CMM trade partner CAROLINE MAGINN explains why the company is proud to launch the Tajara Monitor (the”Tajara”) for teh Kingdom of Saudi Arabia (KSA) and the publication’s importance in the field of trade finance

This is the first publication to the market that looks in depth at the trade finance market-place in the KSA and at its underlying drivers, namely:

– the macro-economic indicators – the trends in trade flows themselves, including the geography and industry composition of imports and exports,

– the trends in imports and exports financed by banks in the KSA

– the level of the individual KSA banks’ commitment to corporate banking and trade as a whole

– KSA banks’ respective marketshare and earnings from corporate banking and trade.

In its supporting commentary developments and trends in the trade marketplace are explored to provide a 360-degree view of the market.

The Tajara is intended as an informative reference tool for existing practitioners in the market and new entrants alike. Further editions are planned to cover each of the GCC countries.

The findings serve to inform corporates’ choice of bank to support their trade needs and banks’ strategies with regard to corporate banking and trade in particular.

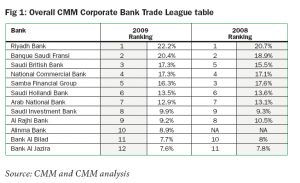

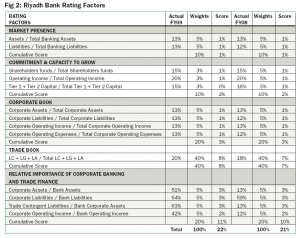

Within the Tajara, CMM publishes a headline Corporate Bank Trade League Table and supporting sub-league tables. In the headline league table the main factors considered can be broken down into the following five elements:

Market Presence

– Commitment and Capacity to Grow

– Corporate Book

– Trade Book

– Relative Importance of Corporate Banking and Trade

These parameters are given specific percentage weightings that are used to calculate the final score per bank. The ratings are assigned on a 0 per cent to 100 per cent scale, which is then translated into a relative market share The purpose of the league tables is to track the major banks’ relative positions in the market.

Trade Book holds the highest weighting in the final score. These broad parameters are further divided into sub-parameters which have their specific weightings and total up to make a score for their respective broad parameter. The rating parameters that drive the scoring which is translated into a relative market share are as follows:

Market Presence

– Total Assets/Total Banking Assets

– Total Liabilities/Total Banking Liabilities

Commitment and Capacity to Grow

– Share of Shareholders’ Funds

– Share of Total Operating Income

– Share of Tier I plus Tier II Capital

Corporate Book

– Share of Corporate Assets

– Share of Corporate Liabilities

– Share of Corporate Operating Income

– Share of Corporate Expenses

Trade Book

– Share of Trade Finance Contingent Liabilities

Relative Importance of Corporate Banking and Trade

– Share of Corporate Assets

– Share of Corporate Liabilities

– Share of Trade Contingent Liabilities

– Share of Corporate Operating Income

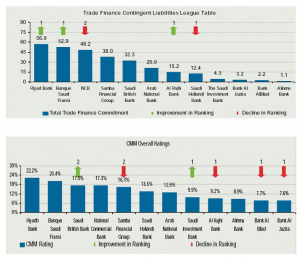

For the second year running, Riyad Bank tops the league table refl ecting its continuing strong focus on corporate banking as a whole and delivery of trade credit to its clients. It appears to have benefi ted from its early investment in a web-based, leading-edge trade fi nance service to satisfy customers and cut cycle times and ineffi ciencies from the processing of trade.

banking as a whole and delivery of trade credit to its clients. It appears to have benefi ted from its early investment in a web-based, leading-edge trade fi nance service to satisfy customers and cut cycle times and ineffi ciencies from the processing of trade.

Also, the strength of its lending activity to commerce, industry, transportation & communications and the mining & quarrying Banque Saudi Al Fransi remains at no 2 position but demonstrated solid growth in market-share year-on-year and its continuing focus on trade.

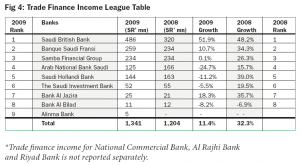

Other banks, most notably Saudi British Bank, are joining Banque Saudi Fransi to challenge for Riyad Bank’s no. 1 position. They improved their ranking from 5th to 3rd in the league table. As we see further below in the Trade Finance Fees and Commissions League table, Saudi British Bank recorded the fastest growth in fee income from trade finance in 2009, continuing from its stellar performance in 2008. From SAR 319.7mn in 2008, trade finance income for the bank grew at an astounding rate of 51.9 per cent in 2009 to touch SAR 485.5mn. Samba Financial Group dropped from 3rd position to 5th, swapping places with Saudi British Bank and suff ered attrition in its relative market share score, notwithstanding the strength of its lending to the Building & Construction, Banks & Other Financial Institutions and Agriculture & Fishing sectors.

National Commercial Bank and Saudi Hollandi Bank maintained their positions and relative market share scores at 4th and 6th positions respectively. NCB maintains its strong position in overall lending to the personal sector (not traditionally highly dependant on trade) but also the Public / Government and Services sectors, which do depend on trade services and can build on this for the future.

Arab National Bank maintained its position at no.7 in the bottom half of the league table suff ering some attrition in its relative market share and suff ered the sharpest fall in trade fi nance income in 2009 as we see further below. From SAR 165.8mn in 2008, fee income from trade finance fell by as much as 24.7 per cent to SAR 124.9mn.

Towards the bottom end of the table, the Islamic Banks vied with the Saudi Investment Bank, which swapped positions with Al Rajhi Bank to take 8th position. Alinma Bank is new to the league this year and made its debut not at the bottom of the league table as one might expect but at 10th position superseding both Al Jazira and Al Bilad Bank. It is worth noting that the Islamic Banks’ collective rating rose illustrating that the demand for Islamic services from corporate banking services as a whole and trade in particular is growing.

If we could add to this the trade and corporate lending business booked by conventional banks through their Islamic banking windows, (which is currently unbundled in the figures available), we estimate that the actual size of the Islamic market and growth therein is substantially greater. The information to arrive at a more precise picture of the Islamic position in the overall market is not yet available but CMM will be monitoring market developments in this arena with great interest and expects the growth trajectory to continue.

At the same time, ICIEC has taken a lead in developing a sharia’h compliant trade credit insurance offering heralding the increased role of other financial institutions in the KSA trade finance market-place as covered in a separate article in this edition of the magazine.

In constructing its overall Corporate Banking and Trade league table, CMM does an in-depth analysis of the KSA banks. By way of illustration, we include above the profile for Riyad Bank, occupying the No. 1 slot in the league table this year. Profiles on each of the other banks included in the league table are available in the full Tajara report.

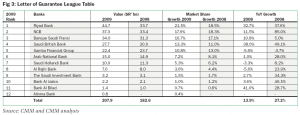

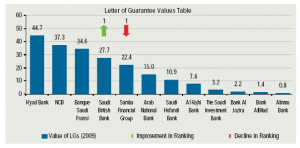

Analysis of annual reports of 12 KSA banks gives us an insight into the primary categories of trade finance products in the country. These include Letters of Credit (LC), Letters of Guarantee (LG), and Letters of Acceptance (LA). At SAR 207.9 bn, LGs were the no.1 trade product accounting for 72 per cent of total trade finance products outstanding as of December 31 2009.

In fact, both the value and share of total trade attributed to LGs outstanding for these banks went up in 2009, in contrast to other trade finance products that reduced slightly but not as sharply as the underlying trade flows.

CMM publishes its LG league table below to provide an insight to market dynamics. Similar league tables on LCs and Acceptances are available in the full Tajara Report.

So, even as total trade finance products outstanding overall grew by 5.4 per cent in 2009 to SAR 287.6bn, LGs outstanding increased by 13.9 per cent to SAR 207.9bn. In contrast, LCs outstanding fell by 6.5 per cent to SAR 65.7bn and Acceptances fell by 30.2 per cent to SAR 13.9bn.

Growth in Trade Finance Income Slows in 2009 though Prospects Remain Bright.

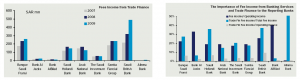

On expected lines growth in fee income from trade financing decelerated last year as trade fl ows declined and bank credit became tighter. nonetheless, for the nine Saudi banks that clearly declare their trade finance income, fee income from trade finance grew by 11.4 per cent to SAR 1.34bn in 2009, compared to a 32.3 per cent growth the year before. Th is growth in profit contribution from Trade Finance fees and commissions is in stark contrast to some other product areas which have witnessed declines.

Fees Income from Trade Finance

Th e performance of trade fi nance in these seven banks was much better than their overall fee income and total operating income and proved itself a safe haven in terms of profi t contribution.

The importance of fee income from banking services and trade finance to the seven reporting banks.

In fact, the importance of trade finance in the overall performance of these seven banks has been rising over the years. In 2006, fee income from trade finance made up a mere 7.1 per cent of total fee income for these banks while accounting for 2.9 per cent of their total operating income. This is not surprising, given the rising volumes of Saudi Arabia’s international trade flows coupled with innovations in banking in the country such as new technology and introduction of sharia’h compliant products.

Our survey of banks in the country reveals that greater innovation in designing secure products, both conventional and Islamic, along with easier online transactions is set to increase as banks focus on secure products and easier access to fi nance for both importers and exporters.

The report concludes:

The banking sector in the KSA has won accolades from rating agencies as well as investors across the world due to its stability. notwithstanding the global turmoil, which has adversely affected banks’ appetite globally to extend credit and/or build assets, the corporate banking sector within the KSA has held fi rm.

Corporate banking continues to be the mainstay of KSA banks as corporate loans accounted for 40 per cent of the total loan portfolio of banks sampled in 2009. A more detailed analysis of banks asset segmentation is available in the full Tajara report.

At the same time, corporate banking operating income accounted for a 32 per cent share of total operating income in 2009. A more detailed analysis of operating income segmentation is available in the full Tajara report.

Hence, corporate banking is of core importance to banks within the region and does not play second fiddle to other business lines.

The report also concludes that the surge in international trade, upon which all countries depend as part of an integrated economy, would not have been possible without the means of secure financing and risk mitigation provided by banks.

The nature and level of international trade has brought forward opportunities for KSA banks to provide trade related services in an increasingly innovative way; and this, in turn, has given them the means to diversify their sources of income.

Countries such as the KSA, for which international imports and exports are a critical component of the economy in good times and bad (imports amount to 22 per cent of GDP and exports 50 per cent of GDP) are broadly resilient to downturns in the global economy.

Th e country is dependant on the external world for food products, heavy machinery, equipment and transportation, which it continues to import throughout the economic cycle, and the rest of the world is dependant, regardless of the price, on the country’s oil related exports, so these flows continue in good times and bad if sometimes contracted.

Accordingly, in recent years the large volume in foreign trade has opened growing opportunities in the trade fi nance market-place and a resultant growth in income for banks as demonstrated above. Th is performance in 2009 is a testament to the resilience of the trade finance market, which has contributed attractive fee-based earnings with low volatility to the banks involved.

The large planned infrastructure spending will bolster trade and the resultant trade finance opportunity for the foreseeable future and make companies more demanding of their banks.

The signifi cant demand for sharia’h compliant trade fi nance services is not to be underestimated and there is signifi cant scope for banks to innovate in this regard and ultimately export such solutions to other parts of the world; particularly South East Asia and other MENA countries.

Banks have been drawing on the well established principles of Murabaha and Musharaka in the context of which they service diff erent forms of letter of credit, documentary collection and guarantee in compliance with sharia’h. however, there is signifi cant scope for banks to build a market leading integrated sharia’h compliant range of finance, risk mitigation, credit enhancement and transaction banking services to support the end-toend trade flow.

In the way that banks engaged in the Sukkuk market to evolve bond offerings in a sharia’h compliant way, and remove the disadvantage experienced by Islamic borrowers who could not tap the conventional bond markets, they can also further the international Islamic marketplace for trade finance.

CMM forecasts that the development of the trade fi nance market-place will echo the success of the Sukkuk market, which has grown from a modest start in 2002 to reach a peak in 2007 at $34bn, dropping to $15.5bn in 2008 and rebounding in 2009 to $16.2bn.

Based on leading indicators in the first quarter of 2010 and for the month of April 2010, the level of private sector imports and exports fi nanced under LCs has grown year on year. CMM forecasts another year of growth in double digits in the overall trade finance market-place based on current market conditions. A fuller analysis is available in the full Tajara report.

The Tajara will be updated at regular intervals and the full report is available on request. Enquiries can be submitted to the Editor at editor@cashandtrademagazine. com

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East