SWIFT’s RMB Tracker shows that 35% of the banks making payments with China and Hong Kong are using the RMB, representing a 6% increase over the last two years.

SWIFT’s RMB Tracker shows that 35% of the banks making payments with China and Hong Kong are using the RMB, representing a 6% increase over the last two years.

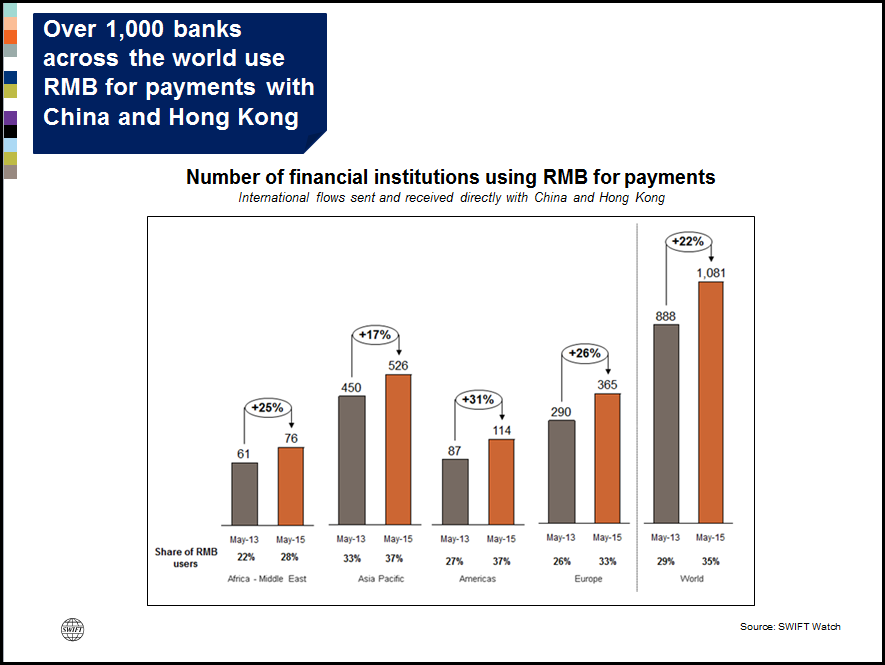

Brussels, 25 June 2015 – Recent SWIFT data shows that the growth in RMB payments is supported by an increasing number of banks. In May 2015, 1,081 financial institutions used the RMB for payments with China and Hong Kong, representing 35% of all institutions exchanging payments with the latter across all currencies. This is a 22% increase in the number of institutions using the RMB and a 6% increase in adoption, up from 29% two years ago.

In May 2015, RMB adoption for payments by financial institutions in Asia Pacific increased to 37% from 33% in May 2013. During the same time period, the Americas experienced even stronger growth with financial institutions increasing their use of the RMB for payments by 10%, leading to 37% adoption. Europe follows closely with 33% adoption and Africa – Middle East with 28%.

“Every month we witness new proof of global RMB adoption”, says Michael Moon, Head of Payments, Asia Pacific, SWIFT. “The number of banks that use RMB for payments with China and Hong Kong is a key internationalization indicator. This large number also shows that many banks, across the globe, may have an interest in connectivity to the China International Payment System that China will launch by end of the year”.

Overall, the RMB strengthened its position as the fifth most active currency for global payments in value and accounted for 2.18% of payments worldwide in May 2015. Although all currencies decreased in value by 3.1%, RMB payments increased in value by 1.99% compared to April 2015 which leads to its record high share in global payments.

About SWIFT and RMB Internationalisation

Since 2010, SWIFT has actively supported its customers and the financial industry regarding RMB internationalisation through various publications and reports. Through its Business Intelligence Solutions team, SWIFT publishes key adoption statistics in the RMB Tracker, insights on the implications of RMB internationalisation, perspectives on RMB clearing and offshore clearing guidelines, supports bank’s commercial RMB product launches and provides in-depth analysis and business intelligence, as well as engaging with offshore clearing centres and the Chinese financial community to support the further internationalisation of the RMB.

The SWIFT network fully supports global RMB transactions, and its messaging services enable Chinese character transportation via Chinese Commercial Code (CCC) in FIN or via Chinese characters in MX (ISO 20022 messages). It offers a suite of dedicated RMB business intelligence products and services to support financial institutions and corporates. In addition, SWIFT collaborates with the community to publish the Offshore and Cross-Border RMB Best Practice Guidelines, which facilitate standardised RMB back office operations.

Please click here for more information about RMB Internationalisation or join our new ‘Business Intelligence Transaction Banking’ LinkedIn group.

About SWIFT

SWIFT is a member-owned cooperative that provides the communications platform, products and services to connect more than 10,800 banking organisations, securities institutions and corporate customers in over 200 countries and territories. SWIFT enables its users to exchange automated, standardised financial information securely and reliably, thereby lowering costs, reducing operational risk and eliminating operational inefficiencies. SWIFT also brings the financial community together to work collaboratively to shape market practice, define standards and debate issues of mutual interest.

For more information, visit www.swift.com or follow us on Twitter: @swiftcommunity and LinkedIn: SWIFT

Contacts:

Borouj Consulting

swift@boroujconsulting.com

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East