Keeping you up-to-date with the latest developments in the region and further afield

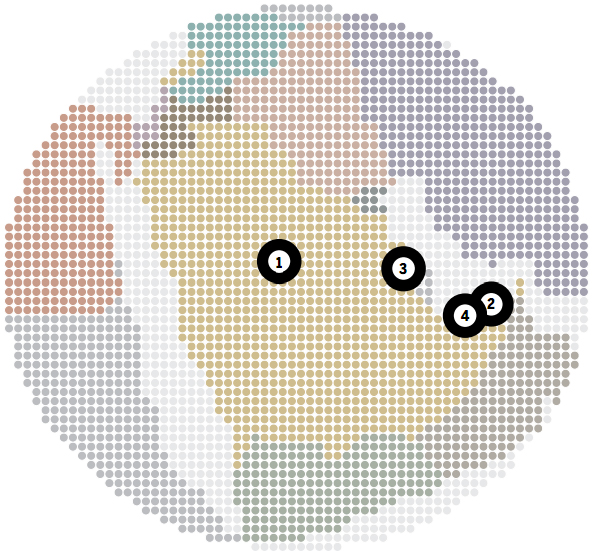

1.Saudi Arabia

MoneyGram expands Middle East presence with NCB ATM remittance deal

National Commercial Bank (NCB), the largest bank in the Middle East, is to offer MoneyGram’s international money transfer service at 1400 aTM locations in Saudi Arabia.

The agreement significantly expands MoneyGram’s presence in the Kingdom, which is seen as a leading global remittance destination.

home to more than six million expatriates, Saudi Arabia saw remittances grow to more than $17bn in 2006, according to the World Bank.

Safe and simple mioney transfers are vital for expatriates who frequently need to send money home to their families who depend on it arriving swiftly.

Anthony Ryan, president and CEO of MoneyGram international, comments: “Saudi Arabia is the second largest send market in the world behind the united states, and our alliance with a premier financial institution like national Commercial Bank represents a significant opportunity for MoneyGram’s expansion plans in the Middle East.”

MoneyGram has been operating in Saudi Arabia since 1998 and manages its services to the region from an office in Dubai.

These transfers at NCB will be sent over NCB’s Quickpay platform. Initially, only send services will be available.

2.Dubai

NASDAQ Dubai taps SunGard for equity derivatives trading

SunGard has extended the capabilities of its GMI system to facilitate processing of equity derivatives traded on NASDAQ Dubai, the Middle East’s international stock exchange. GMi is a clearing and accounting solution for exchange traded derivatives, futures and options.

SunGard’s GMI helps NASDAQ Dubai customers and exchange members to readily trade and process business on the new exchange. GMI has been customized to support futures, futures options, stock futures, equity options, Contracts for differences (CFDs), foreign exchange and dividends listed instruments in the Middle east. it provides the automation firms require to help trade and process transactions from contract to settlement, providing post-trade processing, margin calculation and quick valuation of derivative transactions for brokers and their clients.

NASDAQ Dubai is the only United Arab Emirates exchange that trades equity derivatives. it launched the market in November 2008 by listing futures on the FTSE NASDAQ Dubai UAE 20 index and on 20 individual stocks listed on NASDAQ Dubai, the Dubai Financial Market and the Abu Dhabi securities exchange. in April 2009 NASDAQ Dubai added an equity options service .

3. Bahrain

National Bank of Bahrain H1 net profit marginally ahead

National Bank of Bahrain reported net profit of Bd25.60m ($68.09m) for the 6 months through June 30, compared to Bd25.57m($68.01m) for the corresponding period last year.

net interest income rose to BD25.14m ($66.86m) from BD22.70m ($60.37m), while ‘other income’ fell to BD13.32m ($35.43m) from BD15.42m ($41.01m)– principally due to a fall in income from syndications and mutual fund business on account of a slowdown in market activities. Operating expenses meanwhile increased to BD12.69m ($33.75m) from BD12.55m ($33.38m) due to ‘expanding business requirements’. no major credit deterioration was noted and therefore no impairment provision for loans was made during the period.

Loans and advances as at June 30 were 7.9% at BD1.15 bn ($3.07 bn). Customer deposits stood at BD1.43bn ($3.81bn), compared to BD1.37bn ($3.64bn). The annualised return on average equity of 23.6 % during h1 2009 compared to 20.7 % in the half of 2008.

Union National Bank, one of the uae’s leading banks, has announced the introduction of the interest in advance deposit.

It enables account holders to receive interest on their deposits in advance as and when they place the deposit with unB, instead of at the time of deposit maturity. Customers can book an interest in advance deposit for a minimum amount of aed 100,000. Customers can choose a period from a range of 9 months to 24 months based on their convenience. Commenting on the launch of unB’s latest product offering, Mahmoud halawa, executive Vice President & head of Business Groups said: “The interest in advance deposit account has been introduced to provide our customers with an attractive value-addition and is in line with our philosophy of being ‘the bank that cares’. The guaranteed return on deposits at the time of placing their deposit with us enables customers to enjoy immediate liquidity…This latest initiative underlines our commitment to offer innovative products and services in a bid to help our client base accomplish their financial goals “, he added. The launch of this latest product which is primarily targeted at medium & high net Worth individuals, is in line with the unB’s multi dimensional approach aimed at targeting all segments of the uae community via various socioeconomic initiatives.

4. UAE

Customers can enjoy compliance with new regulations outlined by UAE Ministry of Labour

HSBC Bank Middle east ltd announced the official launch of the new Payroll Card service, which will allow customers to process salary payments electronically while giving their employees the benefit of security Regional roundup Keeping you up-to-date with the latest developments in the region and further afield and the convenience of a debit card. The service is being provided in partnership with C3 Card, a company specialising in prepaid card and payroll services.

With this new service, companies employing a large number of low wage earners can ensure convenient and timely payments of employee salaries. The MasterCard prepaid card can be used at ATMs across the uae and the world. Card users can also swipe their card at any enabled point of sale store terminals to make purchases.

Paul edgar, head of Transaction Banking, HSBC Bank Middle east, says “Our new payroll product further enhances our extensive menu of business services. existing wage payment methods have been fraught with inefficiencies as well as posed security issues. With our new and innovative solution, customers can be assured of making prompt payments in an expedient manner, electronically.

“The Ministry of labour is in the process of implementing the Wage Protection system in order to protect workers’ dues. We believe that the use of a robust electronic payroll system will have an essential role to play in delivering this objective.in order to help with usage and overcome first time card user difficulties, hsBC will work with its partners to provide training support. user enquiries will be attended to through a dedicated telephone line available through the C3 support lines in many languages including english and hindi. Mobile ATM vans may be made available to visit large customer sites, if this is requested as a part of the service proposition.The payroll card is a Pin protected card and will have the user’s name and passport/labour card number imprinted on the card. The user can access the funds anywhere using any ATM connected to the uae’s aTM network. With the new Payroll Card service, HSBC has revolutionised the banking experience of low income earners enabling us to provide our employees with a more efficient and comfortable work environment .

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East