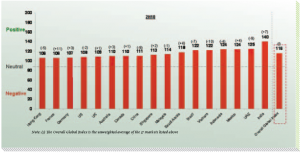

An overall positive outlook across emerging and developed economies has been highlighted in the recently released hSBC survey. It shows respondents from India (140 points), the UAE (125), Mexico (124) and Indonesia (124) as being the most confi dent about trade activity and growth.

An overall positive outlook across emerging and developed economies has been highlighted in the recently released hSBC survey. It shows respondents from India (140 points), the UAE (125), Mexico (124) and Indonesia (124) as being the most confi dent about trade activity and growth.

Emerging markets positive

Improved sentiment was especially evident in France, India and Saudi Arabia, where confi dence scores rose by an

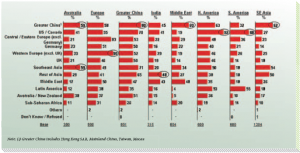

average of six per cent since the last survey, conducted in the fi rst quarter of 2010. Overall, 55 per cent of importers and exporters globally expect trade volumes to increase. Emerging markets were most positive, with Greater China (61 per cent), Australia (57 per cent) and India (70 per cent) leading the group.

“Although global trade confidence remains securely in positive territory despite prolonged uncertainty in developed markets and a normalisation of growth in the emerging world, the dynamics are changing. In the ‘new normal’, emerging markets such as the Middle East will be firmly at the core of trade momentum with intra-regional trade serving as the lynchpin,” commented Simon Vaughan Johnson, head of commercial banking, hSBC Middle East and North Africa.

In the UAE, which has a trade turnover to GDP ratio of 140 per cent, there has been a significant move by the federal government to build activity in the trade sector to benefit the wider economy. These initiatives have been well received in the Emirates, with 47 per cent of respondents indicating that government trade regulation is likely to have a favourable impact.

“We are happy that the international business community continues to view the UAE with exceptional confi dence,” said Sheikha Lubna Al Qasimi, UAE Minister of Foreign Trade. “Th e survey results will be of great help in disseminating our business policies and implemented plans and highlighting our success in enhancing our commercial environments. Th ey will also refl ect the fl exibility enjoyed by our commercial sector and the national economy as a whole.

“We are also pleased to learn that India has assumed the top spot in global trade confi dence. India is our leading foreign trade partner so its commercial success will defi nitely have a positive impact in our bilateral transactions.”

Investments made by the UAE government throughout recent decades have built secure and comfortable urban centres, attracting business people from around the world to set up a base in the Emirates. The expectation of a continued probusiness approach, with limited taxation and free remittances, is a key contributor to the confi dence levels displayed in the UAE, with similar pro-business initiatives (such as the Economic Cities) in Saudi Arabia beginning to take root.

Global exporters and importers remain confi – dent about trade prospects, and confi dence among traders is robust, albeit slightly less bullish than in May – an indication of more evenly paced emerging markets growth while growth in the West remains constrained.

It is still clear that emerging markets are continuing to drive global trade as a result of strong prospects and increasing interaction with other emerging markets – in April 2010, Asia trade accounted for 58 per cent of GDP in the region.

Across all markets, Greater China is among the top three places identifi ed as a leading growth prospect over the next six months. Th is all points to Greater China’s strengthening position as the primary trading partner for key Asian markets and emerging markets such as Asia and Latin America.

The fourth wave of the hSBC Trade Confi dence Index shows that 60 per cent of traders in the Middle East report that they are currently trading with Greater China, and 33 per cent identifi ed the region as one of the most promising areas for growth in the coming six months.

In line with this shift in focus, six per cent of regional respondents already expect to trade in Chinese yuan (commonly known as Renminbi, or RMB) in the coming six months, since the People’s Bank of China, China’s central bank, expanded its RMB Trade Settlement Pilot Scheme in June 2010.

Previously, settlement in RMB for cross border trades was permitted only between fi ve pilot cities in mainland China, hong Kong, Macau and the member countries of the Association of Southeast Asian Nations.

“HSBC has already seen, and successfully met, demand for settlement in RMB from a number of our existing customers with business operations in China,” said Vaughan Johnson.

“Research conducted by the bank suggests that the RMB will become one of the world’s global currencies within the next fi ve years, and this latest issue of the hSBC Trade Confi dence Index clearly demonstrates the importance of China to regional traders, and a continued appetite for eastern expansion.”

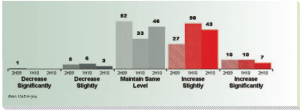

Both globally, and in UAE, more than 90 per cent of respondents expect their need for trade fi nance to be maintained or increased. Th ose economies expecting the most increase in the need for trade fi nance are India (59 per cent) and South-East Asia (42 per cent) followed by the Middle East (41 per cent), including the UAE (50 per cent).

Focus on banks

Similar to the earlier survey, more than 90 per cent of global as well as UAE respondents expect their access to trade fi nance to be maintained or increased.

Middle Eastern traders also showed a renewed confi dence in the fi nancial sector as a source for trade fi nance, with 37 per cent looking to banks for future trade fi nancing requirements, and 44 per cent noting increased use of trade fi nance through banks as a strategy to avoid buyer default.

“The recent scores have levelled as traders in the region get back to business after a turbulent period in 2009, and returned to growth in early 2010,” commented Kersi Patel, head of trade and supply chain, HSBC Middle East, North Africa. “This focus on growing ‘real’ business has resulted in many companies trusting the financing and security of their trade receivables to the banks. Roughly half of the UAE respondents see a requirement for increased trade finance in the coming months, and banks such as hSBC are well placed to service this demand.”

“Our discussions with many of the industry bodies, such as Chambers of Commerce, or national business groups, as well as in the fi nancial sector and amongst multinationals, tell us that companies in the Middle East have reverted to a ‘back-tobasics’ approach, ensuring that their core business is healthy. Companies that grew during the boom years are now leveraging that experience to identify trade routes and international business opportunities which will fuel the next stage of growth.”

The HSBC Trade Confidence Index, now in its fourth bi-annual iteration, is an international survey among small and mid-market businesses engaged in cross-border trade, which gauges sentiment and expectations on trade activity and business growth in the next six months. The survey is conducted by TNS on behalf of the bank, across 5,124 exporters, importers and traders in Australia, India, Hong Kong, mainland China, Singapore, the United Arab Emirates, Vietnam, Indonesia, Malaysia, the UK, the US, Brazil, Canada, France, Germany, Mexico and Saudi Arabia.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East