ALEXANDER R. MALAKET, president of OPUS Advisory Services International Inc. and author of Financing Trade and International Supply Chains, looks at transformational competition in the financing of international trade

Trade finance has been in existence for a very long time, so long in fact that one might have argued justifiably until about 2005 that the industry suffered from several decades of self-congratulatory complacency, in part due to the absence of credible alternatives in the financing of international commerce.

Complacency is not only no longer an option, it is a recipe for irrelevance if not outright self-destruction, in the world of international business, and of trade-related financing today.

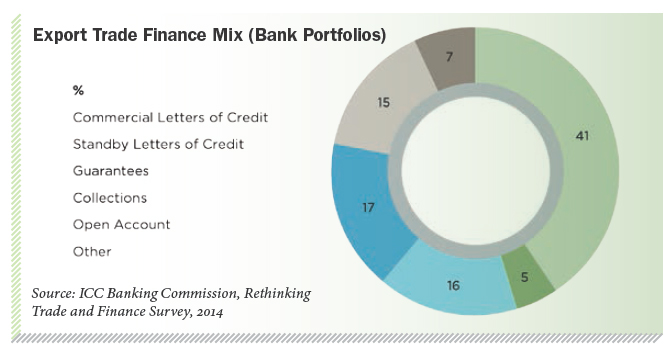

The business of financing international commerce has been in existence in some form or another for hundreds of years or longer, with banks playing a major role in this esoteric form or financing, particularly where solutions have been provided on the basis of traditional mechanisms and products such as documentary letters of credit.

Traditional instruments and providers

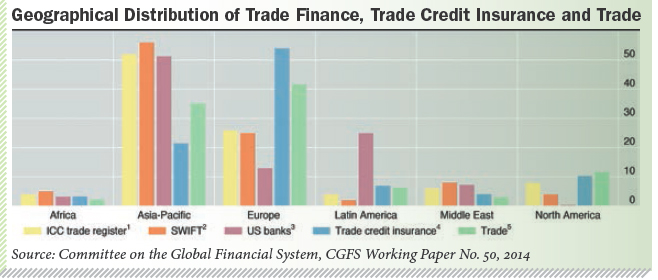

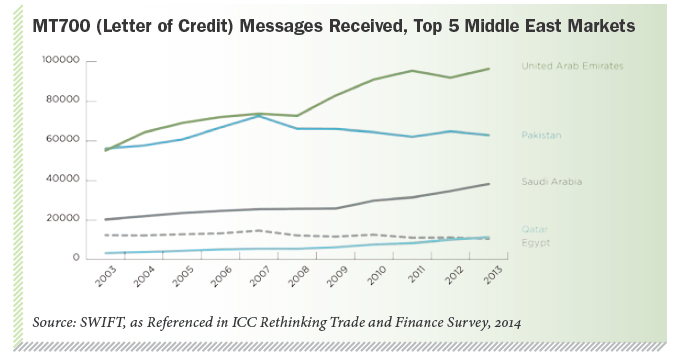

These well-established if under-appreciated banking instruments have permitted and enabled the successful conduct of international commerce in the most challenging and complex markets in the world, and have done so with remarkably robust value propositions. Documentary credits and their various features have remained relatively popular across the Middle East and North Africa, even as most of the rest of the globe shifts decisively to trade on open-account terms, and a commensurate focus on emerging solutions in supply chain finance.

The continuing importance of trade as an engine of growth and development is well known and increasingly acknowledged as a cornerstone of economic development policy and priorities, whether in OECD economies, or in frontier markets, where authorities look to trade as a driver of development. At the same time, bank-intermediated trade finance faces significant internal pressure, even as the critical role of financing as an enabler of trade is finally in the mainstream of analytical thought and on the radar at leading international institutions such as the WTO, the UN and others.

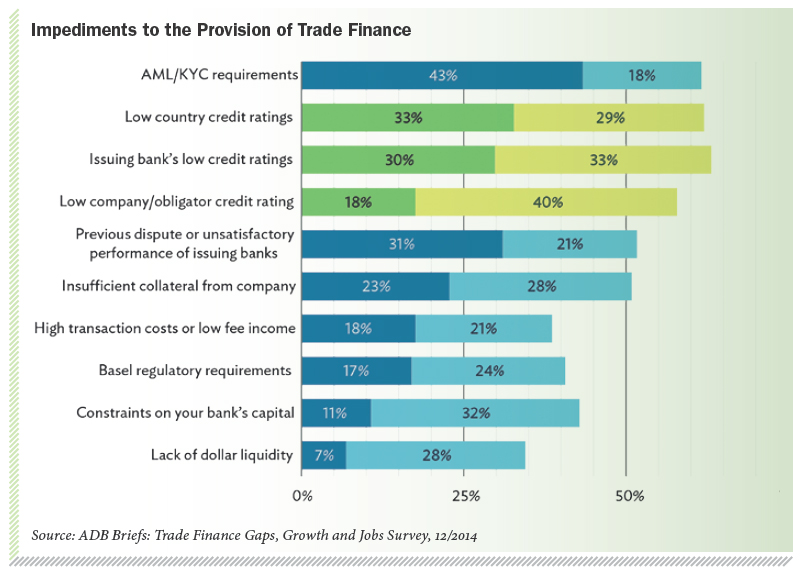

While there is some level of “normalisation” in the global financial system post 2008, there is a new global reality around regulatory requirements, for example, with the more stringent capital adequacy requirements articulated by the Basel Committee on Banking Supervision (BCBS), or on the increased expectation for banks to be on the front line of financial crime identification and reporting, whether related to money laundering or terrorism financing.

The realities of current regulatory and market conditions is such that banks seeking to maintain (or grow) their propositions or capabilities in trade or supply chain finance face an environment of dramatically increasing capital and operating costs, the imposition of severe penalties that can wipe out the P&L of a trade business, and the ongoing need to advocate for and explain the nature of trade finance as an element of a broader value proposition in support of commercial and corporate clients.

Financial institutions in some parts of the world face demands from policymakers to exercise greater care and prudence in the pursuit of business – particularly cross-border business – while concurrently being admonished to provide greater support (to higher-risk?) small and medium-sized enterprises.

The foregoing realities are acknowledged without value judgment: the global financial crisis demanded a decisive and convincing policy and regulatory response, and the industry has had to respond to changing commercial and political realities, as well as significant damage to the reputational standing of much of the global banking sector. Recent fines and legal consequences imposed upon leading financial sector brands likewise, contribute to the shaping of a new reality in enforcement and in the size and scope of financial consequences.

This collection of circumstances, all evolving on the backdrop of ongoing focus on trade as a driver of recovery and growth, sets up a potentially transformational dynamic in the marketplace, the beginnings of which are becoming apparent.

Gaps and mis-matches: creating opportunity

Banks, as the traditional providers of traditional trade finance continue to focus their portfolios largely on familiar products and solutions, with, on average, less than 20 per cent of their business focused on high-growth open-account trade flows and related supply chain finance solutions, despite rough estimates that perhaps 80 per cent of global trade is now conducted on open-account terms.

Leading global banks are developing and growing an offering around supply chain finance, and while past practices do take time to shift, there is clearly a misalignment in terms of the focus of banks in the financing of international commerce.

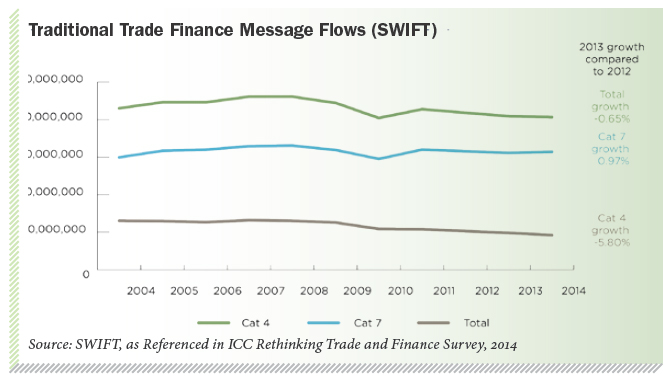

At the same time, the traditional forms of trade finance in which banks continue to focus, are exhibiting low or negative growth, increasing operational and capital costs, margin compression and an overall inability to meet market demand, with recent analysis by the Asian Development Bank suggesting that there is a global gap in trade finance in the area of $1.9 trillion annually, with demand far outpacing supply.

In addition to these macro-level mis-matches, there is the reality that business is increasingly conducted – and evolving – at rates of speed and transformation that are determined by a combination of technology and high-speed market adoption. Trade and supply chain finance are beginning to exhibit similar characteristics, whether at the level of enabling technologies that are finally catching up to visions of tech-enabled trade from the late 1990s, and where importers, exporters, banks are actively beginning to seek ways to adapt technologies and business models in support of the more efficient conduct of international trade.

If it were the case, that trade finance could work its magic in the familiar “shadows” of complexity and obscurity, we might have the luxury of discussing these dynamics as a combination of factors (the internal cost, margin and regulatory pressures noted earlier, together with the evolution of technology and market adoption) leading to a gradual, almost inevitable evolution of the business of trade financing.

The reality is rather more striking and much more urgent.

Putting things into focus

International trade, and the financing of trade, whether through traditional mechanisms or through high-growth supply chain finance programs and solutions, have been brought sharply into focus by the global financial crisis and by the public and international policy initiatives that looked to ensure adequate levels of trade (and by extension, adequate amounts of enabling financing and liquidity) to drive recovery and growth.

Protectionist reflexes in the United States, with “Buy American” edicts, and unprecedented sovereign risk crises in Southern Europe in particular, combined to push exporting economies to seek new markets and new customers, even motivating small startups to look at international markets much earlier in their lifecycles than likely would have been the case, absent these driving forces.

This new-found visibility for trade finance – an area long understood in the Middle East to be key to the conduct of cross-border commerce – allowed international institutions to deploy significant financial resources in support of trade finance through the support of the WTO, the UN and various multilateral development banks and institutions.

This new-found visibility and clear linkage to the creation of economic value, likewise, allowed for the development of a constructive, informed and effective dialogue between industry stakeholders and regulatory authorities, both in Basel and at the level of national regulators charged with the implementation of key regulatory changes in a post-crisis environment.

There was, and is, for industry stakeholders intent on preserving some form of status quo, however, a significant “downside” to all this unaccustomed visibility and profile.

The reshaping of a competitive landscape, perhaps beyond recognition.

Trade finance: healthy competition?

In the spring of 2006, a group of bankers participated in a well-known and regularly scheduled industry event, that year, in London, and were presented with a series of observations related to the state of international trade and trade finance.

The final slide of one set of remarks featured one image at the bottom left of a PowerPoint picture to represent an importer, and one image at the top right of the same slide, to represent an exporter. Midway through the diagonal space separating importer and exporter, the speaker had placed three familiar logos running across the slide. The logos of eBay, PayPal and Skype, ending the presentation with a simple statement and one question to the attending bankers: importers and exporters now have access to an online trading platform (eBay), a secure settlement solution with potential to extend into financing (PayPal) and a free telecommunications capability (Skype).

“What”, asked the speaker, “Do they need you for?”

It has taken some time for the reality of the notional scenario to begin to impact the market, and to shape the conduct of cross-border commerce, but the reality today is that a domain that was once almost exclusively the purview of regional or global banks, is being targeted by technology companies that just happen to have built a “better and faster” payment and financing capability, as defined from the perspective of client experience (and not necessarily in technically accurate terms, as a SWIFT payment is both highly secure and very fast, but takes place in the context of a larger – and slower – trade finance transaction).

Expectations related to functionality and capabilities in commercial and corporate payment are increasingly being shaped by what finance and treasury executives see as being feasible in the context of retail and personal payments (see BNY Mellon Payments 2020: Transformation and Convergence https://www.bnymellon.com/us/en/our-thinking/business-insights/global-payments-2020-transformation-and-convergence.jsp ), and similarly, solutions such as PayPal are extending their capabilities and reach into cross-border commercial business, with recent offerings specifically targeting the provision of working capital support for SMEs, including those engaged in international transactions.

These examples may seem incremental in terms of their evolution and probable impact on the market. However, it is notable that Facebook recently acquired a banking licence in Ireland and now has a peer-to-peer money transfer capability, while Kenya-based M-Pesa has done so well as a mobile payment solution that it is being “exported” to the European Union.

Perhaps more directly and more strikingly, China-based Alibaba has recently announced that it will offer trade financing solutions to clients conducting trade activity on the Alibaba platform. The Alibaba “e-Credit Line” offers financing when purchasing from Chinese suppliers, and while available in the US and the UK only at this moment, already promises “Trade Financing in Minutes without Paperwork”, with the support of a locally based account manager.

This potentially transformational model, alongside the introduction of ApplePay, the activity surrounding virtual currencies and the fast-paced growth of non-bank supply chain finance combine to paint a picture of an industry at a watershed moment in its history: a moment where traditional providers will recognise a sea-change and act quickly and evolve, or cling to the past and perish.

Implications for MENA

The market disruptors will quickly carve niche positions and inevitably shift up-market to serve corporate clients and multinationals if allowed to do so unchallenged, and will for some time at least, have the inherent advantage of being unregulated. Technology-enabled entities can run significant P&Ls with a small fraction of the staff and overhead generally required of financial institutions, providing an advantageous cost base and an inherent advantage in terms of operational agility.

The global impact of these market dynamics bears careful watching, though certain MENA-specific characteristics may result in a slower rate of adoption of these emerging models among traders in the region.

The strong influence and robust authority of central banks and regulatory authorities provides a significant basis for differentiation between banks/traditional finance providers, as against new entrants in the financing of international commerce. While there are ongoing efforts to align accounting and reporting standards to international practices, local practice continues to exercise influence in the way business is conducted, tracked and reported.

In the end, commercial practices related to the conduct of international trade will tend to align as they cross borders and as parties across the globe become aware of alternatives and available business models, such that global practice will shape and enable global trade flows over time.

The implication is that even with robust regulatory frameworks and long-established preferred practices, businesses of all sizes across the MENA region will inevitably respond to transformational developments in the enablement of international trade, including enabling technology, processes and business models around the provision of financing.

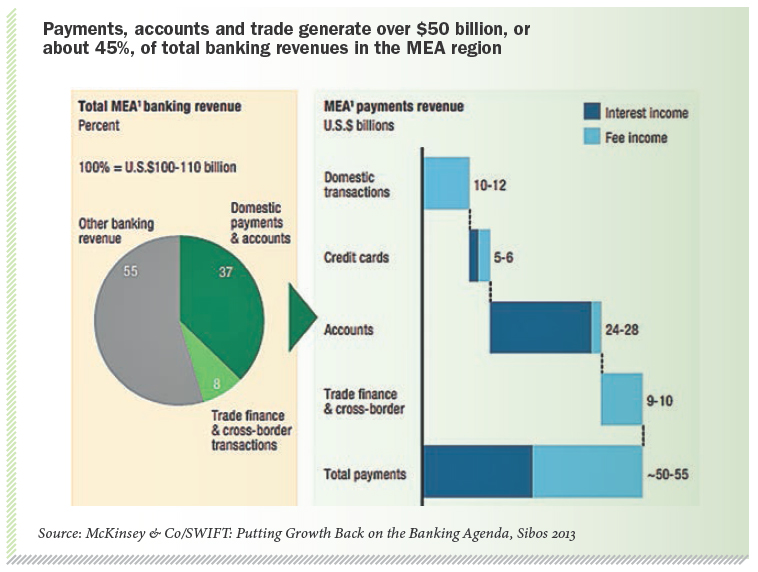

The competitive threat to traditional providers of trade finance is non-trivial, as is the threat to a strategically significant source of revenue generation, yet at the same time, the size and scope of the opportunity for financial services firms that seize the momentum of change and evolution, and can begin to appreciate the sea-change that is about to hit the industry, is proportionately large, significant and perhaps financially and commercially compelling in ways that holding on to familiar but fading business models cannot possibly be.

Trade will grow in impact, importance and reach. Financing (and risk mitigation) will continue to be central to enabling trade. The question of who provides those solutions is however, open to debate today, and will either involve some creative alliances and partnerships, or a wholesale redesign of the trade and supply chain proposition, as well as its sources, delivery channels and target clients, with the latter shifting from individual buyers or suppliers, to ecosystems of commercial relationships that operate across borders.

Transformation is inevitable, but history has its place and its importance: the hard-won lessons of trade and trade financing ought not be lost as the conduct of trade evolves, and the MENA region is well and uniquely placed to strike an effective balance between trusted and transformational, past and future, L/C and virtual currency.

about 45%, of total banking revenues in the MEA region

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East