Tajara Monitor is in the process of broadening its coverage to include the other GCC countries in addition to the KSA, which CMM has published now for two years. In this edition, we look at some of the UAE Tajara findings in relation to trade finance. The UAE is the second biggest trading nation within the GCC. The 2010 report for the UAE revealed that National Bank of Abu Dhabi held on to its lead position in trade finance and made further market-share gains in 2010 to consolidate its market position. First Gulf Bank made solid progress and also gained market-share to strengthen its position at the No 2 rank whilst Mashreq Bank flipped with Emirates NBD for third position. Caroline Maginn, Trade Partner at Cash Management Matters CMM, presents the UAE Tajara Monitor Key Trade Finance Findings for 2010

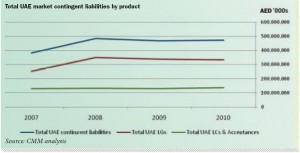

Overall trade finance closed 2010 on a very positive note and is poised for further growth in 2011. At AED 472bn for 2010 this reflects growth in value terms of more than AED 90bn since 2007 and reflects growth if modest over 2009 although it has yet to recover to the peak of AED 484bn in 2008. Hence trade finance has proved to be robust in recent turbulent times and to be a corner-stone of corporate banking. This reflects the Tajara findings in the KSA and other GCC markets.

In 2010 letters of guarantee continued to be the No 1 trade instrument accounting as they did for in excess of 70 per cent of total contingent liabilities with a total value of AED 334bn. They dipped again in 2010 if slightly compared with 2009 and the peak of 2008, although they still registered significant growth compared with 2007 and were the driver of growth in total contingent liabilities over the period.

Generally among banks the dominant trade related instruments are guarantees that cover a broader spectrum of trade activity than letters of credit. In value terms, the guarantee types tend to be #1 performance bonds, #2 other transaction related guarantees followed by #3 financial guarantees/stand-by letters of credit and other direct credit substitutes #4 other direct credit substitutes (which includes trade related letters of credit without provision for the issuing entity to retain title to goods and re-insurance letters of credit) and #5 bid bonds.

At AED 103 billion letters of credit were flat to prior year and still slightly below the levels of 2008 and 2007.

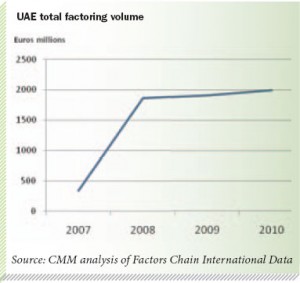

During the period the factoring volume continued to grow by five per cent to a value of €2bn in 2010 proving that factoring is here to stay in the UAE both in good times and bad even if not showing the stellar growth of preceding years, when it grew from its infancy in 2004 at €145m to its current maturity. Domestic factoring still makes up for the bulk of the UAE’s factoring volume accounting as it does for €1.8bn and CMM forecasts that the biggest growth area in the short to medium term lies in the international factoring. Whilst there is little transparency around the factoring volume by individual player CMM’s market sources confirm HSBC Middle East and Emirates NBD to be the major players in factoring.

CMM Contingent Liability League Table

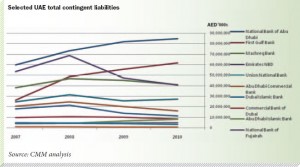

In the following league table CMM tracks the market share of selected leading banks together with the overall market. The selected banks account for approximately 65 per cent of the total market and provide a meaningful insight into the market dynamics. We are regretfully constrained from providing full market transparency as not all banks and in particular the international banks who play a significant role in trade finance in the UAE, do not segregate their UAE trade related contingent liabilities by country. Further not all indigenous banks active in trade make their annual reports readily available.

Whilst both National Bank of Abu Dhabi and First Gulf Bank built on their market leadership elsewhere in the table there was a pattern of market-share attrition. Mashreq Bank improved its ranking to become No 3 in this table taking over in this position from NBD Emirates whose market share declined for the second consecutive year.

It will be interesting to see how investments made last year by several banks further down the table in improving their trade offering will affect the rankings this year. The marked shift in market share strongly illustrates that corporates are not complacent in their choice of trade bank and will award business where reward is due. Trade finance continues to be one of the most complex offerings for banks to achieve excellence in, encompassing as it does a wide range of credit, IT and service issues and involving multiple parties.

Apart from the top two market leaders many other players lost market-share and registered declining value of business booked. Bucking this trend Union National Bank and Abu Dhabi Islamic grew their business by well above AED 1bn although they did not gain in the rankings whilst National Bank of Fujarah and Sharjah Islamic Bank made more modest gains in terms of value of business booked.

The market-place since 2006 has revealed some interesting winners and losers in terms of market-share in relation to the largely trade finance related contingent items of letters of guarantee, letters of credit and acceptances. These are analysed in greater detail in terms of absolute values and market-shares by sub-product in the sub-league tables, which are in the full Monitor.

Above all, the trends underscore the lack of complacency amongst corporates, which change their bank providers of trade finance to achieve higher levels of efficiency, speed, responsiveness and credit line flexibility and certainty.

2011 will prove of significant interest and we will see if National Bank of Abu Dhabi continues its rapid ascent or whether First Gulf Bank and Mashreq Bank build further on recent momentum to erode NBAD’s relentless gains and narrow the gap between themselves and NBAD or whether they will leave takes strategic initiative to the international banks most active in the emirates such as HSBC or whether Emirates NBD will recharge its focus to regain ground lost in recent years.

Amongst Islamic Banks, both Abu Dhabi Islamic and to a lesser extent Sharjah Islamic, conveyed some improvement in performance but have in no way gained as one might have expected from the market-share attrition seen from Dubai Islamic, whose share loss has been absorbed largely by the conventional segment. This begs the question of whether there is a vacuum to be filled by a strongly focused Islamic bank in trade finance in the Emirates.

Our analysis of the income associated with trade is limited by the fact that only seven of the twelve selected banks report their trade finance earnings separately and these are largely limited to just the fees relating to letters of credit and guarantees and don’t include the trade related finance interest income. This means we cannot track the total overall market earnings from this important business activity. However, we can deduce the overall trend in relation to trade finance by looking at the results of the seven banks that do report trade finance related fees in a segregated manner.

National Bank of Abu Dhabi predictably led the growth in relative market share with a gain of more than three percentage points and, in value terms, more than 50 million AED. Interestingly, National Bank of Fujairah, to which trade is extremely important, also performed very well with a gain of more than one percent in relative share terms and a growth in value terms year on year of more than 30 per cent. Union National Bank and Abu Dhabi Islamic Bank also made relative market share gains whilst others suffered attrition

The reported trade fees for the seven reporting banks reached AED 1.517bn in 2010 up from AED 1.081bn in 2007 and reported growth if modest over 2009, if not yet back to the peak of 2008.

Consequently, the share of trade finance income of total fee income from banking services shrank slightly to 25 per cent in 2010 but remains a prime contributor to fees and total corporate segment operating income. These figures and underlying trends underscore the importance of trade finance income to overall bank profitability.

The relative importance of trade fees to total fees varies substantially from bank to bank from a low of 15.13 per cent for Abu Dhabi Islamic Bank to a high of 60.17 per cent for National Bank of Fujairah suggesting scope for several banks to re-balance, re-focus and or re-price their trade portfolios as part of their overall banking strategy.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East