Banks in the GCC have continued to grow and outperform international banks, according to a new study

The banking industry in the Middle East settled at single digit revenue growth in 2012 with a 6.9 per cent increase, although the rise in profits was slightly higher at 8.1 per cent, stemming largely from extraordinary income sources.

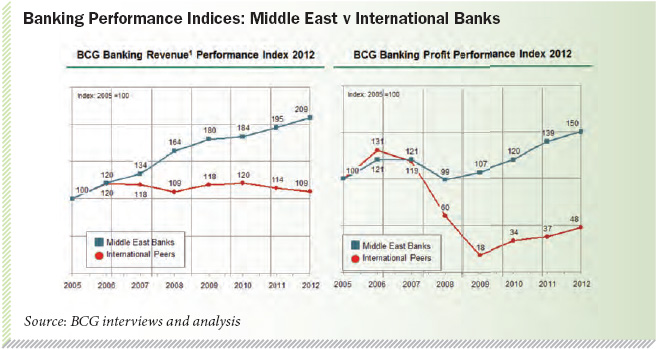

These were among the findings made by the Boston Consulting Group (BCG) based on 2012 annual results as reported by the banks in the first quarter of 2013. The point was made that “the performance of Middle East banks clearly exceeded that of their international counterparts, some of which experienced further revenue declines in 2012”.

BCG launched its first edition of the Banking Performance Index in the Middle East in 2009, and it now covers the largest banks in Bahrain, Kuwait, Qatar, Oman, Saudi Arabia and the UAE.

“The 2012 BCG index includes 32 banks from across the GCC capturing nearly 80 per cent of the total regional banking sector,” said Dr Reinhold Leichtfuss, senior partner and managing director in BCG’s Dubai office and leader of BCG’s financial institutions practice in the Middle East.

He added, “While the performance of Middle East banks settled at high single digit growth figures in 2012, it still compared very well with the international banks which experienced a further revenue decline. This provides the Middle East banks the opportunity to undertake the necessary investments in capabilities and regional expansion.”

He added, “While the performance of Middle East banks settled at high single digit growth figures in 2012, it still compared very well with the international banks which experienced a further revenue decline. This provides the Middle East banks the opportunity to undertake the necessary investments in capabilities and regional expansion.”

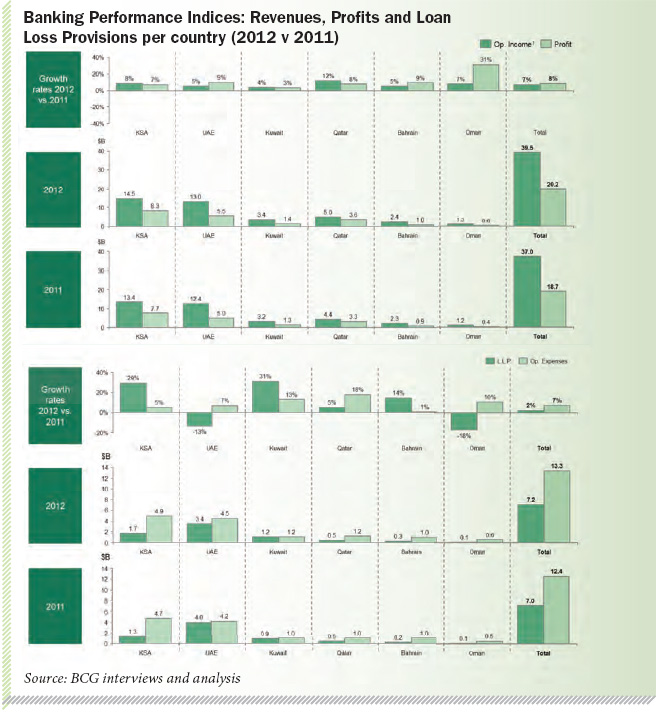

While banks in Qatar grew revenues by 12 per cent and banks in Saudi Arabia and Oman achieved high single digit growth rates, banks in the UAE, Kuwait and Bahrain achieved a revenue growth rate of five per cent or below. Banks in all countries achieved above seven per cent profit growth rates, except in Kuwait with three per cent, said BCG.

In 2012, loan loss provisions varied significantly by country. In particular, banks in Saudi Arabia and Kuwait had to build higher provisions due to increasing delinquencies in sectors such as real estate, construction, banks, financial services, and manufacturing.

UAE banks were, on aggregate, able to significantly reduce the existing high provisioning levels by 13 per cent. Bahrain banks also saw higher LLPs but with a less steep growth rate.

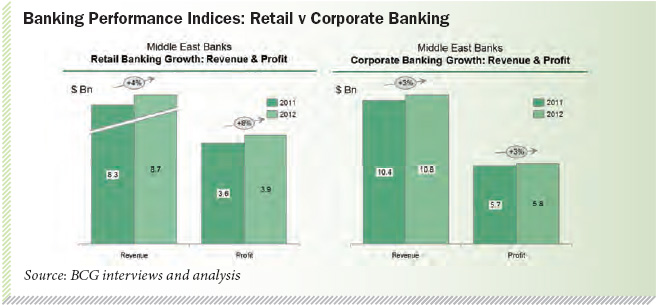

In 2012, retail banking revenues in the GCC, which had remained rather flat during the past few years, experienced a further uptick of some four per cent, largely due to an increase in the three biggest markets – the UAE, Saudi Arabia and Kuwait.

Oman repeated the strong double digit growth of the previous year. On the whole, the variance between growth rates of individual banks in retail was very high and ranged from -39 per cent to +19 per cent.

GCC retail profits, which had been declining for several years, saw another significant uptick of eight per cent compared to 11 per cent last year. Nevertheless, the profit level in 2012 remained slightly below 2005 and 2006 levels, which were exceptional retail years in the GCC.

The corporate segment reached the top index level in revenues in 2012 but only with a minor growth of three per cent. In terms of country breakdown, UAE and Kuwaiti banks experienced a decline in corporate banking revenues while the other countries experienced a healthy increase of six per cent or more. Profits declined slightly driven again by the countries with the highest increase in loan loss provisions – ie,Saudi Arabia and Kuwait.

In an environment of slower market growth, smart strategies and better capabilities are essential to grow more than the competition, according to BCG. Leading Middle East banks are striving for regional expansion to find new areas for growth. Many are prioritising better customer service as a critical part of their agenda; quite a number actually want to become the best bank in customer experience in their countries.

Other banks are in the process of identifying new growth areas in order to avoid a decline in revenues and there are a number of banks that are focusing on their IT and operations platforms in order to prevent costs from outgrowing revenues continuously.

Leichtfuss said,”Middle East banks should approach these challenges in a professional way and have the foresight to invest in strategic areas. Only appropriate platforms in IT and operations, such as online banking and automation of processes will allow scalability of activities. This is an opportune time for Middle East banks to excel: their cost income ratios are still far below their international counterparts, be it in Europe, the US, Australia or Asia.”

The Boston Consulting Group is a global management consulting firm said to be the world’s leading adviser on business strategy. It has 78 offices in 43 countries and serves the Middle East from Abu Dhabi and Dubai.

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

Cash And Trade Magazine For Cash and Trade professionals in the Middle East

One comment