Banks need to start developing their mobile-payments strategies now, according to global experts Mohammed Badi, Laurent Desmangles, Alenka Grealish, Sushil Malhotra, and Carl Rutstein

Mobile payments and mobile wallets— when they come into full force—will affect a wide variety of stakeholders: mobile network operators, handset makers, operating-system providers, retailers, consumers, and, of course, financial institutions. Yet many banks are in a quandary about how to position themselves to participate fully in this opportunity.

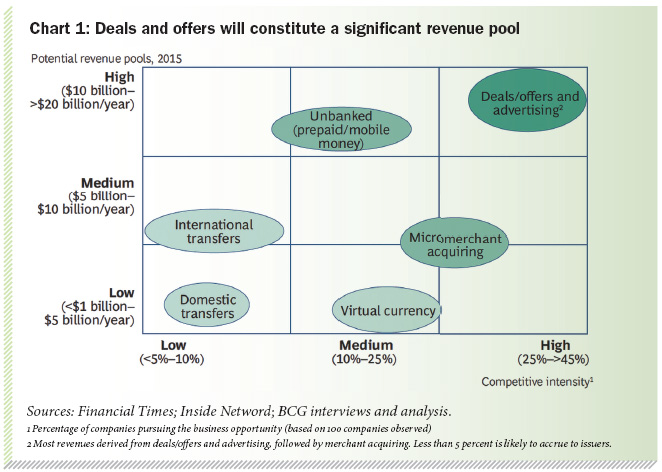

Despite heightened excitement in the payments industry and media about m-payments, strong growth is not yet around the corner. M-payments (as they are being dubbed) are not likely to become mainstream for more than a decade, and even then, credit and debit cards will still be widely used. Moreover, the growth in discount deals and offers sent out to consumers via their smartphones is likely to far outpace the adoption of m-payments, generating significant value over the next five years and potentially representing the largest revenue pool in the payments arena. (See chart 1)

But banks need to start developing their mobile strategies today, well in advance of the time when it becomes as common for someone to make a purchase at the point of sale with a smartphone as it is with a credit or debit card today. Indeed, banks need to play a leading role in addressing issues such as security and the development of standards that can accelerate adoption of m-payments. Otherwise, non-bank players will forge ahead with deals and offers, pushing their m-wallets at the point of sale and eroding banks’ interchange revenues and the integrity of the payment system.

However, before banks can take meaningful steps, they must be able to separate the hype surrounding m-payments from the realities.

The realities amid the hype

Both our client work and our research have revealed some clear truths about m-payments that banks and other payments players should consider.

The value will be in deals and offers, not in payments.The main reason for the slow progress of m-payments and m-wallets has been the absence of a compelling value proposition for the consumer, bank, or merchant. Indeed, m-wallets are challenged by the classic chicken-and-egg relationship between merchant acceptance and customer usage. That is, as a pure payment vehicle (or “form factor”), the mobile handset does not yet offer sufficient benefits to drive mass consumer adoption.

M-wallets need to be both clearly beneficial and trustworthy before consumers will change their behaviour. Merchants, in turn, are naturally reluctant to invest in new equipment at the point of sale until there are clear benefits to doing so, such as increased customer satisfaction, higher incremental sales, less fraud or lower payment costs.

The fact is, though, both merchants and consumers have shown that they value deals and offers. These can be a better value proposition for consumers when they are funded by merchants and other advertisers rather than by credit cards, whose rewards and rebates are constrained by interchange levels. Indeed, given the experience of one large US retailer, consumers are not likely to change their payment behaviour for deals and offers involving discounts of less than five per cent, especially when some deal companies can offer discounts of ten times that much.

Given the likely slow rate of m-payment adoption, players should separate deals and offers from their payments strategy. To be sure, there is more traction to be gained by targeting the 60 per cent of consumers who own smartphones rather than the (at most) one per cent of consumers who regularly use their phones to make payments. We expect offers to be separated from payments for at least the next five years.

Cards will not disappear yet

According to even the most aggressive estimates, only 24 per cent of payments will be mobile within 10 years, and just as ATMs and the internet did not eliminate bank branches, merchants will have to keep accepting plastic cards for the remaining 76 per cent of transactions. Cards will remain in use until m-payments account for more than 95 per cent of transactions, which will not happen for a very long time. Experience shows that until a card network reaches 95 per cent merchant acceptance, its cardholders still feel the need to also carry a competing network’s card.

M-payments are not yet superior to traditional payment methods because they are still in an immature state. They are vulnerable to security breaches and theft. Stakeholders have yet to come together to establish standards, security protocols, and liability responsibilities (these are particularly important for issuers). Meanwhile, headlines warn consumers about the perils of mobile financial transactions and phone theft. And mobile stakeholders have yet to explain how they are protecting consumers.

It is commonly believed that banks are at a disadvantage in m-payments compared with other stakeholders and early movers, such as network providers and deal companies, but the truth is that banks (along with financial networks and clearing and settlement systems) are at the centre of the payments universe.

Banks bring a range of know-how and experience to the table and also have vast experience detecting fraud, leveraging customer insight, mitigating risk and navigating the regulatory environment.

It is banks that hold federally insured deposits, extend credit, provide statements, send and collect bills and provide zero liability for fraud. They influence consumers’ payment habits through product innovation, marketing, and incentives. They have tens of millions of consumer relationships—and, as a result, rich repositories of data — as well as strong relationships with retailers. Finally, they have the ability to create new and compelling offerings, integrating payments into a host of mobile banking features.

For all these reasons, banks should play a vital role in any shift in the payment behaviour of consumers.

Seizing the moment

The preceding points notwithstanding, m-wallets will likely pose a considerable strategic challenge to banks over the next decade. The biggest risk is the erosion of the secure payments infrastructure currently in place, which could happen if new players piggyback on the existing framework without taking responsibility for safety and soundness — leaving banks to pay the price.

Banks can and should begin to play a leading role in the m-wallet game.

In addition, some interchange revenues will be at risk if retailers or other non-banks come up with compelling m-wallet deals that encourage direct transfers from bank accounts in lieu of credit card funding. Banks can and should charge customers for such transactions — just as they do for foreign ATM transactions — but it would be better if they proactively developed their own value propositions. What is more, if m-wallet providers start to control the customer interface, banks risk losing direct links to their customer base from a relationship and individual transaction standpoint.

In our view, banks can and should begin to play a leading role in the m-wallet game, as opposed to the supporting role they have played up to now. The m-payments business is otherwise banks to lose. There are four immediate “no regrets” steps that banks must take to get on track.

They are as follows:

Establish security protocols.

Both consumers and regulators expect banks and networks to maintain the integrity of the payments system and mitigate losses in case of a breach. As stewards of the safety and soundness of the payments industry, banks — along with financial networks and clearing and settlement systems—must play a leading role in establishing security protocols, clarifying liability responsibilities and ensuring reliable, seamless transactions. As a result, banks must make sure that they have visibility into all m-payment transaction details (for example, at the merchant level) in order to monitor fraud.

Preserve the attractiveness of cards.

Banks need to ensure that their card products remain sufficiently attractive as the m-wallet gains in popularity. Since the jury is still out on whether traditional rewards on cards (such as cash back) will be able to compete with merchant-and-manufacturer-funded deals available through m-wallets, banks need to monitor closely how customers respond to their reward programmes and continue to innovate in order to improve uptake. Traditional rewards and rates will likely continue to drive consumers’ payment preferences in the medium term, but there is no guarantee that they will hold sufficient sway in the long term. One reason is that m-wallets, not being limited by interchange fees, can give merchants more margin to work with than banks can. Another is that dynamic optimisation features in m-wallets will challenge what it means to hold the “top of wallet” position with consumers. Therefore, expect more banks to develop or participate in their own deals and offer schemes to stay competitive.

Form a “house view” on the m-wallet.

Banks need to develop an enterprise-wide m-wallet strategy that leverages overall bank resources — particularly in light of lower payment-related revenues resulting from new regulations. Developing this view will require creating an executive role to properly assess the bank’s resources and capabilities, articulating an action plan, and determining realistic ambitions. The executive will need to interact with all stakeholders within the bank, including operations, risk, credit cards, retail banking, IT, finance, and marketing. Among the questions that banks should ask themselves is whether they should do the following:

- invest in card innovation to bring a strong product to m-wallets

- build a bank-owned wallet (open or closed) in addition to or instead of joining existing platforms (such as Google or Isis)

- develop deals and offers independently or with a partner — such as a merchant or deal company — inside or outside of an m-wallet

- proactively manage m-wallet access to customers’ cheque accounts via direct transfers (for example, by charging customers if they use m-wallets in ways that jeopardise or piggyback on the existing payment system).

Invest to gain experience.

Once a house view is established and banks have gained a clear idea of what resources and capabilities they can bring to the table and are sure that their many silos are not working at cross purposes, they should engage in partnership discussions and select at least two concrete initiatives. Many banks are well equipped to be at the forefront of the payment market’s evolution. A few could even become market disrupters.

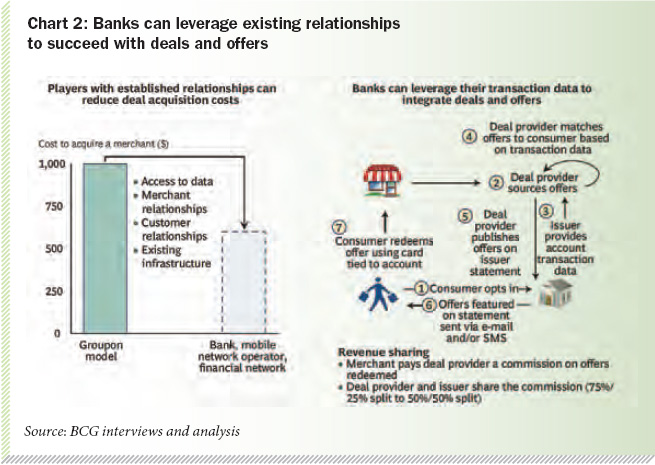

Banks willing to be proactive can generate win-win deals for both merchants and consumers. Such initiatives must be carefully executed, however, and most banks will pursue the lower-cost and lower-risk route of partnering with experienced providers of deals and offers. Others will leverage their consumer-transaction data and formulate deals on their own, going head-to-head with deal companies — some of which have recently been charging higher fees, causing merchants to lose their enthusiasm for working with them. Overall, banks can leverage existing merchant and consumer relationships to win in this arena. (See chart 2)

The next five years will be murky ones for m-payments. Consumers will face an onslaught of choices, and valuable new customer interactions will be up for grabs. There will be both opportunities and risks for banks. Although some may choose to stay on the sidelines, no bank should face the next five years without understanding what is at stake in the new payments world. To avoid falling behind competitors, banks must make sure that they have full visibility into the transaction flow and are able to monitor fraud and uphold regulatory requirements (such as “know your customer”). In order to win, they must decide on a strategy now and lay the groundwork for efficient execution of that strategy going forward.

Ultimately, it will become more and more evident that proactive institutions stand the best chance of benefiting from the rise of m-payments, which are still in a nascent state. Banks currently have a great opportunity to develop unique customer value propositions, including deals and offers, and to ensure a strong positive customer experience across the payments spectrum, from tight security to 24-7 convenience. Joining the game late and missing the window of opportunity may leave many banks unable to control their own mobile destinies.”

Mohammed Badi is a partner and managing director in the New York office of The Boston Consulting Group (e-mail badi.mohammed@bcg.com)

Laurent Desmangles is a partner and managing director in the firm’s New York office and an expert in mobile payments (e-mail desmangles.laurent@bcg.com)

Alenka Grealish is a topic specialist in BCG’s Chicago office (e-mail grealish.alenka@bcg.com)

Sushil Malhotra is a principal in the firm’s New York office (e-mail malhotra.sushil@bcg.com)

Carl Rutstein is a senior partner and managing director in BCG’s Chicago office and leader of payment practice in the Americas (e-mail rutstein.carl@bcg.com).

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

One comment