Although treasury teams view themselves as broadening their strategic contribution, their core focus still remains on tasks such as cash management, cash forecasting and compliance. That was one of the principal findings in a survey that looked at the roles carried out by these key professionals

Treasury teams are playing a broader role, and are contributing to a wide range of tasks beyond pure treasury, cash and risk management, according to on an online survey conducted by Kyriba and the Association of Corporate Treasurers (ACT).

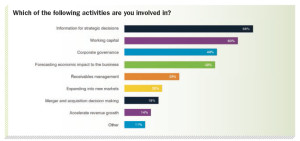

It found that almost seven out of 10 treasury professionals contribute data and analysis for strategic decision-making, and six out of 10 are involved in working capital management.

However, it was discovered that treasury professionals’ counsel is still not widely sought in major corporate initiatives. Also, only one out of five was said to provide input for ideas involving market expansion, with just 18 per cent providing a contribution towards M&A activity.

Responses for the report were taken from a cross-section of finance and treasury professionals, across a broad range of company types and sizes.

All respondents were members of ACT and the goal of the 2014 survey was to see how treasury professionals operate; how productive they are; what challenges and concerns they face; and what type of technology platforms they rely on.

It added, “Equally important, how strategic are treasury professionals? Do they primarily focus their efforts on functional tasks, or more higher-level, strategic and analytical activities? To what extent do they believe that their activities have an overall positive impact on the organisation at large?”

The main findings

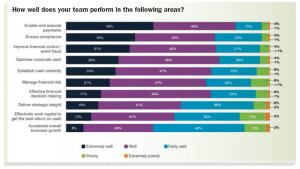

The report found that treasury teams have a high level of confidence in a broad range of tasks, in particular those that form the core of their responsibility.

“However, as the tasks move from operational to strategic, practitioners’ confidence in their ability wanes. Almost 85 per cent of treasury professionals believe they execute payments ‘extremely well’ or ‘well’, and more than 70 per cent think likewise for ensuring compliance. But this number falls to barely half for effectively working the organisation’s capital, and less than 45 per cent for contributing toward the overall growth of the business.”

Other key findings were as follows:

- Organisations are continuing the move away from spreadsheets to dedicated treasury systems. Although almost two-thirds of SMEs still rely on spreadsheets, above £500m revenues, the majority of companies have either a dedicated treasury platform or use an ERP treasury module

- Most companies with a dedicated treasury system continue to use a hosted platform, but the gap is shrinking, particularly for midsize companies. Among £10bn+ revenue companies, installed software is 3.5 times more popular than ERP modules, and 10 times more popular than cloud software. However among midsize companies with £1bn-£10bn revenues, installed software is three times more popular than ERP modules and less than twice as popular as cloud software

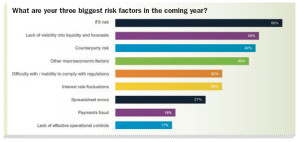

- Global trade and recent economic challenges are top of the list of treasury teams’ concerns when it comes to the biggest risk factors. Half of all treasury teams see FX risk as one of their three biggest risk factors, closely followed by lack of visibility into liquidity and cash forecasts. However, the type of risk factors varies dependent on the type of platform used. For example, more than 40 per cent of treasury teams who primarily use spreadsheets view them as one of their top risk factors, compared to just 15 per cent who use a dedicated treasury platform.

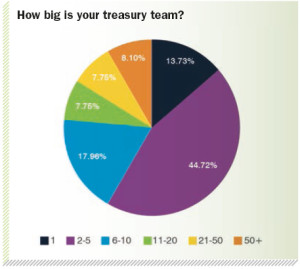

The size of the corporate treasury team remains lean, even as the function has become less focused on tasks and processes, and more on delivering real strategic value. Fifty-seven per cent of all respondents’ treasury teams have fewer than five members, with 14 per cent operating as one-man-bands. While the average number of team members grows steadily in line with the company size (for example, a third of all £10bn and above companies have treasury teams of more than 50), the majority of companies up to £10bn revenues have fewer than five treasury personnel.

Given the predominantly international focus of the modern treasury team, it is not a huge surprise that centralisation of treasury functions is common.

Overall, a little more than half (56 per cent) of all treasury teams are centralised, with 24 per cent using multiple treasury centres, 14 per cent having a hybrid approach of centralised processes with decentralised teams, and six per cent being completely decentralised.

However, this figure varies significantly dependent on the size of the organisation. Treasury is completely centralised at a full 75 per cent of companies with £100m-£500m revenues (although, surprisingly, only 56 per cent of the smallest companies, with under £100m revenues), with this number shrinking evenly as revenues grow. Among the largest companies (£10b+ revenues), just a quarter of treasuries are centralised, with half using multiple treasury centres.

Treasury teams cover a wide variety of tasks, from cash and bank position reporting, through to strategic financial analysis and executive counsel. In general, cash position reporting and forecasting, and liquidity management ranked as the most common tasks (73 per cent of respondents), followed by bank reporting and account administration, investment, and payments (60 per cent).

These figures, “quite surprisingly”, don’t change dramatically based on role, with 73 per cent of treasurers and CFOs involved in daily cash forecasting, compared to 71 per cent for treasury analysts and assistants.

The only area of daily tasks which see any real difference between titles is in risk management, although from CFOs to treasury managers, there is still little variation. Almost 60 per cent of CFOs/treasurers focus on FX and hedging (as well as 72 per cent of treasury directors and 60 per cent of treasury managers), while only treasury assistants and analysts tend to focus away from FX/hedging, with less than one-in-three focusing on it.

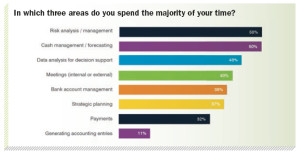

The higher up the treasury ladder one goes and the bigger the company one works for, the more time is spent in meetings. The report commented, “Less than a quarter of treasury analysts cite meetings as one of the three main areas where they spend their time, but among CFOs and treasurers, this figure rises to 46 per cent. However it is not the most time-consuming activity. Risk analysis and management is the number one task performed by respondents overall, at 50 per cent (although higher, at 56 per cent, for CFOs and treasurers).

“Cash management and forecasting, while almost the same in terms of overall respondents’ time consumption, is marginally higher for managers and below (53 per cent).”

The move to more dedicated and cloud-based platforms is also enabling treasury professionals to become less chained to their desktops. The advent of mobile treasury apps and smartphone and tablet-friendly interfaces has increased the use of these devices for treasury management. Twenty-two per cent of treasury professionals now use their tablets to access their treasury data, while 20 per cent also use their smartphones to do so.

The survey also asked, “What is it that drives treasury teams to ditch spreadsheets?”

It found that productivity gains and automation continue to be a driving force behind many companies’ decision to move to treasury software, with 80 per cent of users citing this as a key benefit.

“This isn’t surprising, said the survey, “given the time savings that dedicated software provides. Extrapolating respondents’ estimates for the amount of time they spend daily on manual and operational tasks, spreadsheet users spend 689 hours (more than 17 40-hour weeks) per year, simply performing these tasks.

“This figure falls significantly, to approximately 10 weeks per year for ERP treasury modules and server-installed software, and even further, to just under five weeks, for treasury teams using cloud-based software.

“For the majority of treasury software users, however, moving to a dedicated treasury system has a number of additional, more strategic benefits. Seven in ten treasury systems users cite increased control of processes as a key benefit, with 61 per cent also citing greater visibility into cash balances and forecasts and exposures. Almost half (47 per cent) of users also see an increased ability to provide strategic analysis of data for broader corporate decisions.”

As more treasury teams have the technology to automate many parts of their roles, and have got a firm grip on both cash visibility and control of treasury processes, there has been a continued move towards taking a more strategic role, with 33 per cent of all companies becoming more strategic in their approach.

The report said, “Large companies are significantly ahead of small companies in their transition, with 44 per cent viewing themselves as more strategic than two years ago. Overall, 22 per cent of respondents view their treasury department as mainly strategic in their approach to treasury management, although 24 still view themselves as mainly tactical. Surprisingly, only 17 per cent of CFOs and treasurers view their department as primarily strategic, compared to 30 per cent viewing them as primarily tactical.”

So the survey asked, “If treasury teams are viewing themselves as more strategic than before, what higher value tasks are they involved in?” It found that “information and analysis for strategic decisions was the most common response, with approximately two thirds of respondents claiming this.

“There was little variation in response between roles and company sizes on this question, and only companies with less than £500m had a higher response than strategic decision support. Among this group, the most common strategic task performed was working capital management, with 63 per cent (compared to 59 per cent for strategic decision support)”.

However, said the report, “the results also showed that treasury still has a way to go until is it fully integrated into companies’ overall growth plans. Barely one-in-five treasury professionals plays a role in market expansion, with fewer still being involved in M&A activities and accelerating revenue growth. Even among CFOs, barely a third are involved in revenue growth expansion, and only one in 11 contributes to decisions about expansion”.

“Clearly”, the report commented, “the treasury team needs to raise the awareness of its increased abilities to ensure that it is no longer viewed as a process-oriented cost centre.”

Also, it asked, “As the treasury team sees itself starting to move into a higher level role, how is it performing both on core competencies and also these more strategic tasks?”

It then went on to say, “Clearly, the highest levels of confidence and ability are in core competencies: 42 per cent of respondents believe they execute payments ‘extremely well’ (with a further 40 per cent saying they do it ‘well’), and 33 per cent feel the same way for compliance.

“However, as the strategic value of the activity increases, practitioners’ confidence in their abilities tends to decline. Most treasury teams have a reasonable level of confidence in the abilities to optimise corporate cash (70 per cent saying they do so ‘well’ or ‘fairly well’), and manage risk (68 per cent saying ‘well’ or ‘fairly well’).

“However, when it comes to activities that deliver tangible business value outside of the treasury function, only 16 per cent of respondents believe that they deliver strategic insight ‘extremely well’ (and this number falls to 13 per cent for CFOs and treasurers), while the majority feel they do it ‘well’ or ‘fairly well’.

“Furthermore, only one in 12 overall treasury professionals (and one in 11 CFOs and treasurers) believe that they accelerate overall business growth ‘extremely well,’ with 50 per cent more respondents believing that they perform the task ‘poorly’ or ‘extremely poorly’.”

The report commented, “These statistics make it clear that, although there is a high level of comfort and confidence in treasury teams’ ability to perform core tasks, there is still a considerable way to go until they are similarly comfortable focusing on the more proactive and strategic aspects of treasury management.”

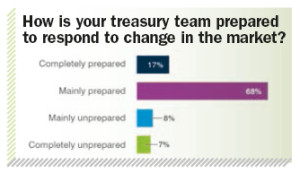

The past few years have proven the need for companies to respond to rapid and often potentially catastrophic change, said the survey. With that in mind, it was curious to find out how companies view their ability to react to those changes?

“Thankfully,” it said, “the vast majority of respondents see themselves as completely (17 per cent) or mainly (68 per cent) prepared, with fewer than 15 per cent seeing themselves as unprepared to respond. Also encouraging is the fact that almost half of all respondents (43 per cent) view themselves as more prepared than two years ago, while only six per cent are less prepared. “

Treasury faces a broad range of risk factors, both from within the organisation and outside. Among respondents as a whole, three of the most commonly cited risk factors for the coming year were those from outside the corporate walls – FX, counterparty and broader macroeconomic factors.

So, said the report, “The turmoil of the past few years is certainly still clear in the minds of many.”

Thereafter, it found that “spreadsheet errors, while relatively low on the agenda for respondents as a whole (27 per cent), are the second most common risk factor for those (43 per cent ) who use spreadsheets as their primary treasury management tool.

“This compares to just 15 per cent of those who use a dedicated treasury platform or an ERP treasury module. While the vast majority of treasury departments still use spreadsheets to some extent, they are certainly a much larger source of concern if relied upon as the primary tool.

“Spreadsheet-only treasuries also cite the lack of visibility of assets and forecasts as a much larger risk factor than those who use treasury management packages.

“Overall, lack of visibility is a top three risk for 60 per cent of spreadsheet-only treasuries, compared to just 32 per cent of those with treasury management software.”

“Interestingly”, found the report, “payments fraud is a low area of concern for treasury teams, with just 18 per cent citing it as one of their three largest risk factors for the year (and 73 per cent saying that they perform compliance and fraud prevention ‘extremely well’ or ‘well’.”

However, it added, “A recent survey conducted by Kyriba showed that 78 per cent of companies have been the target of financial fraud, and 30 per cent of companies have suffered financial losses as a result of it.

“That such a comparatively small group is concerned by it suggests there may be considerable complacency about whether a company will be impacted.”

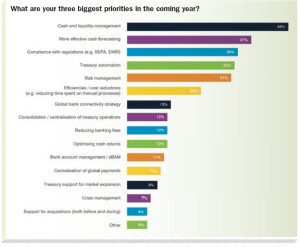

In conclusion, the survey found that “treasury teams’ priorities have changed relatively little over the past year, and three of the top four responses – cash and liquidity management, cash forecasting and compliance – are the same as last year. The only new entrant to the top four is treasury automation, which was a key priority for 27 per cent in 2013, and 32 per cent in 2014.

“What is clear is that although treasury teams view themselves as increasing their strategic contribution, their core focus remains on tasks such as cash management, cash forecasting and compliance.” n

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East