Purchasing the correct technology is a matter of supreme importance for banks. PAUL MELLY looks at the pressures behind choosing the right systems to handle treasury, trade finance and cash management transactions What investment route to follow? That’s the complex and usually expensive question that today’s banks are confronted with as they seek to keep pace with the expectations of …

Read More »Cash

Worries revealed in transaction banking survey

BNY Mellon, a global leader in investment management and investment services, in conjunction with the Exporta group and its leading industry publications, has announced the preliminary results of a comprehensive survey entitled Attitudes to Global Transaction Banking. Drawing on responses from banks, financial institutions, corporations and government/multilateral bodies, it addresses topics such as regulation, funding, technology, cash management, and supply …

Read More »CFO’s role now ‘more complex’

Learning from peers is key to fulfilling the chief financial officer’s increasingly demanding role, according to ICAEW, a world leader in the accountancy and finance profession. Recently, it gathered selected CFOs to its first ever CFO Club event in Bahrain to discuss corporate governance challenges and encourage networking. Peter Beynon, regional director, ICAEW Middle East, commented, “The role of the …

Read More »Future success means being ‘nimble and bold’

There are a number of actions that can be taken in transaction banking to gain the edge in a highly competitive climate. Global experts NICLAS STORZ, GERO FREUDENSTEIN and STEFAN DAB explain what they are The question of the moment is, “How can financial institutions gain a competitive advantage in transaction banking in a hyper-competitive climate?” We believe the answer …

Read More »US ‘foreign account’ rule means taxing time for banks

The US Foreign Account Tax Compliance Act (FATCA), which requires all foreign financial institutions (FFIs) to report to the Internal Revenue Service (IRS) on the activities of investors who are US citizens, has created a huge task for banks and wealth management companies worldwide – and the Middle East is no exception. LIZ SALECKA reports on the implications As in …

Read More »Challenges on the horizon

Competition and cost will be just two areas in which the Islamic banking industry can expect future challenges. MUSHTAK PARKER looks at what 2013 has in store Judging by the cornucopia of optimistic press releases, conference speeches and utterings, it is easy to get the impression that the global Islamic banking industry is the new “untouchable” – seemingly untouchable that …

Read More »Sultanate takes ‘steady view’ over start of Islamic banking

The introduction of Islamic banking into Oman is being greeted with caution by the authorities, who wish to manage the ‘orderly development of the industry’. MUSHTAK PARKER looks at the wisdom behind this decision Central Bank of Oman (CBO) officials are advising against any irrational exuberance about the introduction of Islamic banking in the Sultanate following the promulgation of a …

Read More »Play by the rules

WILL SPINNEY, explains what the treasurer needs to know about internal controls and governance. There have been many approaches to corporate governance over the last 20 years, with new approaches constantly suggested. In the UK there has been the Cadbury Report (1992), the Greenbury Report (1995), the Turnbull Report (1999) and the Higgs Report (2003), among others. New mechanisms are …

Read More »NBAD bond bonanza hits a high note

The GCC bond and sukuk markets are now firmly on the radar screens of global investors, according to the National Bank of Abu Dhabi In the middle of Ramadan, when GCC markets are normally quiet, the National Bank of Abu Dhabi launched and concluded a $750m-bond issue, building an order book of circa $4.5bn in less than four hours. A …

Read More »Avoiding the tripwire

Banks are pausing for thought after the latest controversy regarding sanctions concerning Iran. PAUL MELLY reports If in doubt, stay out. That’s likely to be the watchword in future for banks wondering whether there is a legitimate means of serving customers linked to a country that is the subject of international sanctions. This summer saw the New York State Department …

Read More »Where fund preservation is the first priority

Rigorous management coupled with conservative principles have allowed Invesco to demonstrate how its investment options provide security and preserve core values. PAUL MELLY reports. “Our primary focus is to ensure the safe return of each dollar – rather than to take risks to generate an excessive return on a dollar,” says Tim Jackson, institutional product director at Invesco Asset Management. …

Read More »Ministries move into e-banking

Governments across the Middle East are embracing change. The social justice agenda, which has been rolled out across most of the region, has seen them place a stronger focus on spending on employment, healthcare and education reform – as well as investing in infrastructure and the private sector to encourage growth. LIZ SALECKA reports Many governments are now seeking to …

Read More »New era for banks in the sultanate

PAUL MELLY, looks at growing competition in what has traditionally been one of the Gulf’s quieter financial markets News that HSBC is taking a majority stake in Oman International Bank confirms the growing intensity of competition in what has traditionally been one of the Gulf’s less frenetic financial markets. The government’s decision to allow the development of Islamic finance will …

Read More »Play by the rules

There have been many approaches to corporate governance over the last 20 years, with new approaches constantly suggested. In the UK there has been the Cadbury Report (1992), the Greenbury Report (1995), the Turnbull Report (1999) and the Higgs Report (2003), among others. New mechanisms are usually introduced in response to corporate scandals, such as Guinness in the 1980s, Maxwell, …

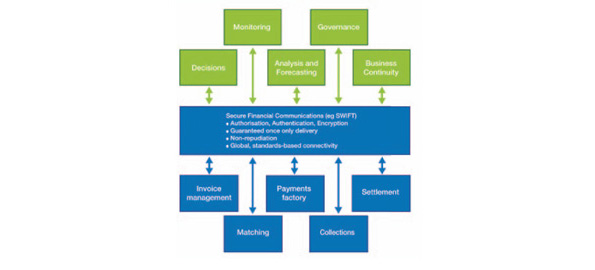

Read More »How to steer through crisis

The scars left behind by the 2008 credit crunch and resulting financial crisis have barely faded and yet 2012 already looks as though it will be another highly challenging year for corporate treasurers. MARCUS HUGHES, business development director, Bottomline Technologies, looks at how they can cope The world economy is once again on the verge of a new crisis as …

Read More »Boost for small business funding

Governments across the Middle East are now looking for ways to help SMEs. MUSHTAK PARKER, looks at what’s in store Small-and-medium-sized enterprises (SMEs) form the backbone of many Middle East and North Africa (MENA) economies. In the aftermath of the global financial crisis, governments are seeking to generate employment, especially youth employment, and economic growth to try to mitigate the …

Read More » Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East