In the wake of the financial crisis, companies in the Middle East are starting to look at ways to streamline their business processes. Treasurers have various tools at their disposal for building efficient liquidity management processes. However, there are challenges that need to be overcome to achieve maximum visibility and mobility of funds. Treasurers need to select cash management providers that address these challenges and support change. SURAJ KALATI, manager, regional product management, global payments and cash management, HSBC Bank in the UAE, explains what can be done

With the ripples of the recent credit crisis extending as far as the Middle East, companies in the region are starting to take a more prudent approach to their business management. Credit is not the only business cost that has increased; rising operating costs in the region have forced businesses to look at ways of generating greater value from their processes, including those related to cash management.

This desire to manage cash more effectively has made visibility and mobility of cash the prime focus of treasurers in the Middle East, and related process improvements are at the centre of treasurers’ discussions with banks.

Many of the tools used globally for building efficient liquidity management processes are available for treasurers in the Middle East today, with some exceptions where local regulatory restrictions limit the types of structures that can be created. Treasurers in many markets in the region have now undertaken the challenging process of change with the ultimate view of building efficiencies.

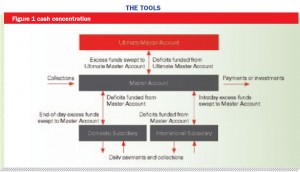

Cash concentration

Cash concentration is the physical consolidation of cash, either on a domestic or a cross-border basis, primarily for the purpose of channelling internally available liquidity to where it is required the most, or to aggregate the investable surplus of the business.

This tool is commonly used to automate the mobilisation of cash across a number of accounts to maximise the value of cash positions across multiple accounts and provide greater flexibility to the central treasurer in managing cash.

Through this process the treasurer also gains greater transparency and control of internal cash, enhancing the level of financial management within the business. The entire process of consolidation is automated and configurable, allowing the structure to be aligned to operating processes.

Cash concentration allows treasurers to aggregate surplus cash from regional subsidiaries to where their treasury, or business, is mainly domiciled. This automation increases accuracy of cash forecasting and reduces local overheads in managing treasury transactions.

Notional pooling

Notional pooling allows for the notional consolidation of cash for the purposes of generating interest savings and optimising group liquidity, whilst still maintaining a degree of autonomy for those managing these cash positions independently. This tool also alleviates concerns related to inter-company lending and the need to track such flows, as funds are not comingled. By using this tool, treasurers can optimise interest within all accounts of the same currency or multiple currency accounts held domestically.

This technique is useful where a degree of autonomy is required for subsidiaries responsible for managing the operating cash of their respective businesses whilst still generating value for the overall group. However, legal documentation and complexities around set-off and cross-guarantees as well as the need for overdraft facilities have required treasurers to closely evaluate the benefits of implementation.

Interest enhancement

Interest enhancement is a form of notional balance aggregation that allows treasurers to enhance returns on net balances based on preferential pricing agreed with their bank for different thresholds, either on a domestic or a cross-border basis. It is a dynamic mechanism of relationship-pricing that gives treasurers value for balances that may be held in deregulated markets or other markets with regulations around repatriation of funds.

A significant benefit of interest enhancement structures is that there is no need to move balances physically between currencies since the service notionally converts balances into a base currency. This service offers treasurers the ability to realise value from positions held across a spectrum of currencies on both a regional and cross-regional basis.

With each structure being bespoke and designed to match the operating requirements of the company, treasurers have also looked at hybrid structures to achieve their objectives. If real-time visibility and efficient mobility, as well as utilisation of internal sources of funds, form the end-state for the treasury professional, there are multiple internal and external obstacles that need to be navigated in order to achieve this position.

THE CHALLENGES

Multiple banking relationships

New banking entrants looking to gain market share and existing relationship banks looking to expand, coupled with the desire of treasurers to secure different avenues of short-term funding, have created new banking relationships for many treasurers in the region. This has also led to the need for overall cash positions to be monitored and managed across multiple accounts with different banks, further complicating the process.

Coverage

While rationalisation of banking relationships is ideal, not many global banking partners can offer the coverage many corporate treasurers require in the Middle East. Banking needs are, therefore, met mainly through a combination of domestic and regional banks. While this arrangement might be sufficient to support an organisation’s domestic needs, it may not provide the reach necessary for cross-border liquidity management structures, leaving treasurers to manage their liquidity across multiple markets using sub-optimal processes.

Technology

The creation of an efficient liquidity management process is dependent on access to technology that presents adequate information on cash, particularly regarding near-term availability and utilisation. Many treasurers rely on treasury management systems (TMS) to organise internal processes. To work efficiently, these processes require input from banking partners, who will provide supporting information.

With multiple cash positions to manage across markets and within the same bank, the aforementioned liquidity management tools are essential to reduce borrowing costs and maximise returns on surplus balances. If these products are not available, treasurers are forced to adopt less efficient, or even manual, processes to match the availability of cash and its utilisation.

Changes to management and corporate structures

Similarity of markets and rising demand within these have prompted businesses to expand across

boundaries. Many of these overseas operations are joint-ventures with domestic partners. However, while some partners may help to leverage local expertise, many are simply the result of company ownership requirements in some Middle East markets. Managing change within these subsidiaries can be a slow process and often an impediment to incorporating them into a complex liquidity structure.

Investing surplus liquidity

Companies operating in the Middle East that are looking to invest surplus liquidity in the region do not enjoy the same alternatives available in other markets. With limited investment options available in some markets, the location of the aggregation of balances is an important consideration that needs to be considered in conjunction with the operating requirements of the business.

The outcome

With many regional economies poised for further economic development, treasurers have begun to examine their practices and processes to ensure that they are prepared to meet the needs of their organisations as they grow and that they are prepared for new challenges that might arise in increasingly competitive markets.

Treasurers recognising these challenges have selected cash management providers that not only provide them with consistency in coverage and technology in the region, but also extend support through the change management process in the implementation of a liquidity solution.

Further, as solutions come with a significant degree of customisation, treasurers have approached banks to advise them during the implementation process, sharing regional and global best practices.

The desire for rationalisation of banking relationships is also noticeable; however, treasurers will face challenges in markets where they continue to rely on domestic banking partners to provide infrastructure support essential to their business.

Banks have begun to recognise the need to cater to interregional capital flows and have increased investment in the development of new technology that provides the functionality as well as the ability to integrate with clients’ operations more closely. Banks, however, still need to do more in terms of facilitating change for their clients.

In summary, liquidity management practices have reached a new turning point in the Middle East, with regional treasurers recognising the value of robust mechanics that will help streamline operational efforts and generate greater savings than sub-optimal processes. This change is encouraging as treasury management processes continue to evolve and mature in the Middle East.

This article is based on information contained in HSBC’s Guide to Cash, Supply Chain and Treasury Management in the Middle East 2011.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East