The US Foreign Account Tax Compliance Act (FATCA), which requires all foreign financial institutions (FFIs) to report to the Internal Revenue Service (IRS) on the activities of investors who are US citizens, has created a huge task for banks and wealth management companies worldwide – and the Middle East is no exception. LIZ SALECKA reports on the implications

The US Foreign Account Tax Compliance Act (FATCA), which requires all foreign financial institutions (FFIs) to report to the Internal Revenue Service (IRS) on the activities of investors who are US citizens, has created a huge task for banks and wealth management companies worldwide – and the Middle East is no exception. LIZ SALECKA reports on the implications

As in other parts of the world, there have been voiced concerns over the imposition of a US regime across the region that will affect the operations divisions of all financial institutions (FIs) and bring substantial compliance costs.

“Effectively, this represents a move by the US Treasury to outsource part of its tax collection efforts,” says John Garrett, group chief compliance officer, National Bank of Abu Dhabi. “One of the key views I hear from my colleagues in the industry is that the cost borne by FIs globally in implementing FATCA will be higher than any gain made by the US Treasury in additional tax revenues.”

One of the biggest challenges FFIs face under FATCA is the huge administrative burden it places on them in terms of identifying US citizen investors; gathering information on their investment activities; and then reporting on them to the IRS. This is expected to generate hefty costs in terms of new processes and procedures; system changes; and additional resources.

“The identification of US persons is going to be one of the toughest obstacles. In the Middle East, it is not unusual for people to have dual citizenship – and they may have either primary or secondary US citizenship. This means that there are a potentially higher number of US persons in the Middle East than the US estimates of 870,000 people,” explains Garrett. “Whereas people who have declared their US citizenship are identified on our systems, there are undeclared citizens – and it is difficult to know who they are without a lot of investigation work.

“There are also concerns over exactly what information will be required under FATCA. Will it remain just the balances held by US investors or all their income?”

Meanwhile, Asim J. Sheikh, MENA business tax services leader and MENA tax financial services market segment leader, Ernst and Young, points out that FATCA creates a huge need for new and enhanced systems. “Almost all the banks in the Middle East region have now formed their own steering committees, which are working with subject matter experts or consultants to enhance and modify their systems,” he says.

He adds that multinational banks active in the Middle East are following system changes that have been implemented for FATCA at their headquarters – although they too will need to initiate some regional changes for the new regime.

According to PricewaterhouseCoopers (PwC), although both banks and regulators in the Middle East have proved slower than their European counterparts in preparing for the US regime, banks in the region are now starting FATCA assessment and implementation programmes.

“FATCA is a reality and delaying implementation could result in real costs for an FFI,” said a PwC spokeman, who pointed out that, although banks still had time in which to conduct due diligence on pre-existing accounts, they should already be focusing on adapting their procedures and processes for new accounts.

He also noted that the implementation of manual solutions for FATCA may be more appropriate for some banks in MENA – particularly for pre-existing accounts.

The legal issues

The new FATCA regime is also likely to prove a testing experience for many Middle Eastern FIs because compliance with it is expected to contravene existing client confidentiality agreements as well as data privacy, and other laws, in many countries.

PwC identifies a number of legal issues such as account holders not being entitled to waive their rights to privacy, and also notes that FATCA may conflict with the terms and conditions laid down for pre-existing accounts.

“Client confidentiality is highly important in banking generally,” confirms Garrett. “When you are doing business with someone, the details should not be made publicly available without the client’s consent – and in many GCC countries, this is enshrined into legislation to protect people.

“I do not think that there is any country where banks can publish information on individual accounts held and balances to a third party unless they are the government or courts of that country. What we are talking about here is providing this information to a foreign government entity.”

He adds that the route to FATCA in this instance is still unclear. Regulators may take steps on a national basis to ease confidentiality constraints so as to accommodate FATCA’s reporting requirements, or banks may need to seek authority from their clients (on a client-by-client basis) to pass on the required information to the IRS.

The costs and burdens that FATCA brings have also led to suggestions globally that FFIs, with small US investor bases, may consider that meeting its requirements outweighs the benefits of attracting US investors – and, here again, the Middle East is no exception.

According to industry commentators, many local banks are considering closing their doors to US citizens – and this is especially the case if they do not have that many US clients.

Deadline extensions will help

Although there have been ongoing concerns about FFIs being ready for FATCA, these have been alleviated recently by the IRS’s decision to extend a number of key deadlines.

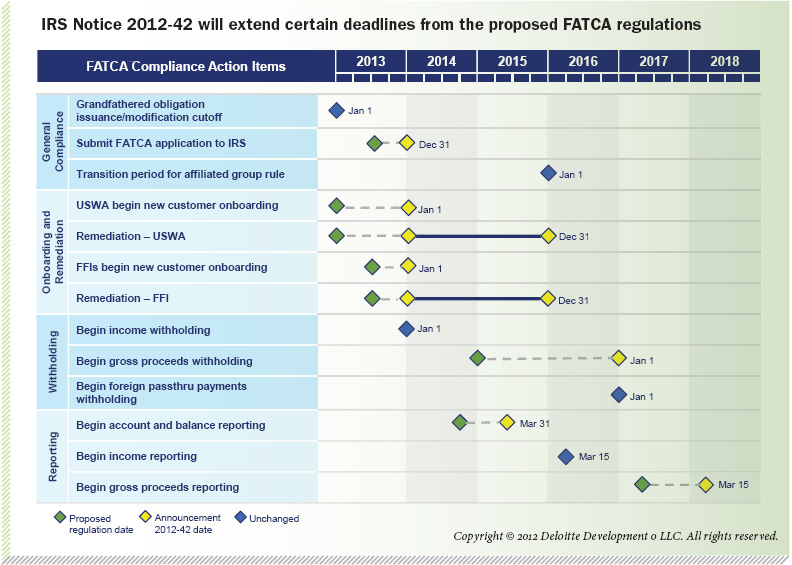

These include the July 2013 deadline by which all FFIs were required to register with the IRS, which has been pushed back by six months; the deadline set for the commencement of account and balance reporting to the IRS (now April 2015); and the date as of which non-compliant FFIs, with US investors, will become liable for a 30 per cent withholding tax on the sale on US securities (now 1 January 2017). (see diagram on deadline extensions)

“The deadline to register has been extended to 1 January 2014. This means that there is an adequate window for FIs to register themselves with the IRS,” says Sheikh. n

FATCA – what it’s all about

FATCA was signed into law in March 2010 as part of the United States Government’s Hiring Incentives to Restore Employment (HIRE) Act in a move to combat tax evasion by US citizens with investments in overseas accounts.

One of its main requirements is that all FFIs with US citizen investors and/or investments in US securities pledge to identify their US investors and disclose information on their assets, including transactions and final investment levels at year-end, to the US Internal Revenue Service (IRS). FFIs with US investors that do not put procedures in place to do this will be liable for a 30 per cent withholding tax on payments to US entities and proceeds from the sale of US securities.

However, some leeway to FATCA’s tough requirements was granted recently with an extension to the regime’s introduction and the publication of a new model, negotiated by five European Union countries, which will streamline the reporting burdens placed on FFIs.

Countries that adopt the new model, known as the Model Agreement I, will enter inter-governmental agreements (IGAs) with the IRS that will allow their FFIs to report directly to local tax authorities, which in turn will pass on the information required to the IRS.

Model Agreement I also offers the opportunity to enter reciprocal agreements with the US, as well as the chance to negotiate some FATCA terms and conditions.

However, so far, it remains unclear whether Middle Eastern authorities will seek to enter IGAs under the new model – or whether FIs in the region will end up reporting directly to the IRS.

“Regulators in Middle Eastern countries are still discussing and debating what approach they should adopt on FATCA,” says Sheikh, but notes: “It is likely that Middle Eastern regulators will adopt a consistent approach.”

“In the GCC region, there has been a call from a number of countries for meetings on how they can adopt a common approach to FATCA,” concurs Garrett. “Banks in the region are also looking for help from their governments – and the signing of an IGA would assist them with the way forward.

“However, entering information exchange agreements with the US is not likely to prove as big an advantage to the Middle East as it is to other countries.”

On the downside, meanwhile, the striking of Model Agreement I, which is being pursued by five countries looking for reciprocal agreements with the US – UK, France, Germany, Italy and Spain – has given rise to suggestions that these same EU countries may introduce their own FATCA-style regimes in the future to curb tax evasion by their own citizens.

“We have not yet come across moves by other countries to impose FATCA-style regimes on the Middle East, but ideas like this can spread very quickly,” notes Garrett.

US may lose citizens because of FATCA

The roll-out of the US FATCA regime globally has given rise to suggestions that American citizens who live outside the United States will be prompted to renounce their citizenship, according to recent research by the deVere Group.

The international financial consultancy points out that, officially, almost 1,800 Americans renounced their citizenship in 2011- nearly six times as many as in 2008. It also claims that, as a company, it has seen a 22 per cent increase in enquiries from American expatriates globally who are considering switching their citizenship to their adopted countries.

“The majority of these US expats are being prompted to consider this due to the complexity of the reporting process to the IRS,” says Nigel Green, chief executive of the deVere Group. “This sense of anxiety is compounded by the fact that a growing number of Americans are being left stranded by their FFIs as all banks and wealth management firms will have to declare the assets of their American clients – and this process is perceived as too costly and burdensome.”

And here Garrett adds: “From talking to people generally, I do know of US citizens who have taken this step (renouncement of US citizenship) but this is not just because of the FATCA legislation, but all the taxes that are applied to them,” he says. “In many respects, US citizens in the Middle East are disadvantaged. Generally, foreigners living and working here are not taxed back in their home country on income earned here.”

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East