With trade finance very central to banks’ boardrooms in the region at present and topical globally for a variety of reasons, Cash&Trade is publishing extracts from CMM’s Tajara Monitor research series on the leading countries within the GCC and summarising key drivers in the market current in bankers’ minds, tabling important questions for banks to address with their clients, partners and suppliers. The GCC Tajara Monitors look in depth at the trade finance market-place in each of the GCC countries and at the underlying drivers of the markets. The level of coverage varies to some extent by country but CMM uses its experience to find the appropriate quantitative proxies, where possible, to measure each of the key areas covered therein consistently. CAROLINE MAGINN, trade partner at CMM, reports

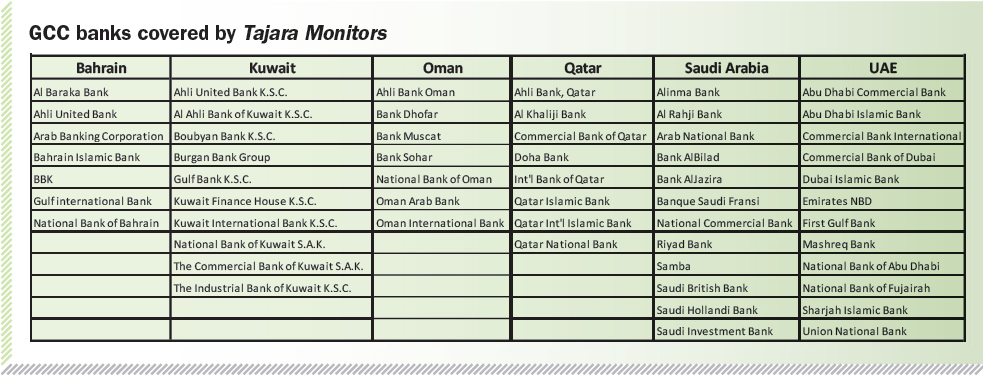

In the Tajara Monitors we analyse the performance of the banking market as a whole and look at the detailed individual performance of the leading indigenous banks that we consider to be cornerstones of corporate banking and trade finance in each of the GCC countries. These banks are:-

The market place is dynamic and presents an opportunity for many GCC and international banks. This drives an incentive in the market, for banks that can, to achieve a competitive edge in this important growth area. This is a means to entrench their overall corporate and banking franchise to create and introduce to the GCC market leading conventional and Shari’ah compliant product and service propositions for trade.

With SIBOS being hosted by SWIFT in the UAE, there is scope of fuelling some new avenues of discussion between banks and their FI relationships during the convening period.

Whilst globally there are concerns about the impact of the fiscal crunch in Europe, sluggish GDP growth and on the increased Basel III provisions for capital and liquidity for trade flows, trade finance is very much booming in the GCC and parts of Asia.

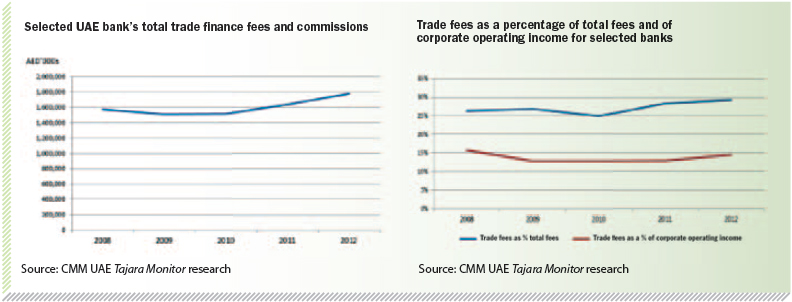

This year we introduced an index to measure the commissions-based return on trade finance capital and this is referred to in the relevant Tajara Monitor extracts (the CMM Commission on Trade Finance Index). These make a compelling business case for supporting trade finance with the majority of banks registering returns on capital employed of significantly above 20 per cent.

Overall, the level of bank intermediation in trade finance has been consistent, the value of flows has been rising and banks have recorded steadily rising valuable fees and commissions from trade as well as significant financing profit shares or interest from the region’s largely trade related corporate banking. At the same time, investor interest in trade finance is growing and diversifying and the GCC is playing a noticeably increasing role as net lender and liquidity provider.

At the same time, trade finance innovation spans a wide range of fronts including:

- initial tapping of the domestic and overseas capital markets for trade transactions in the form of securitised Islamic Lease “Sukuk” offerings

- very noticeably rising Export Credit Agency (ECA) backed financing

- the spread of both conventional and Islamic factoring propositions,

- increasingly sophisticated primary and secondary market trade syndications and participations.

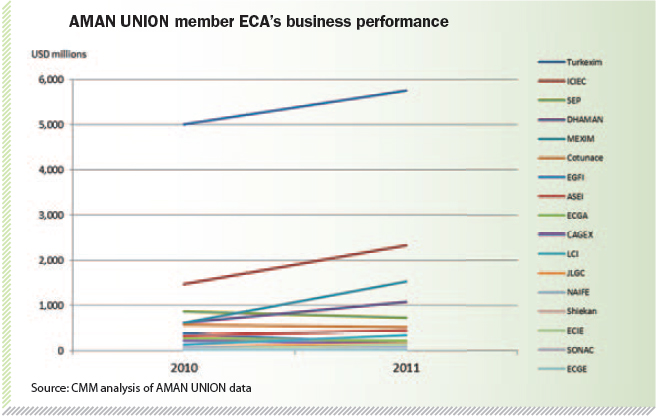

To take the ECA development as an example within the GCC there has been significant development of activity in recent years from virtually a standing start. In 2011 the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) arm of the Islamic Development Bank wrote more than $2bn of cover whilst Dhaman, also a multi-lateral ECA in the region, underwrote more than $1bn. Additionally, the domestic agencies in the KSA, Oman, the UAE and, most recently, Qatar built their books up to between $150-700m in 2011.

This is a remarkable achievement and testament to the emerging political will across the region to get fully behind export promotion for non-oil as well as oil flows and SMEs.

It is worth commenting on the ethos of the region’s agencies, which involves working with importers and exporters to secure solutions to difficult problems when they arise to underpin sustainable trade between bona fide parties without redress unless as an exception to the courts.

Additionally, private insurers such as COFACE, Sovereign Risk Insurance and Atradius are building their focus on the region with underwriters on the ground and providing, inter alia, re-insurance services.

Moreover, trade finance has continued to evolve in many dimensions to facilitate new instruments such as the Bank Payment Obligation and the Uniform Rules of Forfaiting and ISBP revision, amongst others; all of which add to the need to develop skills and competencies amongst trade finance practitioners and IT operations and risk management infrastructures at their banks to deliver against these evolving needs.

With all of these factors in play, trade finance is becoming increasingly complex in the region as well as globally. It still defies a broad-scale in-depth comprehension by many mainstream bankers and regulators.

This knowledge gap, at its worst, can render toothless any broader discussions of the often referred to, but still elusive, supply chain finance that many bankers have with their corporate clients.

The structure, pricing and day-to-day delivery of trade finance solutions, on both the buy and the sell side whether domestic or international trade, is key. This means helping clients to manage risk and secure finance and staying on top of the associated credit approvals, document and liquidity movements on an intra-day basis; and that translates into a sustainable alignment of the multi-disciplined teams involved in some aspect of the equation.

Banks can simply not go it alone to deliver trade finance but depend vitally on their proprietary or third-party overseas FI relationships in the forms of banks, ECAs and insurers. By definition, at least four parties are involved in delivering the component steps in the chain of a single trade transaction; each one crucial in ensuring clarity, transparency and fair play in the exchange of goods for payment or promise of payment and in turn playing the vital role of trusted intermediaries with reference to the ICC Banking Commission’s rules framework.

Everyday challenges to banks and providers of trade finance in the fine-tuning of their business proposition to clients include:

- utilising the collective experience of resources and trade transaction history with clients to be better leveraged in order to make informed investment decisions about new trade products to bring offerings up-to-date and provide clients with the flexible terms they need to compete

- structured training programs to inform all levels of staff, as well as clients, of developments in the field in order to enhance efficiency and streamline product provision

- consideration of how to deepen FI relationships; whether in terms of insurance, re-insurance, underwriting of trade liquidity or reciprocal LC and LG business flows to maximise the leverage of capital committed and the level of service offered to clients

- enhancement of relationships with FIs, with whom banks have already multi-faceted partnerships, in terms of confirmation lines, trade syndications, mutual participations and reciprocal LC and LG flows in the key MENA region countries

- in light of developments in the region banks’ requirements to re-assess their footprints in terms of accessing liquidity for the trade business and building rewarding trade portfolios.

The good news for banks is that whilst in some parts of the world some practices and products of banks have fallen into disrepute, trade finance has not. It remains, ethically, one of the most value-added services banks can bring to the table for corporates that import and export and/or buy or sell in their domestic market-places.

Trade financiers, as traditional merchant banks, still play a very valued and systemically important role in the promotion of this activity, which directly creates jobs and facilitates wealth distribution. The rewards for doing so in the Middle East have been considerable and growing in recent years as demonstrated in our Tajara Monitor highlights.

Hence the corporate need of banks services is growing not diminishing in relation to trade finance at the heart of supply chain finance and the arguments, both in terms of reputation, brand, perception of value-added and risk-related financial returns are all currently positive for trade in the Middle East and many other parts of the world, warranting increased senior management attention and investment.

What remains is an opportunity for banks in the region to develop teeth around their supply chain discussions with clients and to articulate and publish meaningful trade balanced scorecards around their own aggregate unique selling point when it comes to delivering trade solutions.

*In constructing the new CMM Commission on Trade Finance Index “CTFI” for the overall KSA, UAE and other markets CMM computes for the first time the commission element of the return on capital employed by banks providing trade liquidity through letters of credit, letters of guarantee. Clearly there are other elements making up the total return on capital for trade such as the FX, cash management and trade related lending. That said, the CTFI are:

- sizeable and growing

- an attractive, non-interest or lending margin sensitive element of the financial reward for bankers of trade flows.

By introducing this index we hope to bring greater transparency and understanding of the returns to shareholders of capital employed in trade finance. We specifically measure the returns on the trade-related contingent liabilities’ portfolios of banks individually and collectively. To arrive at this CTFI:

- we have estimated the capital employed in light of the current Basel provisions and the tenor and type of trade instruments on banks’ audited books as of the year-end reporting dates

- we have applied the credit conversion factors

- we have calculated the trade-related risk-adjusted capital required by applying a minimum total capital ratio as prescribed by current Basel provisions

- we have computed the CTFI based on trade commissions divided by the relevant risk adjusted capital required and expressed this as a percentage for purposes of comparison.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

One comment