The integration model between banks and their corporate customers is an ever expanding process

By Maki Vekinis – Cash Managment Matters (CMM ) Managing Partner

The rise of enterprise resource planning systems (ERPs) in the GCC, and in Saudi Arabian markets in particular, are well recorded. ERPs have proved to be one of the key components in effective business management for corporations. Initially deployed to reduce complexity and introduce efficiencies to very large companies with multiple, sophisticated operations, over time these systems found applications in wider markets. As a direct result of the evolving nature of these ERPs they have since expanded applications and services to reach a much larger segment of corporate configurations.

In tandem with the switch to ERP systems by GCC corporations, Gulf states have been striving to apply the same principles of information and process discipline to their banking sector.

The current state of methodologies and applicable processes corporations can employ to integrate with their bankers, and whether these are single or multiple relationships, is the central question. Firstly, let’s assess a typical set of requirements from a corporate viewpoint.

ERP systems have a base functionality and a set of modules designed to support integral company functions. In banking, transactions are generated from various modules (payroll from a human resources department, vendor payments from the accounts office, etc.) which are then collated and prepared for submission to the bank from a common area. At the same time, ERPs provide reconciliation facilities. Any payment requested will ultimately be reconciled and reported in real time.

An important aspect of ERP implementation is the rationalisation of banking relationships. It has become a catalyst for a change from multiple collection and disbursement banks to single entities, allowing for the concentration of cash at the parent bank level as well as multiple client companies to use the same bank accounts, reducing costs and manual processing. ERP is the driver behind an environment of well practised controls and further innovation that thereby heralded an era where data integration, G/L automation, funding and sweeping real time as well as month-end error free processing, enhances the reputation of the individual institution.

Yet the deceptive simplicity of these requirements hides a complicated reality, creating problems that have driven banks to devise elaborate platforms for straightthrough processing, often for just a single user (i.e. a single bank). The complication arises from the actual transmission of data mechanism and the condition of the information that needs to be exchanged.

Communication between a bank and a corporation’s ERPs requires coordination on multiple levels. It demands implementing a common data format for transactions, enabling them to be identified and ultimately processed; agreement on the communication methodology to allow data to be transmitted and received; agreement on a secure, authenticated communications platform so data is hidden and protected; and agreement on common reporting, rejections and repair transactions platforms. From each of these considerations, further complications can arise, simply due to the variety of options embedded in each. For example, the format of the information can be SWIFT based, EDI , or message based with a treasury workstation system. The communication of the data itself can be ‘bulked’ and transmitted in batch, or transmitted following preparation and approval. Security and confidentiality are achieved through digital certificate authentication or public key.

Other mechanisms for generating payment requests in various formats can also be present. For example, dividend payments, initial public offerings, rights issues and other corporate actions require an ability to process and authenticate large volumes of information. To achieve this requires reliable integration between the systems of the corporations and their bankers being widely available, i.e. the ERP providers (such as SAP, Oracle, J.D. Edwards) and transfer (SWIFT, in-country clearings). Corporations and bankers must invest in creating simple integration tools that can be used to achieve the desired level of connectivity. SA P initially deployed a ‘business connector’ capability of facilitating integration with external platforms. Recently the SA P NetWeaver, a far more advanced capability, was introduced to connect and securely transport data between the SA P installation and a selected bank. Correspondingly, Oracle developed the ‘Financial Gateway’ to offer, as described in the company’s own June 2007 white paper, “a centralised framework for payment processing and electronic banking. It can be deployed to connect a corporation’s ERP system to all of their banks’ cash and payment systems. ‘Financial Gateway’ enables the corporation to manage all of its payments from a single platform, and helps with the preparation, formatting, validation, approval and release of clean payment instructions to the bank or external payment system”.

It is not only ERP providers that have invested in these tools; various banks have announced they will provide the corresponding functionality to enable ERP systems to seamlessly connect to transmit and receive transactions, report information, reject and repair transactions. Notably HS BC is offering a corporate solution powered by SA P NetWeaver. According to HSBC’s September 2008 announcement: “The new bank-client integration solution will enable corporate clients to link into HSBC’s worldwide banking network via a single entry point, simplifying communications for the bank’s corporate services such as account payables, account receivables and reconciliations. HS BC’s customers will gain easier access to their banking information.”

Since November 2008, Wells Fargo has offered corporate customers the ‘Wells Fargo Adaptor’ that it claims “automates payables, receivables, cash management, and reconciliation activities, with either Oracle E-Business Suite or JD Edwards Enterprise One financial applications”. Finally, to add further credibility to integration as an important direction, the SWIFT organisation announced the ‘SA P Integration Package for SWIFT’ with the directive “Manage Your Bank Relationships More Effectively; SA P Integration Package for SWIFT gives you direct access to SWIFTNet, the financial messaging network built and maintained by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). It also includes out-of-the-box message and process mappings that seamlessly integrate the SAP ERP Financials solution with the SWIFT infrastructure. You have the ability to centralise communications, consolidate statements, pull data from banks in an automated fashion, ability to repair and reject transactions in an automated fashion.”

With a plethora of developments on both sides of the ‘integration bridge’, is it safe to assume benefits to the corporations and their bankers will outweigh the capital investment and the ongoing operating costs?

The answer depends primarily on transaction volumes. As we investigate the detail behind customer requirements for an integrated solution with their bankers, we find a variety of information submissions. This includes both transaction requests and demands for information pertaining to specific accounts as well as other information, such as money market or foreign exchange rates, AP and billing systems and applications.

A complete integration solution, where all information exchanged with a bank or banks is performed through a direct interface, is demanding on.

When all these connections are synchronised with minimum human intervention and adequate reporting and transaction lifecycle management, the corporate customer’s financial managers will hold the key to direct involvement with day-to-day banking, allowing them to concentrate on their core activities, such as investment and expansion planning and execution.

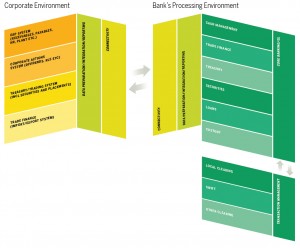

It is important to note the different components of each operating environment and the challenges facing the team tasked with complete integration. For example, in a relatively simple task, offered by most banks with an emphasis on corporate business, total integration ensures that output from the ERP system, suitably formatted to the SWIFT standard, can be securely transmitted to the bank environment for payments to be executed and statements either made available for collection or transmitted immediately back to the corporate servers.

It is important to note the different components of each operating environment and the challenges facing the team tasked with complete integration. For example, in a relatively simple task, offered by most banks with an emphasis on corporate business, total integration ensures that output from the ERP system, suitably formatted to the SWIFT standard, can be securely transmitted to the bank environment for payments to be executed and statements either made available for collection or transmitted immediately back to the corporate servers.

Corporate clients can utilise other systems to generate trade requests, treasury settlements or securities trading.

The obvious questions, such as how would these requests be transmitted to their preferred bank provider for processing?, how is the associated information returned from the bank to be managed?, have no comprehensive response.

There have been numerous attempts to produce a unified solution that can cater for numerous corporate-based systems and multiple bank processing platforms – but a unified solution remains an elusive goal. It is difficult to qualify the business case because of its complexity and heavy service and support requirements. Until a powerful and fully parametric solution is created, in both integration as well as the connectivity components, separate integrators will service the separate business components and functions.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East