any potential process or efficiency enhancements offered by the banks. We have introduced this concept to a few of our customers to seek initial feedback, and the response was always positive,” says Gorzsas.

“At the moment, we are talking to two companies that want to understand the concept of the BPO, and they are considering pilots with the BPO to assess its impact,” adds Siddiqi.

However, Gorzsas also notes: “We foresee that the adoption of the electronic-data-matching-concept – instead of physical documents checking – will take a certain amount of time as IT systems and business and operational processes need to be changed, not only on the bank side- but also on the customer side as well.”

The BPO’s role as a trade finance instrument

Th e BPO is an electronic instrument that can be transmitted between two banks in a trade finance transaction to provide an irrevocable undertaking that one will pay the other on a specifi ed date after the successful electronic matching of data.

a key rationale for its deployment is the highlevel electronic execution it brings to trade finance transactions, which has traditionally lagged other banking product segments, such as cash management, investments, foreign exchange and securities transactions in terms of automation.

“Trade needs to catch up with the rest of the banking industry – and the BPO provides the perfect proposition to do so,” says Gorzsas. “On the international trade side, most of the supporting global trade fi nance processes have not been optimised suffi ciently due to traditional paperbased practices slowing down key processes, such as documentation discrepancies handling.”

he adds that whereas the main purpose of letters of credit is to facilitate payment, in reality approximately 60 per cent of the documents are discrepant – and this delays the provision of payment to the benefi ciary.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East