Middle East Needs to Reduce Vulnerability to Financial Crime

KPMG Global Anti-Money Laundering Survey emphasises far-reaching global AML regulations, reveals MEA readiness and challenges

UAE more proactive since criminalising act of money laundering in 2002

Dubai, 22 April 2014: KPMG’s Global Anti-Money Laundering (AML) Survey 2014 reveals the growing importance of AML globally and in the region, with regulatory fines now running into billions of dollars, regulatory action becoming genuinely license threatening and increased threats of criminal prosecution against banks and individuals.

The survey also highlights the continuing need in the wider Middle East to reduce the region’s vulnerability to financial crime, and how countries including the UAE are taking measures to implement tougher systems.

In KPMG’s recently published Global Anti-Money Laundering (AML) Survey, 88 percent of participants affirmed that AML has emerged as a key area of focus for senior management. The survey drew 317 respondents from AML-related professional backgrounds from across 48 countries.

AML in the Middle East

The financial services industry worldwide and in the UAE is making significant changes in response to regulatory action and increasingly far-reaching global AML regulations, changing the AML scene from a standalone function under compliance, to a complex and overarching function cutting across legal, risk, operations and tax.

Recently, the Financial and Economic Affairs Committee (FNC) in the UAE announced changes in its key money laundering legislation. Additionally, it changed the name of the draft law to ‘Anti-Money Laundering and Combating the Financing of Terrorism’.

In the first draft, the FNC had included four activities that were considered criminal offences – transferring, depositing, transmitting or replacing money with the purpose of hiding or disguising its illicit origin. The FNC has also added two more offences: saving or investing in illegal money.

The National Anti-Money Laundering Committee (NAMLC- UAE) has been proactive and plays a key role in proposing AML rules and procedures in the UAE, facilitates exchange of information and coordination between agencies represented in the Committee and represents the country at international AML forums.

In the recent past, the Governor of Central Bank of the UAE and Chairman of the National Anti-Money Laundering Committee (NAMLC) inaugurated an annual specialised seminar for the NAMLC at the Central Bank’s Head Office in Abu Dhabi. The core areas of discussions were AML/CFT training programs, supervision and examination methodology on AML/CFT, the AML and Suspicious Cases Unit’s online STR System and Suspicious cases analysis methodology including international cooperation.

Several countries in the Middle East are striving to have more robust AML and Countering the Financing of Terrorism (CTF) functions in place. In this regard, the UAE has been proactive and criminalised the act of money laundering in 2002. Various AML related rules and regulations have also been issued by both the UAE Central Bank and the Dubai International Financial Center (DIFC). The law applies to any individual or entity operating within the territory of the UAE including the DIFC.

While the profile of AML within the Middle East region has risen over the last three years, the survey states that it still faces some significant challenges around compliance, especially with regard to customer due diligence, transaction monitoring, and Politically Exposed Persons (PEPs) identification. At present, a major concern for the Middle Eastern banks in the AML and the customer due diligence technology space is a lack of data consistency.

Kauzal Ali Rizvi, director Consulting, KPMG Lower Gulf says: “As a rapidly developing region, the Middle East needs to take a more proactive approach towards reducing its vulnerability to financial crime and create infrastructure which will facilitate effective AML enforcement. The AML Survey indicates that 92 percent of respondents considered AML a high risk area.

“Furthermore, the political and civil unrest in the Middle East continues to pose a challenge for financial institutions’ sanctions screening systems in terms of responding to rapid changes to sanctions lists and their increased volumes.”

Key highlights of the global survey:

- AML costs are rising at an average rate of 53 percent for banking institutions, exceeding previous predictions of over 40 percent in 2011

- Only 32 percent of the 95 percent of respondents who have a global policy are able to maintain global consistency across subsidiaries and branches

- Politically Exposed Persons (PEPs) remain an area of focus, gaining increased attention from senior management. 82 percent of respondents said that senior management is involved in the sign off process

- Know Your Customer (KYC) continues to be an area of concern, with 70 percent of respondents stating that they had been subject to a regulatory visit focusing on this area

- Sanctions compliance remains a challenge

- Transaction monitoring systems continue to represent the greatest area of AML spending

- Regulatory approach was ranked as the top AML concern, with 84 percent of respondents stating the pace and impact of regulatory changes as significant challenges to their operations.

Overall enhanced investment in AML

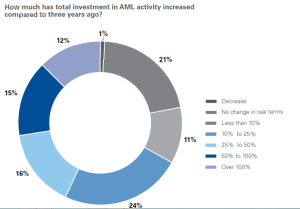

In 2011, 8 percent of respondents predicted an over 50 percent increase in expenditure. In reality 22 percent of respondents increased expenditure by over 50 percent during the three year period from 2011. It is not uncommon for survey respondents to underestimate the increase in AML expenditure and it has been a consistent theme over previous KPMG AML surveys.

Although the reasons behind this remain unclear, it may be related to the fact that AML practitioners, as well as senior management, do not anticipate the announcements of regulatory changes, nor the speed in which new regulations are expected to be implemented.

Seventy eight percent of survey respondents reported increases in their total investment in AML activity, with 74 percent also predicting further increases in AML investment over the next three years.

Emerging trends

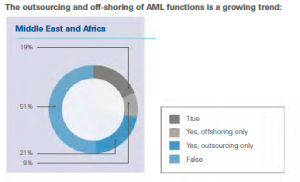

Outsourcing and offshoring of AML functions have emerged as a growing trend, but respondents show reservations about adopting such practices due to a perceived lack of control and oversight.

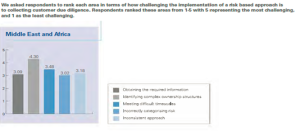

Banks surveyed in Middle East and Africa indicated that the three main concerns on their AML agenda are the lack of qualified resources (76.6 percent), the pace and impact of regulatory change (72.3 percent) as well as the lack of overall training (72.3 percent).

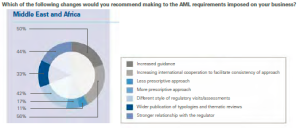

When asked about the changes recommended to the AML requirements imposed on businesses, 56 percent of respondents in the Middle East and Africa stated that they would like to see increasing international cooperation to facilitate consistency of approach. The responses to the survey indicate that financial institutions operating in the region would like their regulatory authorities to become more involved in the globalization of AML standards, learning from their counterparts in other countries to improve the regulatory approach in this region.

The latest set of Financial Action Task Force (FATF) recommendations require member governments to complete a National Risk Assessment to identify, assess and mitigate their money laundering and terrorist financing risks. These assessments, once completed, are likely to influence the areas which each of the national regulators will focus on over the coming period.

Regulators expect financial institutions to identify their clients’ ownership structures and the rationale behind them. Peeling back the layers of ownership can be complex and time consuming, but it is necessary to identify the ultimate beneficial owner, so KPMG anticipates an increase in this practice over the next three years.

As the financial services industry moves towards a globally standardized approach, inconsistent regulations have left gaps in which money launderers have been able to thrive. It has become imperative for regulators to implement a consistent regulatory approach and foster a closer working relationship with industry professionals in order to leverage each other’s resources, align mutual interests, and effectively tackle financial crime.

* Image source: Global Anti-Money Laundering Survey, KPMG International 2014

About KPMG Global AML Survey 2014

The survey results are based on responses from 317 AML and compliance professionals in the top 1,000 global banks, according to the 2013 edition of The Banker Magazine, as well as to KPMG’s contacts in 48 countries. The questionnaire was distributed in November 2013.

About the AML Network

Within KPMG, the AML network consists of over 350 professionals from around the world. KPMG has provided AML advisory assessments worldwide, and contributed to some of the largest AML investigations and program rehabilitations in recent history. Whether assisting a financial institution proactively seeking to improve its program or reactively responding to a regulatory order, we are able to provide services to address many manners of AML program improvement sought by the financial community in today’s marketplace.

KPMG has been named Global AML Firm of The Year at the Finance Monthly Global Awards 2014

Outstanding AML advice is about understanding the risks and devising a proportionate response. Our member firms’ AML teams pride themselves on their practical experience of implementing AML programs at major institutions, both as employees and as advisors. We have also undertaken some of the largest international remediation and look-back exercises in recent years. The lessons we have learned coupled with our track record working at and with regulators allow us to understand what meets compliance standards whilst also making commercial sense for you.

About KPMG

KPMG is a global network of professional firms providing Audit, Tax and Advisory services. We operate in 155 countries and have more than 155,000 people working in member firms around the world. The independent member firms of the KPMG network are affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. Each KPMG firm is a legally distinct and separate entity and describes itself as such.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East